When Does Your Mortgage Become a Danger to Your Life? A Comprehensive Guide with Numbers and Scientific Studies to Protect Your Financial and Family Stability

A comprehensive scientific guide revealing when mortgage installments transform from a homeownership dream into a financial nightmare. Includes the golden 28/36 rule, installment impact by career stage, psychological effects on individuals and families backed by scientific studies, what happens when you default, and golden tips before signing the contract.

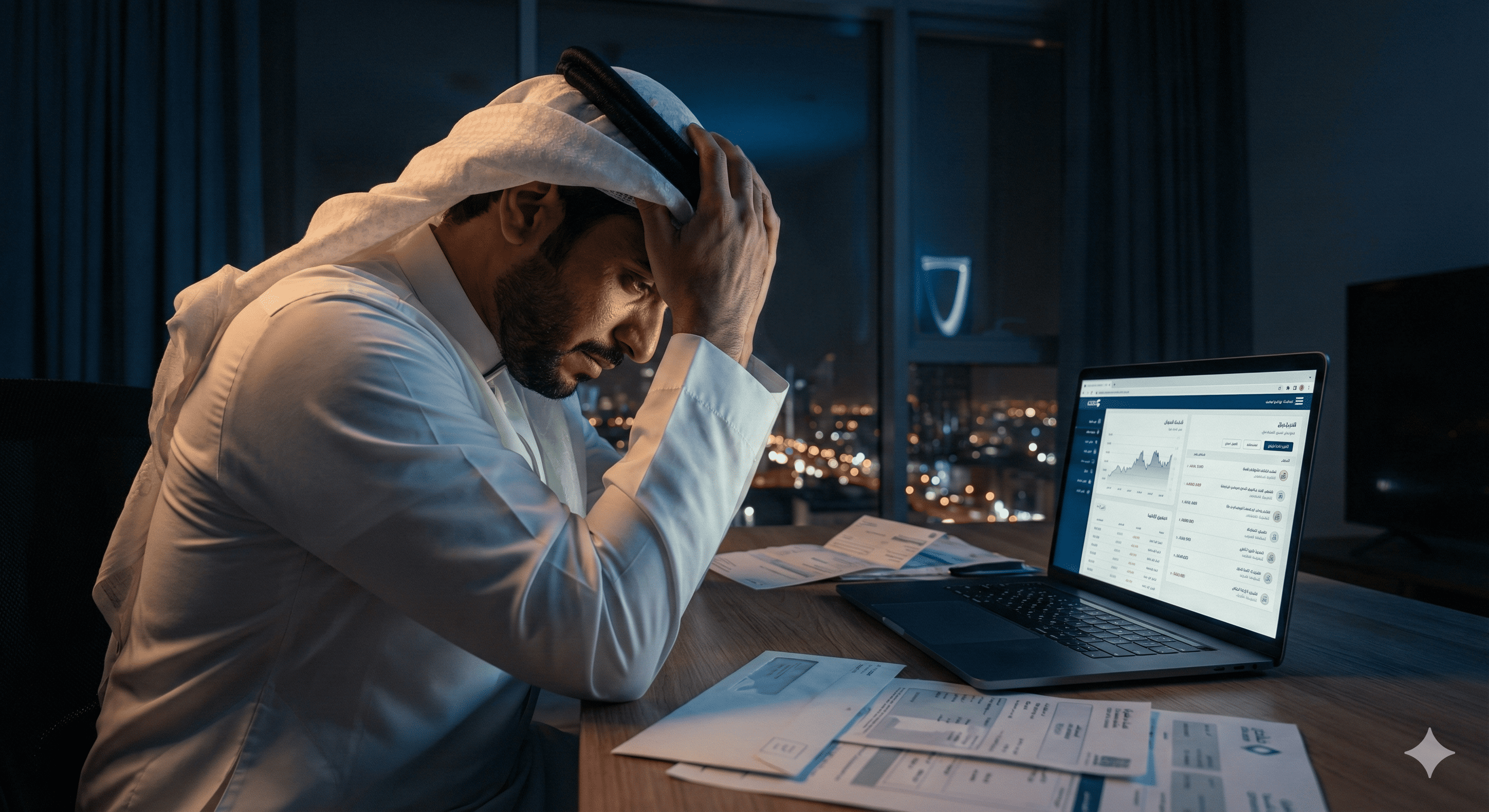

Introduction: Between the Dream of Ownership and the Nightmare of Debt

We sincerely wish from the bottom of our hearts that you achieve your dream of owning your own home, and that this home becomes a source of happiness and stability for you and your family. But before you sign a mortgage contract extending 20 or 25 years, there are critical questions you must ask yourself: Will this installment be a burden that crushes my back? Will I be able to live with dignity after it's deducted from my salary? What if I lose my job?

This article isn't meant to scare you away from real estate financing, but to empower you to make an informed decision based on real numbers and scientific studies. We'll reveal when the installment is safe, and when it transforms into a time bomb threatening your financial, psychological, and family stability.

First: The Golden 28/36 Rule - The Global Standard for Financial Safety

Before we talk about danger, we need to understand what's safe. There's a global rule used by banks and financial advisors worldwide called the 28/36 rule, which simply states:

The Number 28: Housing Percentage of Income

Your monthly housing costs (installment + property taxes + insurance + maintenance) should not exceed 28% of your gross monthly income (before deductions). Example: If your salary is 15,000 SAR, the maximum safe housing installment is 4,200 SAR monthly.

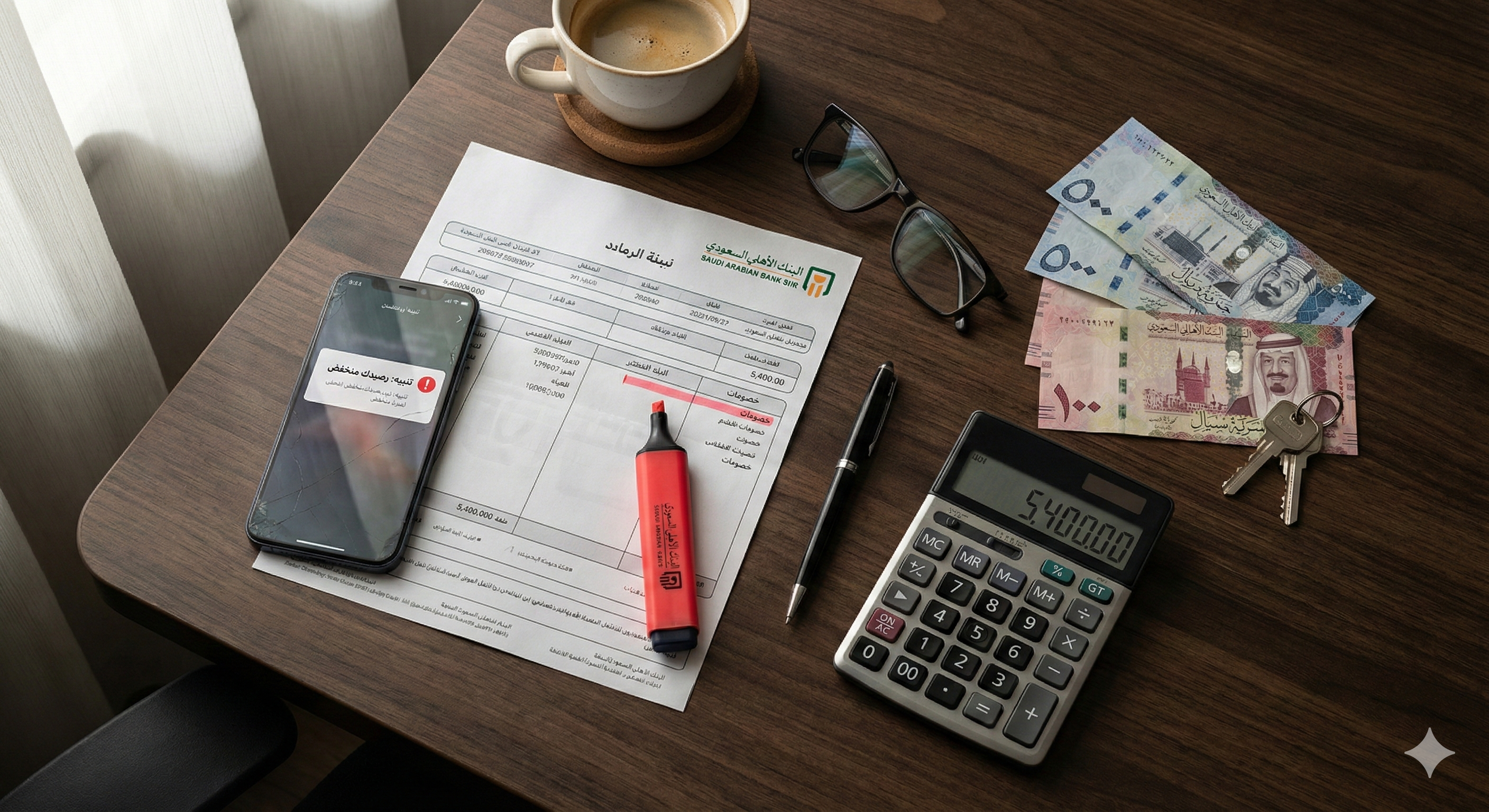

The Number 36: All Debts Percentage of Income

All your monthly obligations (home installment + car payment + credit cards + any other debts) should not exceed 36% of your gross income. Using the same example: The maximum for all your combined debts is 5,400 SAR monthly.

Why These Specific Percentages?

These percentages aren't arbitrary. They were established based on decades of studies and experiences proving that exceeding them puts families in the financial danger zone. When you adhere to these ratios, you have enough left for dignified living, emergency savings, and enjoying life without suffocating pressure.

Second: The Danger Map - When Does the Installment Transform from Burden to Catastrophe?

Let's put things in a clear framework with numbers and percentages:

The Green Zone: 28% or Less of Income

This is the safe zone. The installment is comfortable, you can save, and you face emergencies with confidence. If you're in this zone, you're making a wise financial decision.

The Yellow Zone: 29% - 35% of Income

The caution zone. The installment is acceptable but puts pressure on your budget. Any emergency (illness, car repair, temporary job loss) could put you in trouble. You must have a strong emergency fund.

The Orange Zone: 36% - 43% of Income

The danger zone. You're walking on the edge of the cliff. Most banks hesitate to lend you at this ratio. Financial pressure will be part of your daily life. Any small shake could bring you down.

The Red Zone: 44% - 50% of Income

The imminent catastrophe zone. Half your salary goes to debt. There won't be enough left for dignified living. Psychological pressure will be severe. The probability of default is very high.

The Black Zone: More Than 50% of Income

Financial collapse. Most banks won't approve lending you at all. If you reach this percentage somehow, you're in a real crisis needing urgent intervention.

What Do Studies Say?

A study by the National Association of Realtors in America in 2024 revealed that 48% of mortgage applications were rejected due to high debt-to-income ratios. 2025 data shows that mortgage default rates rise significantly when the debt ratio exceeds 43% of income.

Third: Installment by Career Stage - Not Every Time is Right

Age and career stage play a crucial role in determining how dangerous a mortgage installment is. What's safe in your thirties could be catastrophic in your fifties.

Stage One: Early Career (25-35 Years)

Advantages: You have many years ahead for repayment. Your salary will likely increase with experience. Your ability to adapt and recover from crises is higher. Risks: Salary is relatively low. Job stability isn't guaranteed. Your circumstances may change (marriage, children) increasing your expenses. Advice: This is the best stage to buy, provided the installment doesn't exceed 25% of your current salary (not expected). Don't base your calculations on a promotion you haven't received yet.

Stage Two: Mid-Career (36-50 Years)

Advantages: Your salary is likely at its peak. Your experience makes you more job-secure. Your negotiating ability is higher. Risks: Large family obligations (children in school, elderly parents). Your health may start requiring more attention. Job competition with younger generations. Advice: This is a sensitive stage. The installment should not exceed 28% because your other expenses are at their highest. Beware of social pressures pushing you to buy a house bigger than you need.

Stage Three: Late Career (51-60 Years)

Advantages: You may have larger savings for the down payment. Your children may have become independent. Risks: Remaining work years are limited. Early retirement may be imposed on you. Income will decrease after retirement. Your health may need larger expenses. Banks may refuse to lend you or shorten the term. Advice: This is the most dangerous stage for long-term mortgages. If you'll buy, you should finish repayment before retirement. The installment should not exceed 20% of your salary. Better: Save and buy cash or with a very short installment.

Fourth: Psychological Impact - When the Mind Gets Sick Because of the Installment

Financial pressure isn't just numbers in a bank account. It's a weight pressing on your chest every day. Scientific studies reveal a concerning picture:

What Do the Numbers Say?

A study published in BMC Psychology in 2024 involving more than 25,000 people in China found that housing debt has a significant positive impact on depressive symptoms, meaning it notably increases them. A British study from the Institute of Psychiatry in London revealed that 24% of those with mental illness have debts, compared to only 8% of those without. 2025 statistics show that 43% of American adults say money negatively affects their mental health, causing anxiety, insomnia, and depression.

Psychological Symptoms of Financial Pressure

Chronic anxiety and constant thinking about money. Sleep difficulties and insomnia. Depression and loss of hope. Constant tension and excessive nervousness. Difficulty concentrating at work. Feeling helpless and losing control. In severe cases: suicidal thoughts.

Important Study from Britain

The Money and Mental Health Policy Institute in Britain published a report in 2024 revealing that rising interest rates will affect approximately 5 million British households by 2026. The average household whose fixed-rate contract expires will pay an additional £240 monthly. This sudden financial pressure is directly linked to deteriorating mental health.

Fifth: Impact on Family - When the House You Bought Falls Apart

The painful irony: You buy a house to gather your family, and it becomes the reason for their breakup. Scientific studies confirm this tragic relationship.

Financial Disputes and Divorce

A study from Kansas State University published in Family Relations involving more than 4,500 couples found that arguments about money are by far the strongest predictor of divorce. Financial disputes predict divorce more than any other type of marital conflict. Couples who disagree about money early in their marriage are most likely to separate later.

How Does Financial Pressure Affect Marital Relationships?

It increases the intensity of arguments and shouting. It reduces the quality of communication between spouses. It creates an atmosphere of mutual blame. It reduces enjoyable time together (no money for outings or entertainment). It increases tension that reflects on intimate relationships. It pushes one party to work extra hours, reducing family time.

Impact on Children

Children aren't isolated from this pressure. A study from the American Psychological Association revealed that 69% of parents believe their financial stress doesn't affect their children, while 91% of children said they notice their parents' tension and are affected by it. A study published in 2022 found that family financial stress during the COVID pandemic was directly linked to increased behavioral and emotional problems in children.

Symptoms of Children Affected by Parents' Financial Pressure

Anxiety and fear of the future. Feelings of guilt (they think they're the cause). Embarrassment from peers (they can't buy what their classmates buy). Declining academic performance. Behavioral problems (aggression or withdrawal). Sleep and eating disorders.

Sixth: What Happens If You Can't Pay?

This question frightens many, but you must know the answer before signing any contract. Reality may be harder than you imagine.

Stages of Default

Stage One - Late Payment (30-60 days): Calls and messages from the bank begin. A note is recorded on your credit history. Late fees may be imposed. Stage Two - Default (60-90 days): The delay becomes official on your record. Pressure from the bank increases. Penalties and interest accumulate. Stage Three - Official Warning (90-120 days): The bank sends an official payment warning. SIMAH is notified of the default. Other financing doors close before you. Stage Four - Legal Procedures: The bank has the right to file a lawsuit. A ruling may be issued to seize your assets. Finally: The bank may foreclose on the property.

What Happens to the Property?

In Saudi Arabia, the registered mortgage system gives the bank the right to foreclose on the property upon default. The property is sold at public auction. If the sale price is less than the remaining amount you owe, you remain liable for the difference. If it's higher, you get the difference after deducting all dues.

Long-Term Consequences

Credit record destruction for years (at least 5-7 years). Difficulty obtaining any future financing. Your salary may be garnished to pay the difference. Devastating psychological and social impact. In some cases: You may be banned from traveling until the debt is paid.

Important Statistics

According to 2024 data, approximately 70% of mortgage default cases occur due to negative life events such as: job loss, divorce, severe illness, or death of a family member contributing to income.

Seventh: Real Estate Financing in Saudi Arabia - What You Need to Know

The Saudi system has characteristics you must understand:

Available Financing Types

Real Estate Development Fund (REDF) Financing: Interest-free loans up to 500,000 SAR. For eligible Saudi citizens. In cooperation with more than 40 banks and financing institutions. Sakani Program: A platform integrating all government housing solutions. Support covering the profit margin (interest). More than 560,000 families benefited by 2024. Commercial Bank Financing: Subject to Islamic financing principles (Murabaha or Ijara). Profit margin varies by bank and customer. Terms up to 25-30 years.

General Financing Requirements

Age: 21-65 years (some programs reach 70). Minimum salary: 5,000-7,000 SAR depending on bank. Employment duration: 6-12 months for employees, two years for business owners. Deduction ratio: Determined by SAMA and doesn't exceed a certain percentage of salary.

What Happens in Case of Default?

According to the Saudi Real Estate Financing Law, the financier has the right to resort to the competent court. The system imposes penalties on deliberate defaulters. However, the system also encourages amicable solutions and rescheduling before resorting to litigation.

Eighth: Profit Margin (Interest) - The Hidden Enemy

Many focus on the house price and forget the real enemy: the cumulative profit margin over the years of the loan.

A Shocking Example

Let's assume you're buying a house for 1,000,000 SAR, with a 5% annual profit margin, for 25 years. Monthly installment: approximately 5,850 SAR. Total you'll pay: approximately 1,755,000 SAR. Profit margin alone: 755,000 SAR (more than 75% of the original house value).

How to Reduce Profit Margin?

Pay a larger down payment: The less the financed amount, the less the total profit margin. Choose a shorter term: 15 years instead of 25 will save hundreds of thousands (but the installment will be higher). Pay early if you can: Some contracts allow early repayment without penalties. Compare between banks: The difference in profit margin could save you tens of thousands. Benefit from government support: Programs like Sakani cover part of the profit margin.

Ninth: 15 Golden Tips Before Signing the Financing Contract

Before Looking for a House

Calculate 28% of your salary - this is your installment ceiling. Review all your current debts and ensure the total won't exceed 36%. Build an emergency fund sufficient for at least 6 months of expenses. Improve your credit record months before applying.

When Searching and Comparing

Don't buy the maximum you can afford - leave a margin for emergencies. Compare offers from at least 3-5 banks. Read the entire contract and ask about every unclear clause. Ask about early repayment and late payment penalties. Make sure of the profit margin type: fixed or variable?

Before Final Signing

Imagine the worst scenario: What if you lost your job tomorrow? Discuss the decision with your spouse and agree together. Don't be shy to withdraw if you feel uncomfortable. Consult a financial specialist if the numbers confuse you. Remember: The house can be postponed, but your mental and family health cannot be recovered.

Tenth: When Should You Say "No" to Real Estate Financing?

There are cases where the decision not to buy is the smartest decision:

Say "No" If:

The installment will exceed 30% of your salary. You don't have a sufficient emergency fund. Your job is unstable or your sector is experiencing layoffs. You have other large debts. You're at the end of your career and the installment will continue after retirement. You're buying because "everyone's buying" and not because you actually need it. The house is bigger than you need to satisfy social appearances.

The Alternative: Rent and Invest the Difference

In some cases, renting + investing the difference between rent and installment may be financially better. This isn't shameful. It's financial intelligence.

Frequently Asked Questions

Is it true that the bank takes the house if you don't pay?

Yes, ultimately they have that right after legal procedures. But most banks prefer amicable solutions like rescheduling before resorting to court.

Is real estate financing haram (forbidden)?

Real estate financing in Saudi banks is subject to Sharia-compliant contracts (Murabaha or Ijara) approved by Sharia committees in banks. Consult a specialist if you have specific religious questions.

What's the ideal financing duration?

The shortest term you can afford. The longer the term, the greater the total profit margin. 15-20 years is better than 25-30 years if you can.

Should I buy now or wait for prices to drop?

No one can predict the market. More important than timing is your ability to afford. If you find a suitable house with a safe installment, don't wait.

What if the profit margin increases after signing?

If your contract has a fixed profit margin, you won't be affected. If it's variable, your installment may increase. Therefore, fixed is better for stability.

Can I sell the house before paying off the financing?

Yes, but you must pay off the remainder to the bank from the sale price first. If the sale price is less than the remainder, you'll pay the difference.

Conclusion

Owning a home is a beautiful dream, but it's not worth paying the price with your mental health, family stability, and peace of mind. Before you sign, ask yourself: Will I be able to sleep peacefully with this installment being deducted from my salary? If the answer is "no" or even "maybe not," then wait. Save more. Look for a smaller house. Or rent until your circumstances improve.

Always remember: A small house with peace of mind is a thousand times better than a palace that steals your sleep and destroys your relationships. We pray that Allah grants you safe housing and halal sustenance, and preserves your health and families. Share this article with those you love, as it may save someone from a decision they'll regret for the rest of their lives.