Tourism & Real Estate Intersection 2025: Small Investor's Guide to Golden Opportunities from Gathern to Heritage Properties

Comprehensive guide to tourism real estate investment in Saudi Arabia 2025. Learn about Gathern economy, short-term rentals, new licensing requirements, REEF rural tourism program, heritage property investment, and the summer home dilemma with ROI and risk analysis.

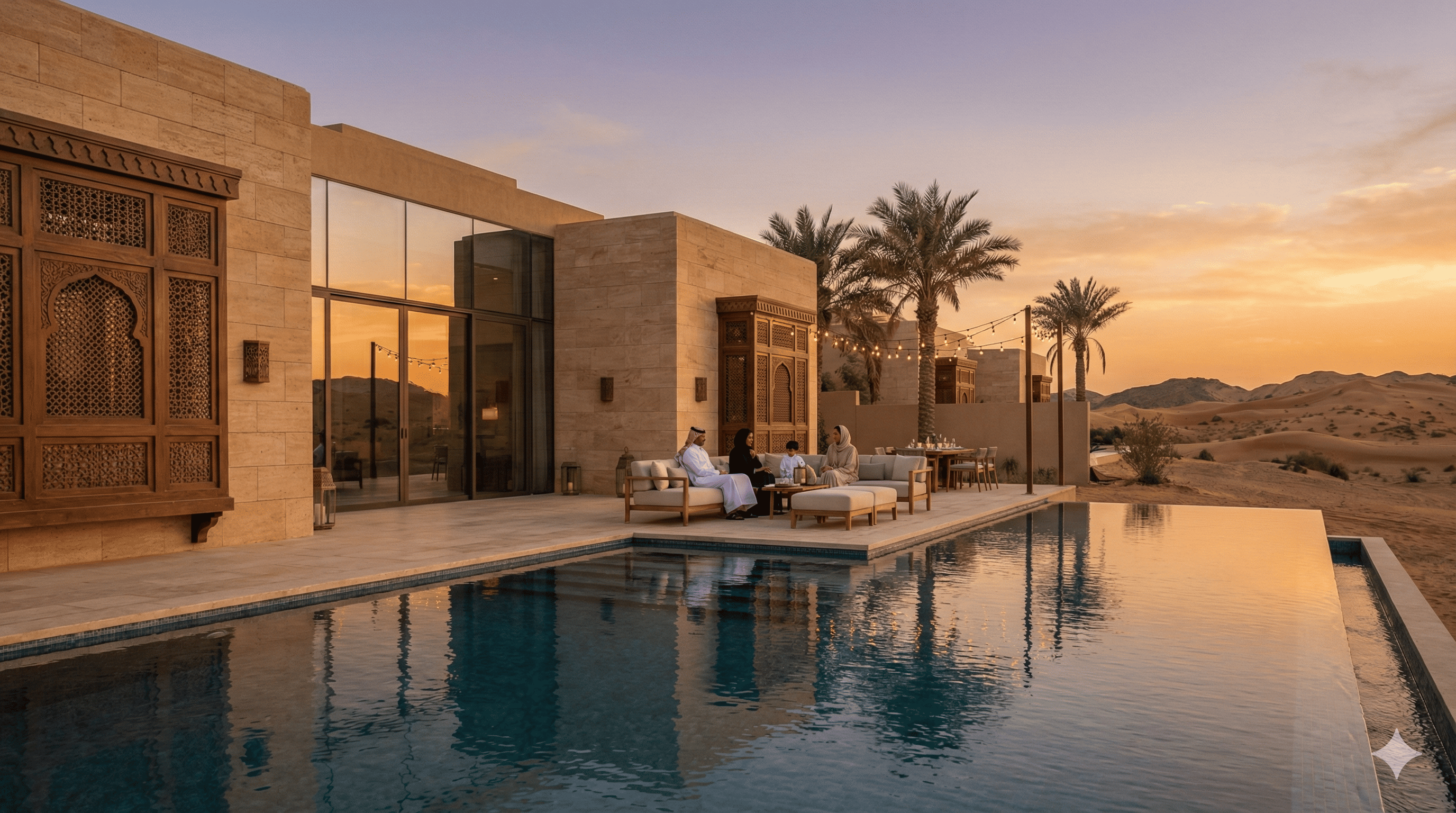

Introduction: Where Real Estate Meets Tourism

At the heart of Saudi Arabia's major economic transformations, a unique intersection emerges between two giant sectors: real estate and tourism. This intersection is no longer exclusive to large corporations and hotel owners but has become a fertile field for small investors who own an apartment, villa, or even an inherited mud-brick house. In 2024, the Kingdom welcomed over 116 million visitors with spending exceeding 284 billion riyals, and with the target of 150 million visitors by 2030, opportunities are doubling for those who can read the landscape.

This article dives into the details of this dynamic sector, from the economy of short-term rental platforms like "Gathern," to new licensing requirements that changed the rules of the game, from rural tourism supported by the "REEF" program, to investing in heritage houses as premium assets. We conclude with a frank analysis of the "summer home" dilemma and whether it's worth buying in 2025.

Chapter One: Gathern Economy - Short-Term Rental as Primary Income

The Boom That Changed the Equation

Saudi domestic tourism witnessed an exceptional leap of 44% in 2024 compared to the previous year, forming 40% of total travel movement in the Kingdom. This accelerated growth proved the viability of the short-term rental model and transformed it from a side hobby into a real income source. Platforms like "Gathern" and "Airbnb" have become household names, enabling thousands of citizens to convert their residential units into tourism investment assets.

Gathern platform, the first licensed by the Ministry of Tourism for booking tourist accommodation units in the Kingdom, has grown to include more than 50,000 residential places covering more than 200 areas and governorates from Hail in the north to Asir in the south. This expansion reflects the market's growing appetite for alternative accommodation options that combine privacy with authentic local experiences.

Host Economics: The Real Numbers

The main attraction for small investors lies in the significant difference between traditional residential rental returns and short-term tourist rental. While long-term residential rental yields in major cities range between 6% to 8% annually, short-term rentals during peak seasons can achieve net returns ranging from 8% to 12%.

But these attractive numbers hide operational complexities. The critical variable is occupancy rate, as a property achieving high occupancy during Riyadh Season or Abha summer or school holidays may suffer long periods of stagnation off-season. The "hidden costs" of hospitality also consume a large portion of profits: platform commissions typically range from 15% to 20%, plus cleaning fees, consumables, rapid furniture depreciation, and regular maintenance costs.

From Side Income to Active Business

The short-term rental model is no longer just a passive additional income source but has transformed into an active business requiring dedication or professional management. Short-term rental management is operationally intensive: continuous communication with guests, 24-hour response to inquiries and problems, ensuring high cleanliness standards, and dealing with challenges related to some guests' behavior.

Negative reviews on digital platforms can quickly destroy an asset's viability. In the world of ratings, a property's reputation is its real capital, and losing it means losing future bookings. This reality pushes many hosts to contract with specialized management companies, adding an additional cost ranging from 20% to 30% of revenue.

Chapter Two: Mandatory Licensing - End of the Informal Era

Ministerial Decision 2295: New Rules of the Game

With the start of 2025, a new era began in the short-term tourist rental market. The Ministry of Tourism issued a binding decision requiring anyone who owns or rents a furnished real estate unit providing daily accommodation for tourists for a fee to obtain a "Private Tourist Hospitality Facility" permit before practicing the activity.

This radical transformation ended the era of informal renting. The Ministry notified all local and international booking platforms to remove unlicensed facilities from their listings, and non-compliance exposes violators to strict penalties reaching up to one million Saudi riyals, or facility closure, or both, in addition to public shaming of violators.

License Requirements and Conditions

To obtain a Private Tourist Hospitality Facility permit, several basic conditions must be met. The applicant must be of Saudi nationality and must have an electronic ownership deed or electronic lease contract proving the right to use the unit. It also requires no objection from co-owners of the shared property for daily rental in the case of apartments within residential buildings.

License fees are 1,100 Saudi riyals annually per unit, valid for one full renewable year. There is a maximum ceiling for permits: no more than 3 permits per property and 8 total permits for one owner, unless contracted with a licensed hospitality facility management company.

Remarkable Growth in Licenses

Numbers confirm the market is moving toward regulation at great speed. The Ministry of Tourism recorded 333% growth in private hospitality facility licenses during 2024 compared to 2023, reaching 8,357 licenses compared to 1,929 licenses the previous year. This massive growth reflects investors' awareness of the importance of complying with new regulations.

Chapter Three: REEF Program and Rural Tourism Renaissance

The Less Discussed, More Promising Opportunity

While investors race for chalets and apartments in major cities, an exceptional opportunity emerges in rural tourism supported by the Sustainable Agricultural Rural Development Program "REEF Saudi." This program aims to diversify income sources for rural families and open a specialized field for "agritourism" properties.

In a qualitative step, REEF program, in cooperation with the Saudi Tourism Authority, completed preparing the "Agricultural Tourism Atlas" as an interactive digital platform facilitating access to activities and farms, enhancing rural tourism and opening new markets and job opportunities for authentic local products.

Rural Entrepreneurship Incubators

The "REEF Entrepreneurship" program provides real support for entrepreneurs in the sector. In 2025, the first 20 entrepreneurial projects graduated within two specialized business incubators in agricultural rural tourism and rural development. These projects varied to include agricultural tourism, agricultural projects, and transformative industries for local products.

The program was implemented in 8 training camps covering 8 different regions, targeting more than 200 projects and entrepreneurial ideas. Qualified projects enter the "REEF Business Accelerator" hosting 10 startups with the goal of converting them into complete companies, providing financing, training, and mentorship.

Rural Investment Models

For small investors wanting to enter this field, several models are available. The first is converting the family farm into a tourist destination offering authentic experiences: farm tours, tasting fresh products, harvesting or honey production workshops. The second is creating or renting rural accommodation units (cabins, luxury tents, heritage houses) in areas with natural attraction.

The main challenge lies in distance from service centers and access. Success depends entirely on proximity to a "hero destination" like AlUla or Abha or Al-Baha, or being on an active tourist route. Location is everything in rural tourism.

Chapter Four: Heritage Property Investment - Premium Assets

From Dilapidated Burden to Precious Asset

There is a growing trend of acquiring and restoring traditional mud-brick and stone houses in areas like AlUla, and heritage villages in Asir, Taif, and Al-Baha. These properties, once considered dilapidated assets or burdens on their heirs, have today become Premium Assets due to the scarcity of authentic heritage experiences that both international and local tourists seek.

The Royal Commission for AlUla Governorate is implementing integrated projects to restore old mud-brick houses as part of a strategy to revive the traditional urban fabric. Restoration work relies on traditional materials such as mud, stone, and palm, while integrating modern techniques ensuring sustainability and resistance to environmental factors.

Functional Transformation of Heritage Buildings

Restored heritage buildings are transformed into various tourist and cultural destinations: small museums, art galleries, heritage guesthouses, shops and restaurants reflecting local identity. This functional diversity enhances investment returns and creates unique experiences for visitors. A carefully restored mud house in a heritage village can command nightly rates rivaling five-star hotels, driven by the "experience economy" that values authenticity and uniqueness.

Risks and Challenges

This is a "high-risk, high-reward" strategy requiring careful study. Restoration costs are very high and require rare specialized craftsmanship. A single small village may cost millions of riyals to restore. There are also complex regulatory challenges for heritage preservation: what can and cannot be modified, and approvals required from the Heritage Authority and Ministry of Culture.

The Rijal Almaa village model demonstrates the possibility of success. An investment of four million riyals over three years transformed the village into a prominent tourist destination in Asir Province tourism publications. But this model's success depends on unique advantages: a stunning environment in a mountain valley, and its stone houses decorated with various forms of quartz stone. Not every heritage village has these qualifications.

Chapter Five: The Summer Home Dilemma - Buy or Rent?

Cultural Dream vs. Financial Reality

For many Saudi families, owning a summer home in Taif or Abha or Al-Baha is considered part of culture and social aspirations. But rigorous financial analysis in 2025 indicates a fundamental shift in this investment's logic that deserves deep reflection before making a decision.

The Real Cost of Ownership

Buying a secondary property for seasonal use involves several hidden costs beyond the initial purchase price. First, freezing substantial capital in an asset that is unproductive most days of the year, known as opportunity cost. Second, ongoing maintenance costs that are higher for properties left empty for long periods, where humidity, insect, and damage problems accumulate. Third, fixed utility and service bills regardless of usage. Fourth, periodic security and cleaning fees.

Rental Alternative: Flexibility vs. Ownership

With the emergence of high-quality rental options through digital platforms (resorts, chalets, luxury villas), the "cost of use" for renting two weeks per year has become much lower than annual ownership holding costs. Renting provides flexibility to choose different destinations each year, avoidance of maintenance burden, and investment of the financial difference in more productive assets.

There is also what can be called the "use trap": many owners feel compelled to spend their vacation in the same place every year to "justify" the investment, limiting the diversity of their travel experiences and turning them into prisoners of their property instead of being free to explore the world.

The Middle Ground: Dual-Purpose Asset

For small investors, buying a summer home makes financial sense only if treated as a dual-purpose asset: used personally for 2-3 weeks per year and actively managed as short-term rental for the rest of the season. This way, the property becomes a productive asset covering its costs and generating additional returns.

Ownership for purely personal use, without investing it in rental, is considered financially inefficient in the current interest rate environment and opportunity costs. The final decision depends on personal priorities: do you value the psychological comfort of ownership or the financial efficiency of renting?

Chapter Six: Small Investor Roadmap

Before Entry: Self-Assessment

Before diving into tourism real estate investment, ask yourself fundamental questions. Do you have the time and energy to actively manage a tourism property, or will you need a management company? Can you tolerate seasonal income fluctuations and low occupancy periods? Do you have a financial reserve for emergency maintenance and difficult periods? Do you understand licensing requirements and legal obligations?

Location Selection: The Critical Factor

Location makes the difference between a successful investment and a failed one. Look for proximity to major tourist attractions and seasonal events. Study occupancy rates in the area through digital platforms. Verify infrastructure: roads, airports, services. Monitor upcoming government projects that may raise the area's value.

Realistic Financial Calculation

Don't be fooled by advertised gross returns. Calculate net return after deducting all costs: platform commissions (15-20%), cleaning fees, consumables, maintenance, insurance, annual license fees, and depreciation reserve for furniture and equipment. Compare this net return to other investment alternatives before deciding.

Gradual Start

Wisdom dictates starting with one property to test the market and build experience. Invest in professional photography and attractive descriptions. Build an excellent reputation through positive reviews. Learn from mistakes before expanding. Don't bet all your savings on a sector new to you.

Conclusion: Opportunity Exists for Those Who Seize It Well

The intersection of tourism and real estate in Saudi Arabia truly represents "golden opportunities" for the smart small investor. Numbers speak clearly: 116 million visitors, 284 billion riyals in tourism spending, 44% growth in domestic tourism, 333% growth in private hospitality licenses. But these opportunities are not for everyone, and are not risk-free.

Success in this sector requires deep market understanding, commitment to new regulations, active and professional management, and patience with seasonal fluctuations. Those who enter this market with an "easy passive income" mindset will be disappointed. But those who treat it as a real business deserving effort and continuous learning may find it a rewarding income source integrating with the major transformations the Kingdom is witnessing on its journey toward 2030.

Quick Summary for Investors

Gathern Economy: 8-12% net returns in seasons vs. 6-8% for traditional rental, but requires active management. Mandatory License: 1,100 SAR annually, violation penalty up to 1 million SAR. Rural Tourism: Promising opportunity supported by REEF program but requires location near major destination. Heritage Properties: Premium assets with high returns but high restoration costs and risks. Summer Home: Worth buying only if managed as dual-purpose asset (personal use + rental).