Saudi Stock Market 2025: The Complete Guide from Zero to Pro - Buying, Trading, Technical Analysis & Fraud Detection

Your complete guide to the Saudi Stock Market (Tadawul) 2025: How to buy stocks as a Saudi or foreigner, speculation vs investment, reading Japanese candlesticks and technical indicators, detecting manipulation and suspicious recommendations, and protecting your investments from market manipulators. Includes the latest statistics and updated regulations for 2025.

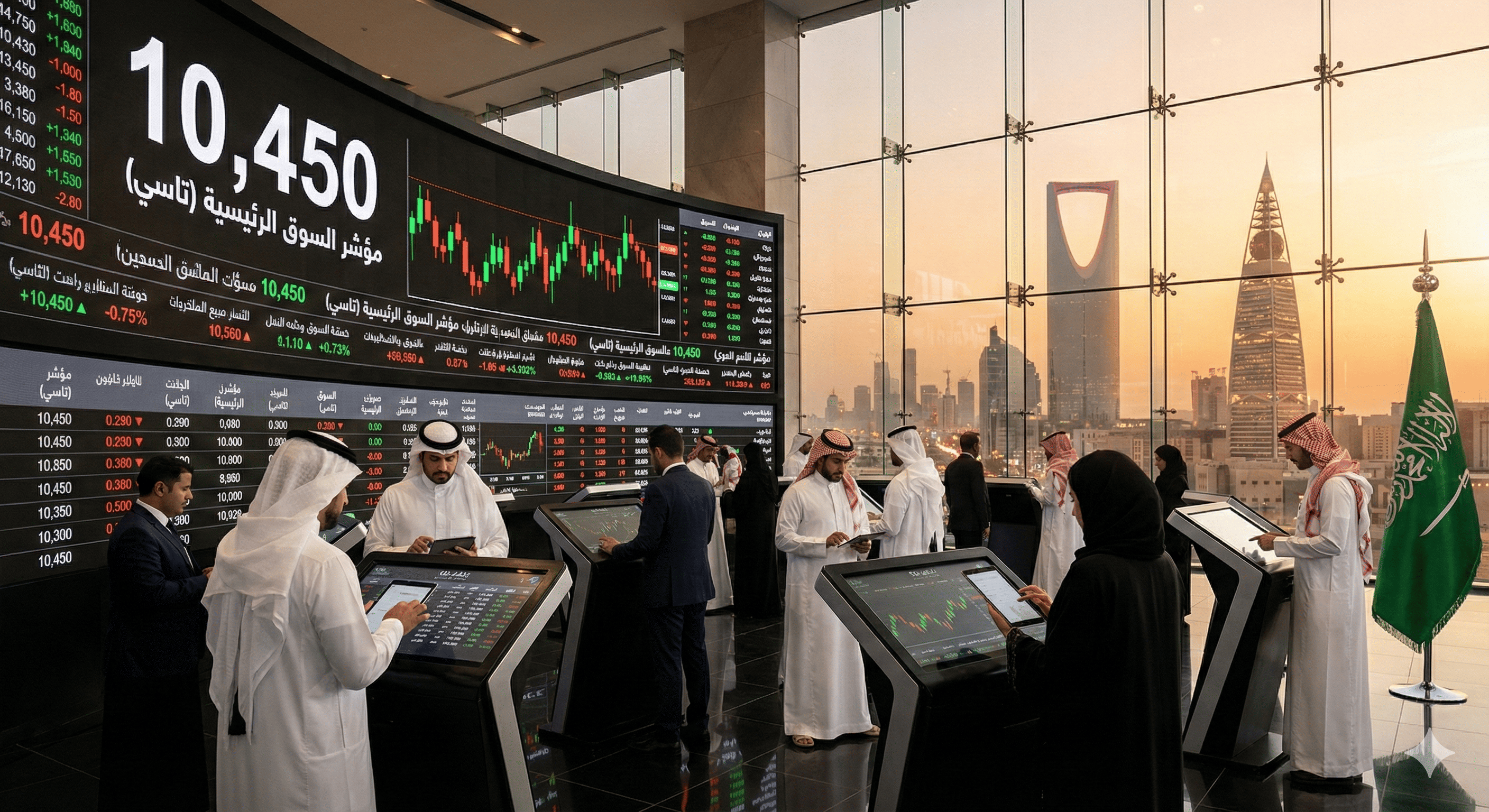

Introduction: Journey into the Middle East's Largest Financial Market

In the heart of Riyadh, where skyscrapers intersect with Vision 2030 ambitions, beats the pulse of the largest financial market in the Middle East and North Africa. The Saudi Tadawul market is not just a platform for trading securities; it's a mirror reflecting the health of the Saudi economy and its future aspirations, and a key driver in transforming the Kingdom into a global investment powerhouse.

With a market capitalization exceeding SAR 8.7 trillion ($2.3 trillion) at the end of December 2025, and more than 200 companies listed on the main market, Tadawul ranks as the ninth-largest stock exchange in the world. But behind these massive numbers lie truths every investor must understand: golden opportunities await those who understand the rules of the game, and serious risks lurk for those who ignore them.

This comprehensive guide takes you on an in-depth journey through everything you need to know about the Saudi stock market: from opening your first investment portfolio to decoding Japanese candlesticks, from understanding the difference between speculation and investment, to exposing manipulation tactics that cost investors fines exceeding SAR 96 million.

Chapter One: Saudi Tadawul - Birth of an Arab Markets Giant

Establishment and Historical Development

The story of the Saudi stock market began informally in the 1970s, when stock trading operations were conducted through primitive methods via unlicensed brokers. However, the fundamental transformation came on July 31, 2003, with the establishment of the Capital Market Authority (CMA) by Royal Decree No. (M/30), to be the government body responsible for regulating and developing the Saudi financial market.

The Authority undertakes essential tasks including: protecting investors from unfair practices, regulating and monitoring securities issuance, and working to achieve justice, efficiency, and transparency in market transactions.

Market Infrastructure

The Saudi financial system consists of three main pillars:

Main Market (TASI): Hosts more than 200 large and medium-sized companies, and is the primary gateway for investing in Saudi stocks. The TASI index is the main benchmark for market performance.

Nomu (Parallel Market): An alternative market dedicated to emerging, small, and medium enterprises, featuring more flexible listing requirements to encourage entrepreneurs to list their companies.

Derivatives Market: Recently launched to provide advanced hedging tools for professional investors.

Live Market Numbers (December 2025)

Market Cap: SAR 8.766 trillion | TASI Index: approximately 10,450 points | Average Daily Trading: SAR 5.87 billion | Daily Transactions: 348,000 trades | Largest Listed Company: Saudi Aramco (SAR 7.3 trillion) | Trading Hours: Sunday to Thursday, 10:00 AM - 3:10 PM

Chapter Two: How to Buy Your First Stocks - A Practical Step-by-Step Guide

Basic Requirements for Saudis and GCC Citizens

Before diving into the world of stocks, you need to prepare the following documents and requirements:

For Individuals: Valid national ID (for Saudis), active bank account at a Saudi bank, mobile number registered in your name, active email address, verification through Absher platform.

For Non-Saudi Residents: Valid residence permit, valid passport, bank account in the Kingdom, same technical requirements (mobile, email, Absher).

Five Steps to Opening an Investment Portfolio

Step One: Choose a Licensed Financial Broker

The financial broker is your gateway to the market. Always ensure the broker is officially licensed by the Capital Market Authority. Available options include: major Saudi banks (Al Rajhi, Al Ahli, Riyad, Inma, Albilad) and independent brokerage firms (Derayah, Sahm Capital, Aljazira Capital). When choosing, compare commissions and fees, trading platform quality, research and analysis services, and customer support.

Step Two: Open the Investment Account

Most banks and brokers allow opening a portfolio electronically within minutes: Enter the bank or broker's app, select "Open Investment Portfolio," verify your identity through Absher, sign contracts electronically, wait for activation (usually instant or within 24 hours).

Step Three: Fund the Portfolio

After portfolio activation, transfer funds from your current account to the investment account. There is no official minimum, but it's recommended to start with at least SAR 5,000-10,000 for effective diversification.

Step Four: Research and Select Stocks

Before any purchase, study: the company's business model and sector, financial statements (revenue, profits, debt), P/E ratio and comparison with the market, dividend history, analyst opinions and forecasts.

Step Five: Execute the Buy Order

Search for the stock symbol (e.g., Aramco = 2222), select order type: Market Order (immediate execution at best available price) or Limit Order (specify a specific purchase price), enter the desired quantity, review details and confirm the order, stocks appear in your portfolio upon execution.

Trading Hours and Auction Mechanisms

Pre-opening Session: 9:30 - 10:00 AM (order entry only) | Opening Auction: 10:00 AM (determining opening price) | Continuous Trading Session: 10:00 AM - 3:00 PM | Closing Auction: 3:00 - 3:10 PM (determining closing price)

Chapter Three: Foreign Investment - Opportunities and Restrictions

Foreign Resident Investors

Since 2006, non-Saudi residents have been allowed to invest directly in the stock market. Procedures are similar to Saudis with some differences: submit a copy of residence permit and passport, open an account with an approved broker, enjoy the same trading rights.

Qualified Foreign Investor (QFI) Program

Launched in June 2015 and updated in 2019, it allows large foreign financial institutions to invest directly in Saudi stocks.

Qualification Requirements: Must be a licensed financial institution (bank, insurance company, investment fund), assets under management of at least $500 million (excluding government entities), subject to supervision in their home country.

Ownership Limits: A single foreign investor cannot own more than 10% of shares in one company, total foreign ownership cannot exceed 49% of any company, exceptions for strategic investors with special approval.

New Development 2025: Opening the Market to Foreign Individuals

In October 2025, the Capital Market Authority proposed a new regulatory framework to allow non-resident foreign investors to invest directly in listed stocks, marking a significant leap in the Saudi market's openness.

6 Target Categories: Foreign government entities, sovereign wealth funds, licensed financial institutions, pension funds, large investment companies, high-net-worth individuals.

Tax Advantages for Foreigners

No taxes on capital gains from listed stock sales, no wealth or inheritance taxes, only 5% withholding tax on dividends.

Chapter Four: Speculation vs Investment - Understanding the Fundamental Difference

Defining Both Terms

Long-term Investment: Buying shares of strong companies and holding them for years, aiming to profit from company value growth and dividends. Similar to buying property for rental and value appreciation.

Speculation (Day Trading): Buying and selling stocks within short periods (minutes, hours, days) to benefit from price fluctuations. Similar to quick trading to profit from price differences.

Detailed Comparison

Time Frame: Investment (years) vs Speculation (minutes to days) | Analysis Required: Investment (fundamental - financial statements) vs Speculation (technical - charts and indicators) | Daily Time: Investment (hour weekly) vs Speculation (4-6 hours daily) | Risk Level: Investment (medium) vs Speculation (very high) | Suitable Capital: Investment (any amount) vs Speculation (SAR 20,000+) | Expected Return: Investment (8-15% annually) vs Speculation (variable - large profit or loss)

Day Trading Strategies

Breakout Strategy: Buy when the stock breaks through an important resistance level with high trading volume. Used with leading stocks like Al Rajhi and Inma.

Scalping Strategy: Execute dozens of trades daily to achieve small cumulative profits (0.5-1% per trade). Requires high liquidity and constant attention.

Gap Trading Strategy: Exploit price gaps between the previous day's close and the next day's open, especially after important news like Aramco dividends.

Best Times for Speculation

First Golden Hour (10:00 - 11:00): Highest liquidity and largest fluctuations, ideal for exploiting opening momentum.

Last Golden Hour (2:00 - 3:00): Active movement before the closing auction, good opportunities for speculators.

Stagnation Period (11:30 - 1:30): Low liquidity, advisable to avoid opening new positions.

Favorite Speculation Stocks 2025

Based on liquidity and volatility: Saudi Aramco (record liquidity exceeding hundreds of millions daily), Al Rajhi Bank (highest trading value at SAR 7.26 billion monthly), Inma Bank (suitable volatility for scalping), Derayah Financial (recent listing with 32% volatility), Maaden (high sensitivity to global commodity prices).

Red Warning: Speculation Risks

Painful Statistic: 70-80% of day traders lose their money in the long term.

Main Reasons for Loss: Overtrading, ignoring stop-loss, emotional attachment to the stock, trading based on unknown recommendations, excessive leverage use.

Chapter Five: Fatal Mistakes New Investors Make

Mistake One: Putting All Eggs in One Basket

Investing all money in one stock can lead to 50% or more loss if that stock declines. Golden Rule: Don't put more than 10-15% of your portfolio in one stock. Solution: Diversify across different sectors (banks, energy, telecommunications, real estate, industry).

Mistake Two: Buying Based on Rumors and Recommendations

WhatsApp and Telegram groups are full of "recommendations" from people who may be: manipulators aiming to pump the stock then dump it (Pump & Dump), unlicensed by the Capital Market Authority, benefiting from trading company commissions. Solution: Don't buy any stock without personal research. Remember: whoever has truly golden information won't share it for free.

Mistake Three: Fear of Political Events

Legendary investor Peter Lynch says: "More money has been lost trying to predict market crashes than from the crashes themselves." Solution: Focus on company quality, not news headlines.

Mistake Four: Selling at the Bottom and Buying at the Top

Emotional behavior drives investors to sell when fearful (after decline) and buy when greedy (after rise). Solution: Create a plan in advance and stick to it. Set entry and exit points before opening any trade.

Mistake Five: Ignoring Financial Statements

Buying a stock because "the chart looks nice" without understanding the company's financial position is a recipe for disaster. Solution: Learn to read at least basic financial statements (income statement, balance sheet).

Mistake Six: Investing with Borrowed Money

Loans for stock investing double psychological pressure and can lead to disastrous decisions. Solution: Only invest money you can afford to lose completely.

Mistake Seven: Not Setting Stop-Loss

"The stock will bounce back" is a phrase that has destroyed many portfolios. Some stocks drop 90% and never recover. Solution: Set a stop-loss point (5-10% below purchase price) and stick to it.

Chapter Six: Technical Analysis - The Language of Charts and Indicators

Japanese Candlesticks: Foundation of Technical Analysis

Japanese candlesticks are the most common way to display price movement. Each candle contains 4 pieces of information: opening price, closing price, highest price, lowest price.

Green Candle (Bullish): Closing price higher than opening - indicates buyer strength.

Red Candle (Bearish): Closing price lower than opening - indicates seller strength.

Basic Candlestick Patterns

Hammer Pattern: Candle with small body and long lower shadow, appears at the end of a downtrend and signals potential bullish reversal.

Doji Pattern: Candle with very small body (opening price ≈ closing price), indicates market indecision and possible trend reversal.

Bullish Engulfing: Large green candle engulfs the previous red candle, strong signal for upward movement.

Bearish Engulfing: Large red candle engulfs the previous green candle, strong signal for downward movement.

Basic Technical Indicators

RSI (Relative Strength Index): Measures price momentum on a scale of 0 to 100. Above 70 = overbought (possible decline), below 30 = oversold (possible rise).

MACD Indicator: Measures the relationship between two moving averages. Fast line crossing above slow = buy signal, fast line crossing below slow = sell signal.

Bollinger Bands: Measures price volatility. Price at upper band = possible decline, price at lower band = possible rise.

Golden Tip

Don't rely on a single indicator! Best practice is combining 2-3 indicators for confirmation. Example: RSI indicating oversold + hammer pattern + high trading volume = strong buy signal.

Chapter Seven: Market Manipulation - How to Protect Yourself

Common Types of Manipulation

Pump and Dump: A group buys a stock in large quantities to raise its price, then spreads positive recommendations to attract new investors, and when the price rises, they sell and leave others at a loss.

Wash Trading: A person sells and buys the same stock to themselves to create an illusion of high trading activity.

Closing Auction Manipulation: Entering large orders in the last minutes to move the closing price.

Undisclosed Coordination: Families or groups owning large percentages without disclosure.

Real Cases and Fines

Dar Al Arkan Case (2019-2020): 10 investors were fined SAR 96 million by the Authority for coordinated manipulation of the stock.

Al-Kathiri Group Case (2020): 8 investors were fined SAR 302 million for coordinated ownership reaching 24-27% of the company without disclosure, with trading before capital increase announcements.

Unlicensed Recommendation Fines: Range between SAR 70,000 - 200,000 for anyone providing investment recommendations without CMA license.

How to Detect Manipulation?

Sudden increase in trading volume without clear news, illogical price movement conflicting with company performance, repeated recommendations from unknown sources on social media, major shareholders selling immediately after price rise.

How to Protect Yourself?

Never follow free recommendations, verify official disclosures on Tadawul website, monitor major shareholder ownership changes, don't enter stocks that rose sharply without clear reason, always use stop-loss.

Chapter Eight: Reading Financial Statements - The Most Important Skill

P/E Ratio (Price-to-Earnings)

The most important metric for stock valuation. Formula: Stock Price ÷ Earnings Per Share. Market Average: 16.8x | Low P/E (below 10) = stock may be cheap | Very high P/E (above 50) = stock may be overpriced.

Market Examples: Amiantit (4.4x) - cheap, ACIG (5.6x) - cheap, Saudi Electricity (6.4x) - reasonable, SABIC (4,900x) - danger! accumulated losses.

Dividend Distributions

Companies that distribute regular dividends are usually more stable.

Top Distributors in 2024: Aramco (SAR 429.5 billion), STC (SAR 18.75 billion), Al Rajhi (SAR 10.8 billion), Sadafco (SAR 15 per share annually).

Warning Signs in Financial Statements

Negative P/E ratio (company is losing money), debt exceeding 70% of equity, revenue decline for several consecutive years, external auditor qualifications, frequent changes in senior management.

Chapter Nine: Promising Sectors for Investment 2025

Vision 2030 Sectors

Technology: Expected growth with digital transformation | Logistics: Benefiting from the Kingdom's strategic location | Insurance: Expanding with mandatory health insurance | Tourism: Emerging sector with mega projects (NEOM, Red Sea) | Renewable Energy: Companies like ACWA Power

Best Stocks for Long-term Investment

Look for companies characterized by: regular dividend history (25+ years = "Dividend Aristocrats"), reasonable P/E ratio (12-18x), debt less than 50% of equity, continuous revenue growth, sector leadership.

Conclusion: Your Roadmap to Success

The Saudi stock market offers exceptional opportunities for those who prepare well and learn the rules of the game. Always remember:

For Beginners: Start with a small amount you can afford to lose, learn before you invest, diversify your portfolio, don't follow random recommendations.

For Speculators: Respect stop-loss, don't speculate with more than 10% of your portfolio, avoid emotional trading, monitor liquidity and volatility.

For Investors: Focus on company quality not price fluctuations, reinvest dividends, review your portfolio periodically, patience is the key to wealth.

Invest wisely, and remember that the best investment is in educating yourself first.