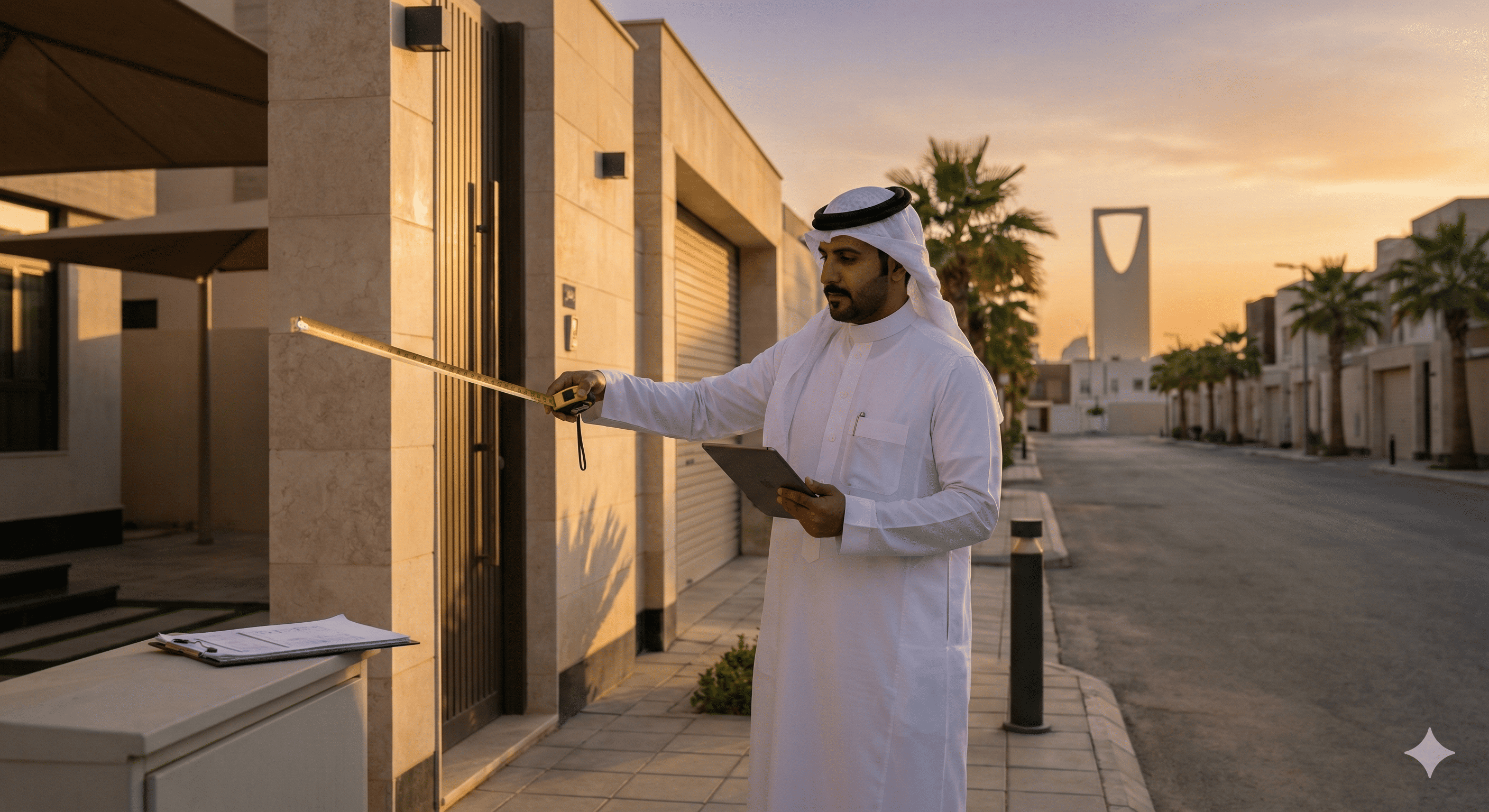

Why Does Property Valuation Differ Between Entities? Your Complete Guide to Understanding Real Estate Valuation in Saudi Arabia 2026

A comprehensive educational guide explaining real estate valuation in simple terms: What is valuation? What are its types and purposes? Why does it differ between banks, insurance, and sales? Who is responsible? And how to appeal if you're affected? Everything you need to know in one place.

Introduction: Why This Article Matters to You

Imagine you want to sell your property and receive a valuation of 800,000 SAR. Then you go to the bank for financing, and they tell you their valuation is only 650,000 SAR! When you insure the property, you find the insurance company valued it at 500,000 SAR. Three entities, three different values for the same property! Is this normal? And who is right?

If you've faced this situation or heard about it, you're not alone. Different property valuations from different entities is common and confusing for many. But the good news is there are logical reasons for these differences, and understanding them will help you make better decisions.

In this comprehensive guide, we'll explain everything you need to know about real estate valuation in a simple and clear way, even if you have no prior background. We'll answer all questions: What is valuation? Who does it? Why does it differ? And what do you do if you're harmed by it?

First: What is Real Estate Valuation?

Real estate valuation is simply the process of estimating the fair market value of a specific property at a specific time. This process is performed by a specialist called a "property appraiser," who uses scientific methods and international standards to reach a figure that reflects the true value of the property.

Think of real estate valuation as a "medical diagnosis" for the property. Just as a doctor examines your body and gives you a report on your health condition, the property appraiser examines your property and gives you a report on its financial value.

The Difference Between Valuation, Appraisal, and Price

Many confuse these terms, but there are important differences. Value is the scientific estimate of what the property is actually worth based on objective criteria. Price is the amount for which the property is offered for sale, which may be higher or lower than the value. The actual price paid is the amount actually paid when the transaction is completed after negotiation.

Illustrative example: Your property's value may be 500,000 SAR according to valuation, but you offer it for sale at a price of 550,000 SAR, then ultimately sell it for 520,000 SAR after negotiation.

Second: Who is Responsible for Regulating Real Estate Valuation in Saudi Arabia?

The Saudi Authority for Accredited Valuers (TAQEEM) is the official body responsible for regulating and developing the valuation profession in Saudi Arabia. The Authority was established under the Accredited Valuers Law issued by Royal Decree No. (M/43) dated 9/7/1433H.

What Does TAQEEM Do?

The Authority performs several vital tasks including: Accrediting and licensing property appraisers after they pass required tests and courses. Setting standards and rules regulating the valuation profession. Monitoring the quality of valuation work and appraiser performance. Receiving complaints, investigating them, and taking necessary actions. Developing the profession and raising the efficiency of workers through continuous training programs.

The "Qeem" Electronic Platform

The Authority launched the "Qeem" electronic platform, which is the official portal for all real estate valuation operations. Through this platform: Valuation requests are submitted and tracked. Valuation reports are uploaded and documented. Reports are verified and approved. A complete record of all valuation operations is maintained.

Third: The Three Real Estate Valuation Methods

Property appraisers use three main methods to reach property value, choosing the most appropriate method based on the property type and valuation purpose:

1. Market Approach (Comparison)

This is the most common and widely used method, especially for residential properties like apartments and villas. The appraiser compares the property to be valued with similar properties that have recently sold in the same area or comparable areas.

The appraiser considers several factors when comparing: location and neighborhood, area, property age, finishing and maintenance condition, number of rooms and facilities, view and orientation. Then adjustments are made to the prices of comparable properties to reflect differences, arriving at the final value.

2. Income Approach

This method is used for investment properties that generate income, such as rental residential buildings, commercial complexes, and offices. The valuation relies on calculating the expected annual net income from the property, then converting it to capital value using the prevailing market return rate.

Simple example: If a property generates net rent of 100,000 SAR annually, and the market return rate is 8%, then the property value = 100,000 ÷ 8% = 1,250,000 SAR.

3. Cost Approach

This method is used for unique or new properties for which sufficient market data is not available, such as schools, hospitals, or specialized buildings. The appraiser calculates the cost of rebuilding the property at today's prices, then deducts the depreciation percentage based on the building's age and condition, and adds the land value.

Example: New construction cost = 800,000 SAR, depreciation rate 20% = 160,000 SAR, land value = 400,000 SAR. Final value = 800 - 160 + 400 = 1,040,000 SAR.

Fourth: Different Purposes of Real Estate Valuation

There is no single valuation that fits all purposes. The purpose of valuation significantly affects the final result, and this is one of the main reasons for differing valuations. Let's review the different purposes:

Valuation for Sale and Purchase

The goal here is to determine the fair market value at which the property can be sold in the open market. The appraiser focuses on actual sale prices of similar properties and the state of supply and demand in the market.

Valuation for Financing and Mortgage

When you apply for a real estate loan, the bank requests property valuation to determine the collateral value. Banks are usually more conservative in their valuations because they want to ensure recovery of their money if the customer defaults. Therefore, bank valuation may be 10-20% lower than market value.

Valuation for Insurance

Insurance companies need property valuation to determine the insurance coverage amount. This valuation focuses on the cost of rebuilding in case of disaster, not market value. Therefore, it may be lower because it often doesn't include land value.

Valuation for Inheritance

When distributing estate, property valuation is required to determine each heir's share fairly. The valuation must be neutral and accurate to avoid disputes among heirs.

Valuation for Expropriation

When the government needs to expropriate a property for public benefit, valuation is conducted to determine fair compensation for the owner. This type is subject to special regulations and a professional guide issued by the Authority.

Fifth: Why Does Valuation Differ From One Entity to Another?

Now we've reached the most important question: Why do you get different valuations for the same property? There are several logical reasons:

1. Different Valuation Purpose

As we explained, each purpose has different criteria. Bank valuation focuses on collateral value, while sales valuation focuses on market value, and insurance valuation focuses on replacement cost. It's natural for results to differ.

2. Different Methodology Used

One appraiser may use the comparison method, while another uses the income or cost method. Even when using the same method, the comparable properties chosen or adjustments applied may differ.

3. Different Available Data

Valuation quality depends on data quality. An appraiser with access to a comprehensive database of recent sales transactions may reach a different result than one relying on limited information.

4. Different Appraiser Experience and Competence

Although all accredited appraisers have met Authority requirements, practical experience and knowledge of the local market varies from one appraiser to another, especially for complex properties or areas with unique characteristics.

5. Valuation Timing

The real estate market is changing. A valuation conducted six months ago may differ significantly from today's valuation due to market changes and supply and demand.

6. Policies of the Requesting Entity

Banks, for example, have internal policies requiring a safety margin in valuation. Some request the appraiser not to exceed a certain percentage of the area's average prices.

Sixth: Types of Value in Real Estate Valuation

It's important to understand that there are different types of "value," and each type is used for a specific purpose:

Market Value

This is the estimated amount for which the property can be sold in the open market, between a willing seller and a willing buyer, after appropriate marketing and without coercion. This is the most common type.

Investment Value

The property's value to a specific investor based on their own goals and expectations. It may differ from market value depending on the investor's strategy.

Liquidation Value

The value in case of quick or forced sale. Usually 20-40% lower than market value due to time pressure.

Insurance Value

The cost of rebuilding or replacing the property, used to determine insurance coverage.

Book Value

The property value recorded in company accounting records, which may differ significantly from market value.

Seventh: Factors Affecting Property Value

The property appraiser takes many factors into account when determining value:

Location

The most important factor in valuation. Includes: neighborhood and area, proximity to services and facilities, accessibility and transportation, quality of nearby schools and hospitals, safety and tranquility.

Property Characteristics

Total area and building area, number of rooms and bathrooms, building age and maintenance condition, finishing quality and materials used, additions such as pool or garden.

Economic Factors

General real estate market condition, supply and demand in the area, interest rates and financing costs, general economic situation.

Legal and Regulatory Factors

Type of deed and legal status, building regulations and permitted heights, existence of mortgages or restrictions on the property.

Eighth: How to Get a Property Valuation?

If you need to value your property, follow these steps:

Step One: Determine the Valuation Purpose

Is the valuation for sale? Bank financing? Insurance? Inheritance? Determining the purpose is important for choosing the right appraiser and getting the correct type of valuation.

Step Two: Choose an Accredited Appraiser

Make sure to choose an appraiser or valuation company licensed by the Saudi Authority for Accredited Valuers. You can verify the license through the Authority's website or the Qeem platform.

Step Three: Prepare Required Documents

Usually you'll be asked for: copy of ownership deed, copy of national ID, property plans if available, any additional documents depending on property type.

Step Four: Field Inspection

The appraiser will visit the property to inspect it, take photos, and gather necessary information.

Step Five: Receive the Report

You'll receive an official documented valuation report through the Qeem platform, including all details and the final value with reasons and criteria used.

Valuation Fees

There is no unified pricing for real estate valuation. Fees vary based on property type, size, location, and appraiser experience. Generally, residential property valuation fees range from 1,000 to 3,000 SAR. Commercial and complex property valuation may be higher.

Ninth: What to Do If You're Not Convinced by the Valuation?

If you receive a valuation you believe is unfair or inaccurate, you have several options:

Option One: Request Review from the Same Appraiser

Contact the appraiser and ask about the reasons that led to this value. There may be information they didn't see or errors that can be corrected.

Option Two: Get a Second Valuation

You can request valuation from another appraiser for comparison. If there's a big difference, one of the valuations may be inaccurate.

Option Three: File a Complaint with the Authority

If you believe the appraiser violated professional standards or made a serious error, you can file a complaint with the Saudi Authority for Accredited Valuers. The Authority will investigate and take appropriate action.

How to File a Complaint

You can file a complaint through: The Saudi Authority for Accredited Valuers website (taqeem.gov.sa). The Qeem electronic platform. Direct communication with the Authority. The complaint should include: valuation report number, reasons for objection, any supporting documents.

Appealing Bank Valuation

If your objection is to a valuation done for bank financing purposes, you can: Discuss the matter with the bank and request re-valuation. File a complaint with the Saudi Central Bank (SAMA) through "SAMA Cares" service if you feel wronged. Apply to another appraiser and submit their report to the bank for consideration.

Tenth: Golden Tips for Dealing with Property Valuation

Before Requesting Valuation

Clearly define the valuation purpose. Choose an accredited appraiser with experience in your property type and area. Prepare all required documents and information. Ensure the property is in the best possible condition before inspection.

During the Valuation Process

Be present during the inspection to clarify any inquiries. Highlight features and additions in your property. Provide any information that may benefit the appraiser such as recent sales in the area.

After Receiving the Report

Read the report carefully and understand the methodology used. Ask about any unclear points. Compare the result with your expectations and market prices. If there's a significant discrepancy, discuss it with the appraiser or request a second valuation.

General Tips

Don't rely on internet valuations or personal estimates for important decisions. Keep a copy of the valuation report as it's an official approved document. Remember that valuation reflects value at a specific moment and may change over time. Don't sign any waivers before fully understanding your rights.

Frequently Asked Questions

How long does the property valuation process take?

Usually it takes 3 to 7 business days depending on property type and complexity. Simple residential properties are faster, while commercial or complex properties may need more time.

Can I attend the appraiser's property inspection?

Yes, and it's preferred so you can explain the property's features and answer the appraiser's inquiries.

Is bank valuation final and binding?

Bank valuation is binding for the bank in its financing decision, but you can object or request re-valuation if you have justification.

Does land valuation differ from building valuation?

Yes. Land is usually valued using market comparison method, while buildings may be valued using different methods depending on type and valuation purpose.

Can valuation be higher than the asking price?

Yes, valuation may be higher or lower than the offered price. The seller may offer their property for less than its value for personal reasons, or for more than its value hoping for higher profit.

What's the difference between accredited and non-accredited appraiser?

An accredited appraiser holds a license from the Saudi Authority for Accredited Valuers, has passed required tests and training, and is subject to oversight. Their reports are officially recognized. Non-accredited appraiser reports are unofficial and not accepted by government entities and banks.

Can one valuation report be used for more than one purpose?

It depends on the purposes. Some reports may work for multiple purposes, but in many cases entities require their own specific valuation.

Conclusion

Real estate valuation is both science and art, not just a random number. Different valuations are normal and expected because each entity has its own criteria and purposes. What's important is that you understand these differences and know your rights.

Always remember: Choose an accredited appraiser. Clearly define the valuation purpose. Read the report carefully and understand its methodology. Don't hesitate to ask and inquire. Know your right to appeal if you feel wronged.

Knowledge is power, and your understanding of real estate valuation will help you make better decisions whether you're a seller, buyer, or investor. Share this guide with those you know, as it may help them in their real estate journey.