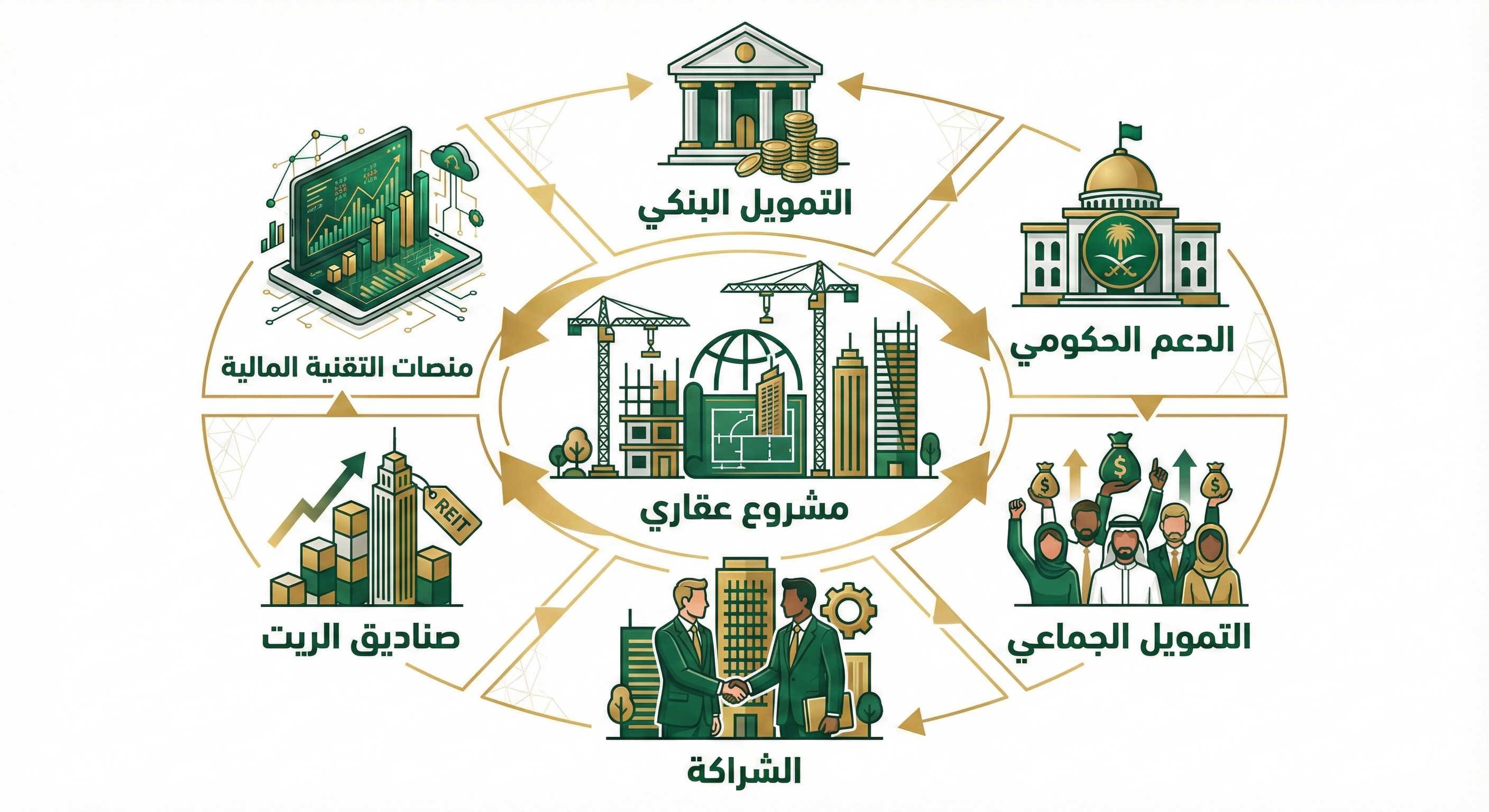

The Complete Beginner's Guide: How to Finance Your First Real Estate Project in Saudi Arabia Without Drowning in Debt

A comprehensive detailed guide to all real estate project financing methods in Saudi Arabia 2025. Learn about government-supported programs, bank financing, crowdfunding, partnerships, and REITs. Golden tips for beginners to avoid risks and achieve success.

Introduction: The Real Estate Dream Between Ambition and Reality

You have a brilliant real estate project idea, studied the market, found the right opportunity, but there's one obstacle in your way: "Where do I get the financing?" This question has stopped thousands of promising projects before they started, and drowned others in debts they couldn't escape because they chose the wrong path.

The truth is that Saudi Arabia today offers more than 15 different sources for real estate project financing, some government-supported with near-zero interest rates, and some that allow you to start with almost no personal capital! But the problem is that most beginners don't know these options, or fall into the trap of the easiest choice (traditional bank loan) without studying alternatives.

In this comprehensive guide, we'll take you on a detailed journey through all available financing sources in Saudi Arabia, from government-supported programs to modern crowdfunding, with detailed explanation of risks and how to avoid them. Our goal is for you to finish this article knowing exactly which path suits your financial situation and project.

First: Understanding Types of Real Estate Projects Before Seeking Financing

Before looking for financing, you must precisely determine your real estate project type, because each type has different financing sources:

1. Residential Real Estate Development

Building villas, apartments, or residential complexes for sale. This type needs large capital but is heavily supported by the government through the "Tatweer" program and "Wafi" off-plan sales program.

2. Commercial Real Estate Development

Building offices, commercial centers, or warehouses. Returns are higher but risks are greater, requiring more market experience.

3. Buy and Rent Properties

Buying a ready property and renting it for monthly income. Less risky and easier for beginners, can be financed through banks or REITs.

4. Property Flipping

Buying an old or unfinished property, renovating it, then selling at a higher price. Requires experience in valuation and renovation, but profits are quick.

5. Raw Land Development

Buying raw land, planning it, and selling as subdivided plots. Needs large capital and long time, but profits are huge.

Second: Government-Supported Financing Sources - The Smartest Choice for Beginners

Saudi Arabia provides exceptional support for the real estate sector under Vision 2030. Here are the most important programs:

1. Real Estate Development Fund

The Real Estate Development Fund is one of the largest real estate support entities in the Kingdom, having deposited over 55.9 billion riyals to support beneficiaries by the end of 2023. The Fund offers several programs:

The Housing Support Program includes monthly support for real estate financing profits, and instant non-refundable support up to 150,000 riyals for units under construction. The "Your Support Equals Your Payment" solution enables beneficiaries to own a home with a monthly payment equal to the housing support value.

2. "Tatweer" Program for Real Estate Developers

This program is dedicated to companies and institutions working in real estate development. In 2024 alone, the program supported 38 companies to implement 41 residential projects totaling 3,749 housing units. The program provides credit rating for real estate developers to qualify for bank financing and helps facilitate obtaining necessary financing.

3. "Wafi" Off-Plan Sales Program

Wafi program enables developers to sell residential units before construction completion, providing self-financing for the project. Buyers get prices up to 30% below market, and developers get liquidity to execute the project.

Requirements for Wafi license include: submitting complete engineering and design documents, having an accredited engineering consultancy office, having a legal accounting firm, opening a bank escrow account for buyer payments, and committing to clear timelines.

The new "Wafi Trilateral Financing" service facilitates financing for both developers and buyers, where the bank serves as escrow trustee and financier for the project and buyers simultaneously.

4. Social Development Bank

The bank offers several financing products for small and medium enterprises:

Entrepreneur Financing up to 500,000 riyals to support startups. Excellence Financing up to 4 million riyals for innovative projects, with investment cost up to 12 million riyals, grace period up to two years, and financing term up to 8 years. Liquidity Financing up to 500,000 riyals for micro enterprises.

5. SME Bank

This bank was established specifically to bridge the financing gap for small and medium enterprises, offering diverse digital financing products in cooperation with local and international partners.

6. Kafalah Program

Provides financing guarantees that help small and medium enterprises obtain bank loans, where the program bears part of the risk from the bank.

Third: Bank Financing - The Traditional Option with Caution

Bank financing is the most common option, but it carries risks that must be well understood:

Types of Bank Real Estate Financing

Murabaha (cost-plus financing) is most widespread where the bank buys the property and sells it to you at a price including a known profit margin, and you become the owner immediately. Ijara (lease-to-own) means the bank buys the property and leases it to you, with ownership transferring after full payment. Diminishing Musharaka means you share property ownership with the bank and gradually buy out its share.

Current Interest Rates (2025)

Real estate financing rates range between 2.99% and 4.73% depending on the bank. Lowest rates from Al Ahli Bank at 2.99%, followed by SAB First Bank at 3.30%, then Bank AlJazira at 3.35%. Highest rates at Alinma Bank at 3.99% and Saudi Investment Bank at 4.16%.

Basic Real Estate Financing Requirements

Requirements include Saudi citizenship (some banks accept residents), minimum salary ranging from 5,000 to 10,000 riyals, age between 20 and 60 years, job tenure of at least 3 months, down payment starting from 5% to 30%, and financing term up to 30 years.

Important Warning: The Debt Trap

Bank financing is a double-edged sword. Before signing, calculate carefully: Does expected project income cover the monthly payment with a safety margin? What if the project is delayed or prices drop? Do you have a backup plan? Never borrow based on optimistic expectations alone.

Fourth: Crowdfunding - The New Revolution in Investment

Crowdfunding has become an available and regulated option in Saudi Arabia, subject to Capital Market Authority and Central Bank oversight:

Types of Crowdfunding

Debt Crowdfunding involves a group of investors lending to a business through an electronic platform, with specified returns and known duration. Equity Crowdfunding means the investor gets ownership shares in the project in exchange for their contribution. Real Estate Crowdfunding resembles fractional ownership where investors buy shares in a property and benefit from its income and sale profits.

Major Licensed Platforms in Saudi Arabia

Raqamyah platform is licensed by the Central Bank for debt crowdfunding, offering financing up to 7.5 million riyals. Arat platform specializes in financing small and medium real estate developers with crowdfunding sukuk up to 20 million riyals, with returns ranging from 9.6% to 18%. Manafa'a offers invoice-backed investment and equity investment. Mudaraba platform offers Shariah-compliant Mudaraba sukuk. Thara platform specializes in real estate financing and investment.

Crowdfunding Advantages

You can obtain financing without traditional collateral, the process is faster than banks, cost may be lower in some cases, and it allows small investors to participate in large projects.

Risks and Challenges

Risks include possibility of payment default, no capital guarantee in some types, and limited liquidity compared to traditional investments.

Fifth: Real Estate Investment Trusts (REITs) - Invest Without Owning

REITs allow you to invest in real estate without needing to buy a complete property:

What are REITs?

They are real estate investment funds traded on the Saudi Stock Exchange (Tadawul), investing in developed and ready properties that generate income from rentals. They are required to distribute at least 90% of net profits to investors.

Best REITs in Saudi Arabia

Options include Derayah REIT with highest distribution rate, SEDCO Capital REIT, Jadwa Saudi REIT, Al Rajhi REIT, Riyadh REIT, and Mulkia REIT. Average annual return exceeds 10%.

REIT Advantages

Features include easy investment and trading like stocks, low cost compared to buying property, risk diversification across multiple properties, high transparency and periodic reports, and regular income from distributions.

How to Invest in REITs?

Steps are simple: Open an investment account at any Saudi bank, access the trading platform, search for available REITs, buy units that fit your budget. You can start with a very small amount.

Requirements for Establishing a REIT

If you're a developer wanting to establish a REIT, capital must be at least 100 million riyals, real estate investments must constitute at least 75% of asset value, and investing in white lands is not allowed.

Sixth: Real Estate Partnerships - The Power of Alliances

Partnership is one of the oldest and most successful financing methods, especially for beginners:

Types of Real Estate Partnerships

Capital and Expertise Partnership combines a party with capital and a party with expertise and time to manage the project. Capital Partnership has multiple parties contributing money to one project. Diminishing Partnership has one partner gradually buying out the other's share until owning the project completely.

Islamic Partnership Structures

Mudaraba has one party providing capital (Rab al-Mal) and another providing work and expertise (Mudarib), sharing profit according to agreement, with losses borne by the capital owner only unless there's negligence from the Mudarib. Musharaka has both parties contributing capital and work, sharing profit and loss according to participation ratios.

Tips for Successful Partnership

Ensure everything is documented in a written and notarized contract, clearly define each party's responsibilities and profit/loss ratios, agree on exit mechanisms and dispute resolution, choose a trustworthy partner with good reputation, and consult a specialized lawyer before signing.

Partnership Risks

Risks include disagreements between partners, non-commitment by one party, difficulty exiting the partnership, and joint legal liability.

Seventh: Fractional Ownership - Invest with Only 500 Riyals!

A new concept allowing you to own a share in a property with a small amount:

How Does Fractional Ownership Work?

The property is divided into small shares, and each investor buys what they can afford. Ownership is managed by a specialized company, and investors receive their share of rentals and sale profits.

Fractional Ownership Companies in Saudi Arabia

Hissatech allows investment starting from only 500 riyals in income-generating properties. Juz' signed a partnership with the Real Estate Registry to develop fractional ownership and real estate tokenization solutions. Madak also works on applying the fractional ownership model.

Fractional Ownership Advantages

Advantages include low entry barrier for real estate investment, diversification by spreading investment across multiple properties, no need to manage the property yourself, and relative liquidity compared to owning a complete property.

Eighth: Major Risks and How to Avoid Them

Every financing source carries risks. Here are the most important and how to handle them:

1. Over-Leveraging Risk

The problem is borrowing more than the project can handle. The solution is ensuring project income covers the payment with at least 30% safety margin, and never borrowing to cover losses or for an unstudied project.

2. Market Fluctuation Risk

The problem is property prices may drop leaving you at a loss. The solution is investing for long-term, diversifying your portfolio, and not buying at market peak.

3. Project Delay or Failure Risk

The problem is the project may stall for technical or financial reasons. The solution is having a contingency plan, working with reliable contractors, and continuously monitoring execution.

4. Liquidity Risk

The problem is real estate is hard to sell quickly when cash is needed. The solution is keeping emergency cash reserve and not putting all money in one property.

5. Bad Partnership Risk

The problem is the partner may not commit or disagreements may arise. The solution is documenting everything legally, choosing partners carefully, and defining exit mechanisms in advance.

6. Legal and Regulatory Risks

The problem is regulatory changes may affect your project. The solution is following regulatory updates, working with a legal consultant, and complying with all requirements.

Ninth: Practical Steps to Start Your First Real Estate Project

Step 1: Comprehensive Feasibility Study

Before anything, study the market well. What's the demand for your desired property type? What are prevailing prices? Who are competitors? What are expected costs? What's the expected return? Get expert help if needed.

Step 2: Determine Required Financing Amount

Calculate all costs precisely: land or property price, construction or renovation costs, fees and taxes, marketing and sales costs, and emergency reserve (10-15%).

Step 3: Assess Your Financial Situation

How much capital do you have? What's your monthly income and current obligations? What's your risk tolerance? Do you have collateral to offer?

Step 4: Choose the Appropriate Financing Source

Based on the above, choose the most suitable source. If you're a citizen with limited income, start with the Real Estate Development Fund. If you're a beginner developer, explore Tatweer and Wafi programs. If you have an innovative idea, try crowdfunding platforms. If you want to participate without management, REITs or fractional ownership are excellent options.

Step 5: Build Your Team

Don't work alone. You need a real estate lawyer, legal accountant, consulting engineer, and real estate marketer depending on project size.

Step 6: Execution and Follow-up

Start execution with careful monitoring, periodic reports, and flexibility to adjust when needed.

Tenth: Comprehensive Comparison Table of Financing Sources

Bank Financing

Available amount up to 5 million riyals, repayment period up to 30 years, interest rate between 2.99% and 4.73%, requirements include fixed salary and collateral, risks are long-term debts, suitable for employees with fixed income.

Real Estate Development Fund

Available amount up to 500,000 riyals supported, repayment period up to 25 years, interest rate is subsidized or zero, requirements include Saudi citizenship and Sakani registration, risks are very low, suitable for citizens wanting home ownership.

Wafi Program

Available amount depends on project, repayment period according to sales plan, cost is licensing and supervision fees, requirements include license, guarantees and engineering supervision, risks are medium depending on project management, suitable for real estate developers.

Crowdfunding

Available amount up to 20 million riyals, repayment period from 6 months to 5 years, investor return rate between 9% and 18%, requirements include commercial registration and financial statements, risks are medium to high, suitable for small and medium enterprises.

REITs

Available amount with no minimum investment, distributions quarterly or annually, average return over 10% annually, requirements are investment account only, risks are low to medium, suitable for investors seeking regular income.

Partnership

Available amount according to agreement, duration according to project, profit percentage according to agreement, requirements are documented partnership contract, risks depend on partner and project, suitable for those with expertise but no capital or vice versa.

Frequently Asked Questions

Can I start a real estate project without capital?

Yes, through partnership with someone who has capital (you provide expertise and management), or through crowdfunding, or through Wafi program which provides self-financing from buyers. However, it's always preferable to have minimum capital to cover emergencies.

What's the best financing source for beginners?

If you want to buy property for living or renting, the Real Estate Development Fund is best. If you want to invest with small amount, REITs or fractional ownership. If you want to develop a project, start with partnership with an experienced developer.

What's the interest rate on supported real estate financing?

Support covers a large part or all financing profits depending on your income. In the "Your Support Equals Your Payment" program, your monthly payment equals the support you receive, meaning you effectively pay nothing from your pocket!

What's the ideal real estate financing duration?

Depends on your repayment ability. Longer duration means lower payment but higher total cost. Golden rule: Choose a duration where the payment doesn't exceed 30% of your income.

Is crowdfunding safe?

Platforms licensed by the Capital Market Authority or Central Bank are subject to strict oversight. But like any investment, there are risks. Read terms carefully, diversify investments, and don't invest more than you can afford to lose.

What's the difference between Murabaha and Mudaraba?

Murabaha is a sale contract where the bank buys the property and sells it to you at a price including known profit, and you become owner immediately. Mudaraba is a partnership where one party provides capital and another provides work, sharing profit according to agreement, with losses borne by the capital owner unless there's negligence.

How do I choose the right real estate developer for partnership?

Look for a track record of successful projects, valid licenses from official authorities, good market reputation, transparency in dealings and reports, and proven financial and technical capability.

Conclusion: Start Smart, Not Fast

Financing a real estate project isn't a race, but a journey requiring planning and study. Mistakes at this stage may cost you years of debt and suffering, while correct decisions may be the beginning of real wealth.

Always remember: Don't borrow more than you can repay, diversify your financing sources, take advantage of available government support, document everything legally, and consult experts before major decisions. Saudi government programs today offer exceptional opportunities that weren't available before, so use them wisely.

At Raghdan, we believe knowledge is the first capital for any investor. We hope this guide has illuminated the path to your first real estate project. Share your experience or questions with us, and we're here to help you every step of the way.