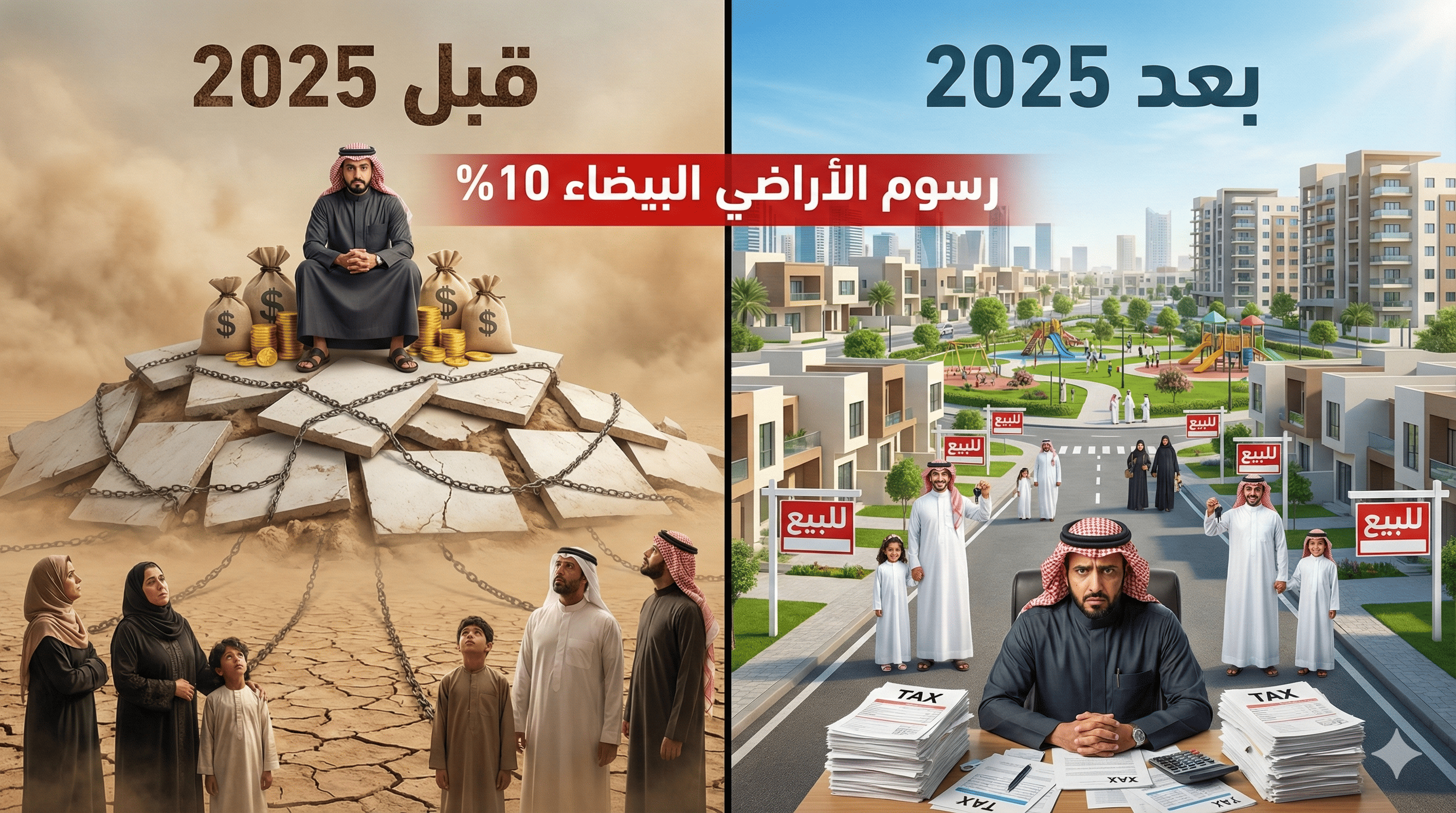

2025 White Land Fees Analysis: Will Major Landowners Be Forced to Sell and Land Prices Drop?

Comprehensive analysis of Saudi Arabia's new 2025 white land fees system and its impact on real estate prices. Learn about the five-tier system, progressive rates up to 10%, most affected areas, and whether land prices will actually decrease.

Introduction: The Question on Every Citizen's Mind

For years, Saudi citizens have been asking: When will land prices drop? Why do vast empty lands remain idle in fully-serviced neighborhoods while their prices keep doubling? And why must young Saudis take on 25-year loans just to afford a small plot of land?

In April 2025, the long-awaited decision came: a radical amendment to the white land fees system, raising rates from 2.5% to 10%, and expanding coverage to include vacant properties! But will this decision truly break the monopoly of major landowners and make land affordable for citizens? Or is it just another tax that buyers will ultimately bear?

In this comprehensive analysis, we break down the new system in simple terms, present expected scenarios, and reveal the most affected neighborhoods.

First: Understanding the Problem - Why Is Land So Expensive?

Shocking Monopoly Statistics

Before understanding the solution, we must grasp the scale of the problem. In Riyadh alone, 64% of land within urban boundaries remains undeveloped! We're talking about more than 1.9 million square meters of empty land in the capital, while citizens search for reasonably priced land in distant city outskirts.

Nationwide, white land covers approximately 1.91 million hectares, with 26% in the Riyadh region alone. These lands have complete services including electricity, water, sewage, and roads, yet they remain empty because owners are waiting for prices to rise further!

Why Do Merchants Hoard Land?

The reason is simple: land was a "free investment"! Before the amendment, the fee was only 2.5% and applied to areas starting from 10,000 square meters. This meant a merchant could buy land worth millions and leave it empty for years while its value doubled without paying anything significant!

Second: Breaking Down the New System - What Changed in 2025?

The Shift from "Fixed Fee" to "Painful Progressive Fee"

The new amendment approved by the Council of Ministers on April 29, 2025, completely changed the game. Here are the key changes:

Fee rates quadrupled: From a maximum of 2.5% to a maximum of 10%. This means a landowner with property worth 10 million riyals may pay 1 million riyals annually in fees!

Minimum area reduced: From 10,000 square meters to 5,000 square meters. This doubled the number of owners covered by the system.

Expanded scope: The system no longer covers only residential land but includes all developable land within urban boundaries.

Addition of vacant properties: For the first time, the system includes empty unused buildings! Fees up to 5% of property value (can be raised to 10%).

The Five Tiers: Not All Lands Are Equal

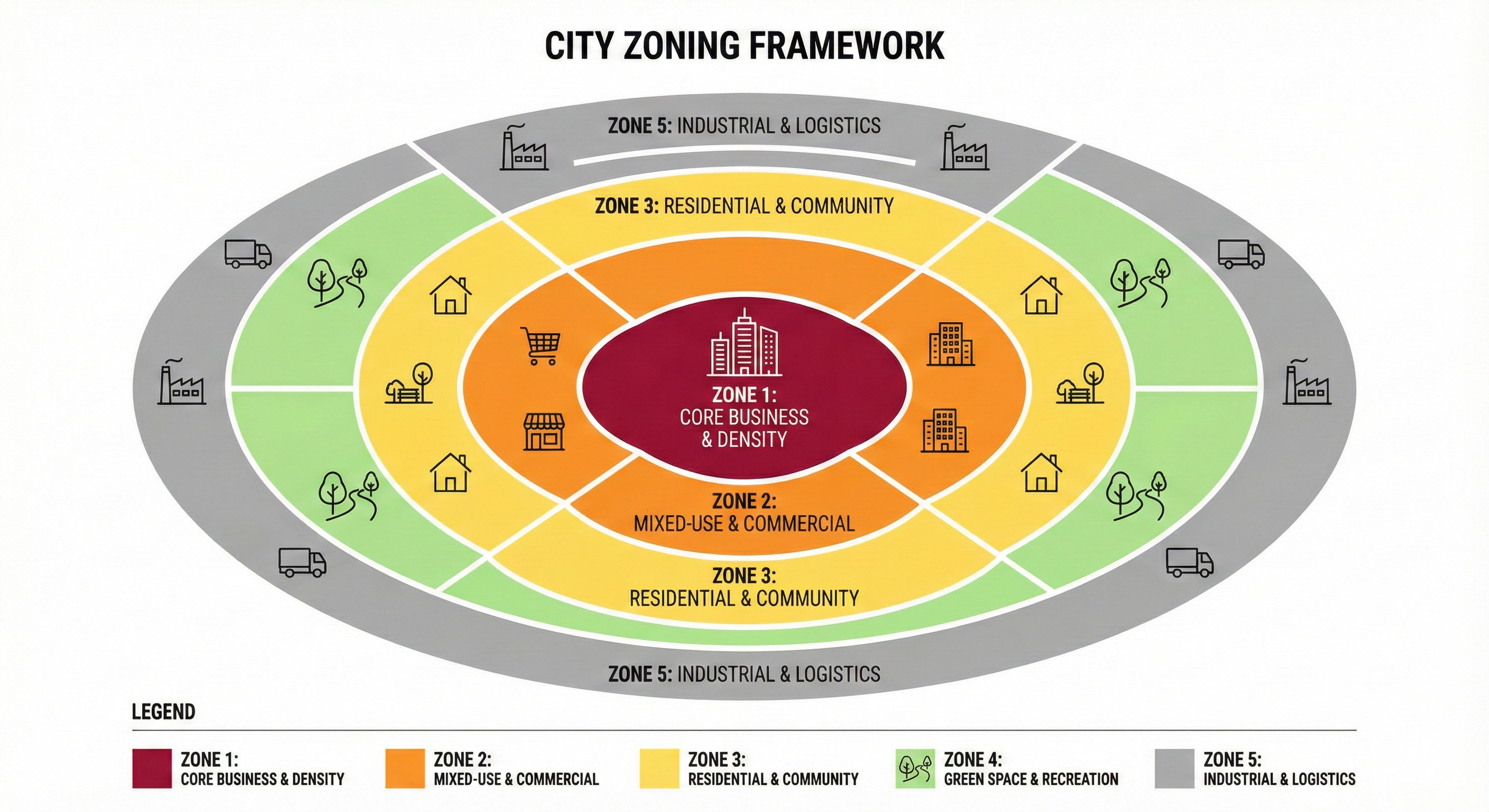

One of the smartest aspects of the new system is dividing the city into 5 tiers based on development priority. The better the location and more complete the services, the higher the fee rate:

Tier One (Highest Priority) - 10% fees: These lands are in the city center, fully serviced, close to vital centers and major projects. Maximum pressure on owners.

Tier Two (High Priority) - 7.5% fees: Vital areas but slightly further from the center, such as areas along Prince Mohammed bin Salman Road east of Riyadh.

Tier Three (Medium Priority) - 5% fees: Areas needing medium-term development, services may not be fully complete.

Tier Four (Low Priority) - 2.5% fees: Distant city outskirts, areas requiring larger infrastructure investments.

Tier Five (Outside Priorities) - 0% fees: No fees imposed, but counted within the owner's total land holdings!

Third: Expected Scenarios - What Will Merchants Do?

Scenario One: Selling and Increasing Supply

This is the ideal scenario the government hopes for. When holding land becomes costly, owners will be forced to sell. Initial numbers are promising: within one week of the announcement, 5 million square meters of land were listed for sale! Total current supply is estimated at 200 million square meters of white land.

Expected result: Increased supply = lower prices. Reports indicate an actual 30-40% decrease in undeveloped land prices in Riyadh since implementation began!

Scenario Two: Development and Increasing Housing Units

Some owners will choose to develop their lands rather than sell. This is also positive because it means more apartments and villas in the market = lower rental and ownership prices.

Scenario Three: Subdivision and System Evasion

Some owners try to circumvent the system by dividing their lands into plots smaller than 5,000 square meters. But the system anticipated this: if an owner's total lands in the city exceed 5,000 square meters, fees apply!

Scenario Four: Gifting to Relatives (The Loophole)

A 50% increase in "gift" transactions has been observed compared to the annual average! Some owners transfer ownership to relatives up to the third degree to fragment ownership. But this is a temporary loophole expected to be addressed.

Fourth: The Heat Map - Most Affected Neighborhoods

Hot Zones (10% fees)

These areas will see the greatest pressure on owners and highest probability of price drops: central Riyadh and vital area surroundings, areas near major projects like NEOM and Diriyah, and fully-serviced neighborhoods filled with hoarded white land.

Medium Zones (5-7.5%)

Living example: Al-Narjis and Al-Arid neighborhoods in Riyadh contain more than 4 million square meters of developed but unbuilt white land! This latent capacity is estimated at more than 13,500 housing units.

Cool Zones (2.5% or less)

Distant city outskirts and areas with incomplete services will be less affected, but may benefit from demand migration seeking better prices.

Fifth: Vacant Properties - The New Important Addition

What Are Vacant Properties?

For the first time, the system targets empty buildings, not just land! A vacant property is: a building within urban boundaries unused for a long period without acceptable justification, whose non-use affects adequate market supply.

Why Is This Important for Citizens?

How many times have you passed a completely empty building because its owner demands an astronomical rent? This system will force such owners to lower rents or pay fees up to 5% of property value annually!

Sixth: International Experiences - What Happened in Other Countries?

Canada (Vancouver)

Imposed taxes on vacant properties, result: 5-15% decrease in housing unit prices, and thousands of units returned to market.

Australia (Melbourne)

Applied similar tax, within 3 years: 10% of vacant properties returned to market, improved housing unit availability especially in rental sector.

France (Paris)

Tax result: vacant apartments decreased by 20% between 2000 and 2015, rental supply increased.

Seventh: What Does This Mean for Average Citizens?

If You're Looking to Buy Land

Time is on your side! Prices have already started dropping (30-40% in some areas). Wait a bit and monitor the market, especially in Tier One and Two neighborhoods where pressure on owners is greatest.

If You're Looking to Rent an Apartment

The vacant property system will force owners of empty buildings to lower rents. Watch buildings that have been empty for long periods - you may find better offers soon.

If You're a Real Estate Investor

The old model (buy land and wait for prices to rise) is over! Now you must think about development or partnership with developers. Opportunities exist in lands whose owners will be forced to sell at reduced prices.

If You Own White Land

Your options are clear: develop the land and recover fees, sell before fees accumulate, or enter into partnership with a developer to share costs.

Frequently Asked Questions

Will land prices actually drop?

Initial indicators are very positive. Undeveloped land has already dropped 30-40% in Riyadh since the implementation announcement. But the decrease will vary by location and tier.

Will the end buyer bear the fees?

This is difficult for several reasons: fees are annual and recurring, competition among owners wanting to sell will lower prices, and land supply in the market will increase significantly.

When will the system apply to vacant properties?

The vacant property regulations will be issued within one year of the system's publication, approximately mid-2026.

What if I don't register my land?

Penalty may reach 100% of the fee value! Registration deadline is October 30, 2025.

Where does the fee revenue go?

All fee revenues are allocated entirely to support housing projects! So far, more than 2.7 billion riyals have been spent on infrastructure development for over 100 housing projects.

Conclusion: Beginning of a New Era for Saudi Real Estate

The new white land fees system is not just a tax, but a fundamental restructuring of the Saudi real estate market. The message is clear to major landowners: land is no longer a "free vault" for freezing money - either develop it and serve the economy, or sell it to those in need.

For average citizens, this means real hope for affordable home ownership. Initial numbers are promising: 30-40% drop in undeveloped land prices, 200 million square meters offered for sale, and thousands of housing units coming to market.

At Raghdan, we help you understand the market and make the right decision. Browse our real estate listings and benefit from our consulting services to achieve your ownership dream.