The Retired Renter: Emergency Plan for Those Who Didn't Own a Home Before Sixty

Practical guide for employees approaching retirement without home ownership. Realistic solutions including relocating to affordable cities, developmental housing eligibility, and choosing a small apartment over an impossible villa. A real rescue plan, not just consolation.

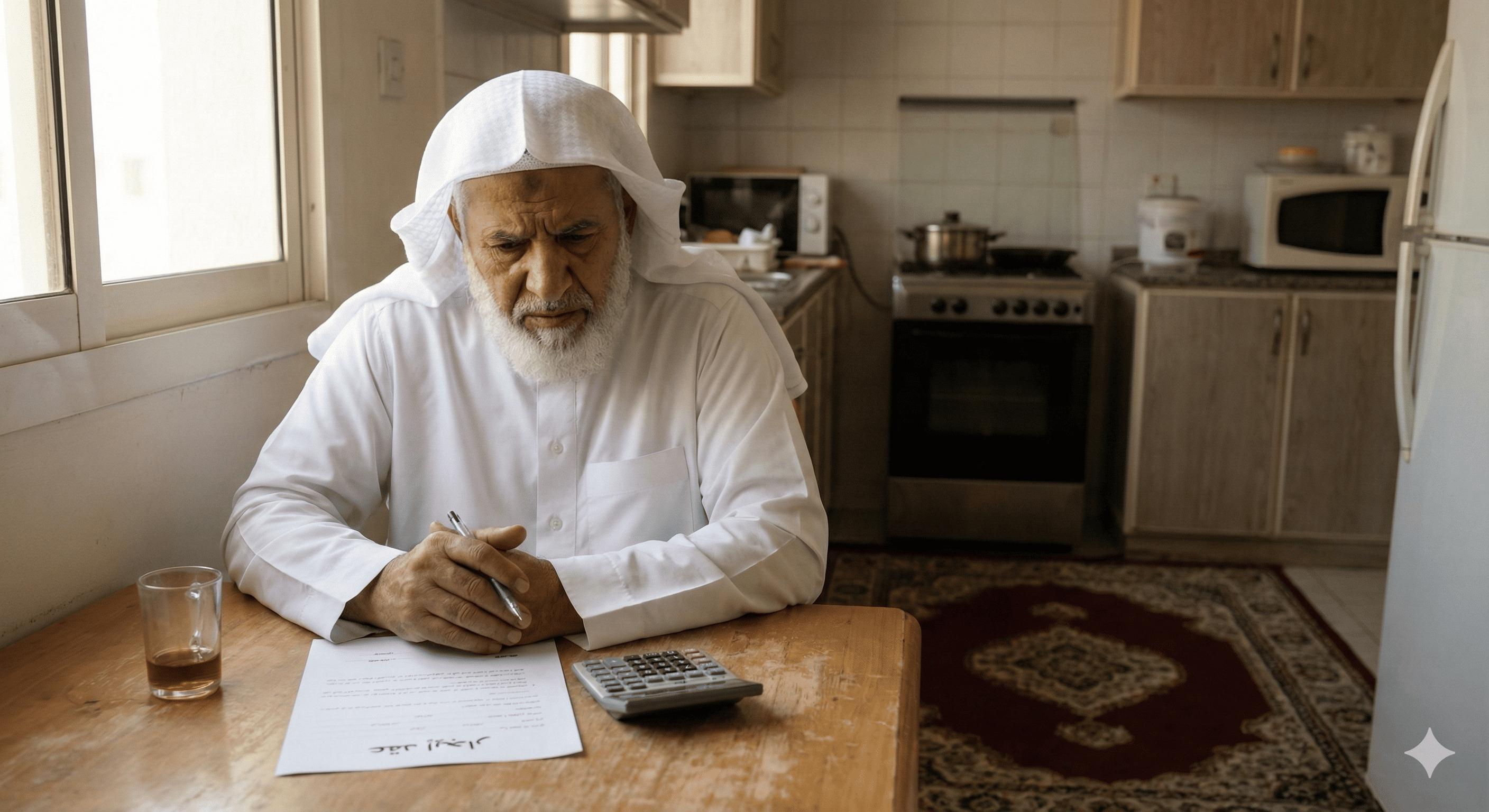

Introduction: The Nightmare No One Talks About

In every government office and private company, there's an employee approaching sixty with a question haunting their heart: What will I do about rent after retirement? My salary will drop to half or less, but rent will stay the same or increase. This isn't a fictional scenario but a reality hundreds of thousands of citizens face who couldn't afford to own a home during their working years.

Statistics show that Saudi family home ownership reached 65.4% by end of 2024. This means about 35% of Saudi families don't own homes, and a significant portion are employees nearing retirement age. In this article, we won't offer consolation or emotional words, but a real emergency plan with practical solutions that can be implemented.

Chapter One: The Problem in Numbers

To understand the problem clearly, we need to look at the real numbers facing the retired renter.

The Income and Rent Equation

An employee earning 15,000 SAR monthly with 30 years of service will receive a pension of approximately 10,000-11,000 SAR monthly, a 30-35% reduction. But their apartment rent in Riyadh that was 30,000 SAR annually years ago has now become 45,000-50,000 SAR after recent price surges. The result? Rent alone consumes 40-50% of pension income!

Shocking Rent Increase Numbers

According to General Authority for Statistics data, residential rents in the Kingdom rose by 10.63% during 2024 alone. But the variation between cities is huge. Riyadh recorded a 23% increase and Makkah 25%. This means someone paying 36,000 SAR annually three years ago in Riyadh might pay 50,000-55,000 SAR today for the same or similar apartment.

Minimum Pension

In the current system, the minimum pension is 1,983.75 SAR monthly. This amount barely covers a room rental in some cities! Even in the new system applying to new employees, the minimum will be 4,000 SAR for those completing 40 years of service. The problem is many retirees don't reach this threshold.

Chapter Two: Solution One - Reverse Migration to Cheaper Cities

This solution may seem emotionally difficult, but it's the most financially effective. Moving from a high-cost city to a lower-cost one can completely change the equation.

The Kingdom's Rent Map

Not all Saudi cities are equal in cost of living. Here's the real comparison:

Highest Cost Cities

Riyadh tops the list with a rent index reaching 158 points, followed by Makkah then Jeddah. These cities have seen major price jumps due to high demand and mega projects.

Lower Cost and More Stable Cities

In contrast, some cities have seen stability or even rent decreases. Buraydah recorded a 10.6% decrease in rents. Al-Bahah dropped by nearly 10%. Hail and Arar saw relative stability with slight increases not exceeding 2%. Abha and Taif recorded increases not exceeding 1%.

The Real Difference in Riyals

A three-bedroom apartment in a middle-class Riyadh neighborhood might cost 45,000-60,000 SAR annually. The same specifications in Hail or Al-Bahah might not exceed 18,000-25,000 SAR. The difference? 25,000-35,000 SAR annually that can be saved or invested.

What Will You Gain and Lose?

You'll gain significant financial savings, more tranquility, and perhaps better quality of life away from big city congestion. You'll lose proximity to some advanced services, and perhaps distance from children if they work in major cities. But with developing health and educational services in all regions, the gap is constantly shrinking.

Chapter Three: Solution Two - Developmental Housing

The Developmental Housing program is one of the most important options available to limited-income retirees, but many don't know its conditions or application process.

What Is Developmental Housing?

It's a government program providing housing units with usufruct rights to families most in need. The program works in partnership with charitable associations across all Kingdom regions, aiming to provide suitable housing for those who cannot afford high purchase or rental costs.

Eligibility Conditions for Developmental Housing

Applicant must be Saudi citizen by nationality and origin. Must be residing in Saudi Arabia. Must be low-income or without income. Must not have received previous housing support from any entity. Applicant must be over 25 years old. Applicant must be the primary family breadwinner.

Is a Retiree Eligible?

Yes, a limited-income retiree can apply for Developmental Housing if registered in Social Security or if their income falls within eligible brackets. Many retirees don't know they're eligible for this program.

Application Steps

Application is through the Sakani electronic platform or Housing Support portal. You need to log in with national ID, then select the Developmental Housing program and fill in required data. The platform will automatically determine your eligibility based on your data registered with government agencies.

What If You're Not Eligible?

If your pension is higher than the Developmental Housing threshold, don't despair. There are other options we'll discuss, but most importantly verify your eligibility first before excluding this option.

Chapter Four: Solution Three - Small Apartment Instead of Impossible Villa

This is perhaps the most important part of the article. Many people remain renters their entire lives because they dream of a villa they can never afford, while ignoring realistic options within reach.

Changing the Way of Thinking

A villa in north Riyadh might cost 2-4 million SAR. This is an impossible dream for most employees. But a studio or one-bedroom apartment in a medium city might not exceed 150,000-250,000 SAR. The difference isn't just in price, but in achievability.

Advantages of Small Apartments for Retirees

First, reasonable purchase price that can be afforded. Second, much lower maintenance costs than a villa. Third, lower electricity and water bills due to smaller space. Fourth, suitable for two people after children become independent, which is the normal situation for retirees. Fifth, ease of mobility and access to services in residential buildings.

Where to Find Reasonably Priced Apartments?

Small and medium cities offer much better options. In Hail, Tabuk, and Qassim, you can find ownership apartments starting from 150,000 SAR. Even in distant suburbs of Riyadh and Jeddah, prices are much lower than central areas.

Installment Purchase Option

Even if you don't have the full amount, many developers offer direct installment without bank financing. 20-30% down payment and the rest over 3-5 years. This is a realistic option for those with limited savings who want to own housing before or immediately after retirement.

Simple Calculation

Suppose you pay 30,000 SAR annual rent. Over 10 years, you'll have paid 300,000 SAR and own nothing. The same amount was enough to buy a small apartment you own and can bequeath to your children. The problem isn't money, but way of thinking.

Chapter Five: The Last Five Years Plan Before Retirement

If you're 5 years or less from retirement and don't own housing, here's a practical action plan.

Year One: Assessment and Planning

Calculate your expected pension accurately through the Social Insurance calculator. Evaluate your current expenses and identify what can be reduced. Start saving a fixed monthly amount no matter how small. Check your eligibility for housing support programs.

Year Two: Research and Exploration

Start visiting potential cities to relocate to. Compare rental and ownership prices in several areas. Talk to retirees who moved to smaller cities and hear their experiences. Start clearing unnecessary possessions and selling them.

Year Three: Decision and Execution

Determine the city or area you'll move to. Start serious property search. If deciding to buy, begin financing or installment procedures. If deciding to rent in a cheaper city, start searching for a suitable apartment.

Year Four: Gradual Transition

If possible, move a year before retirement to adapt. Arrange administrative matters like transferring records and files. Establish new social relationships in the new place. Ensure availability of health services you need.

Year Five: Settling

Settle in your new place before retirement starts. Review your new budget and ensure it's balanced. Enjoy the beginning of a new phase without high rent pressure.

Chapter Six: Financial Tips for the Retired Renter

If you couldn't achieve ownership for any reason, here's how to deal with rent smartly.

The One-Third Rule

Rent should not exceed one-third of your monthly income. If your pension is 9,000 SAR, rent should not exceed 3,000 SAR monthly or 36,000 annually. If you're paying more than that, you're in a financial danger zone.

Negotiating Rent

Many landlords prefer a stable tenant who pays regularly over one who pays more but might be late. Use your record as a committed tenant to negotiate a lower price or at least fix the price for several years.

Shared Housing

An unconventional but practical option. Some retirees share housing with a friend or relative in the same situation. This halves the cost and provides important social companionship at this stage.

Investing End-of-Service Benefits

If you receive end-of-service benefits, don't spend them on luxuries. Invest them in buying small housing, or at least in an investment that generates monthly income to help cover rent.

Chapter Seven: Real Success Stories

You're not alone in this challenge. Many faced the same situation and found solutions.

Abu Mohammed: From Riyadh to Hail

A government employee who retired after 32 years with an 11,000 SAR pension. He was paying 48,000 SAR annually in Riyadh rent. He decided to move to Hail where he bought an apartment for 180,000 SAR. Now he lives rent-free, and the difference goes to his savings and trips with his wife.

Um Abdullah: Developmental Housing

A retired widow with 4,500 SAR pension. She thought she wasn't eligible for any support. After applying for Developmental Housing, she received a usufruct apartment in her city. Now she lives peacefully without rent worry.

Abu Sultan: The Small Apartment

He dreamed of a villa all his life and couldn't afford it. In the last 3 years before retirement, he changed his thinking and bought a two-bedroom apartment in a Riyadh suburb for 320,000 SAR on installment. Now he owns his home and pays an installment less than what he used to pay in rent.

Frequently Asked Questions

Can I get a mortgage after retirement?

Yes, but options are more limited. Some banks finance retirees but with stricter conditions and shorter repayment periods. The better option is direct installment from developers or cash purchase.

What if my children reject the idea of moving to another city?

Your adult children have their independent lives. The moving decision concerns you and your spouse. Mutual visits are possible, and technology has made communication easy. Your financial and psychological health is a priority.

Is renting in small cities safe in terms of housing quality?

Yes, small cities have very good properties at reasonable prices. The issue isn't quality but supply and demand. Less demand means lower prices, not lower quality.

How do I verify my eligibility for Developmental Housing?

Enter Sakani platform with your National Access account and select Developmental Housing. The system will automatically determine your eligibility based on your data in Social Security and Insurance.

Can I rent out my small apartment if I need to relocate in the future?

Yes, this is an additional ownership advantage. Small apartments are easy to rent and provide additional income if you need to move to live with one of your children, for example.

Conclusion: Time for Action Is Now

If you've reached this line, you're serious about finding a solution. The problem is real but not impossible to solve. Options exist: moving to a cheaper city, benefiting from Developmental Housing, or owning a small apartment instead of waiting for the impossible villa.

Most important is to act now. Every month that passes while you pay high rent is a month lost from your life and savings. Start planning today, and take one small step toward the solution. The next five years will pass whether you plan or not; the difference is where you'll be at the end.

Don't let fear of change prevent you from improving your life. A retiree who owns modest housing lives with far greater peace of mind than one living in a luxury rental apartment with heart anxious about payment deadline every month.