Saudi Real Estate Index 2025: The Most Comprehensive Report - Historic Decisions, Prices, Rent Freeze, and Future Outlook

A comprehensive and detailed report on Saudi real estate market performance in 2025. Includes quarterly index analysis, Crown Prince's five directives, 5-year rent freeze, new 10% white land fees, Riyadh Metro impact, villa and apartment prices, transaction volumes, and 2026 forecasts.

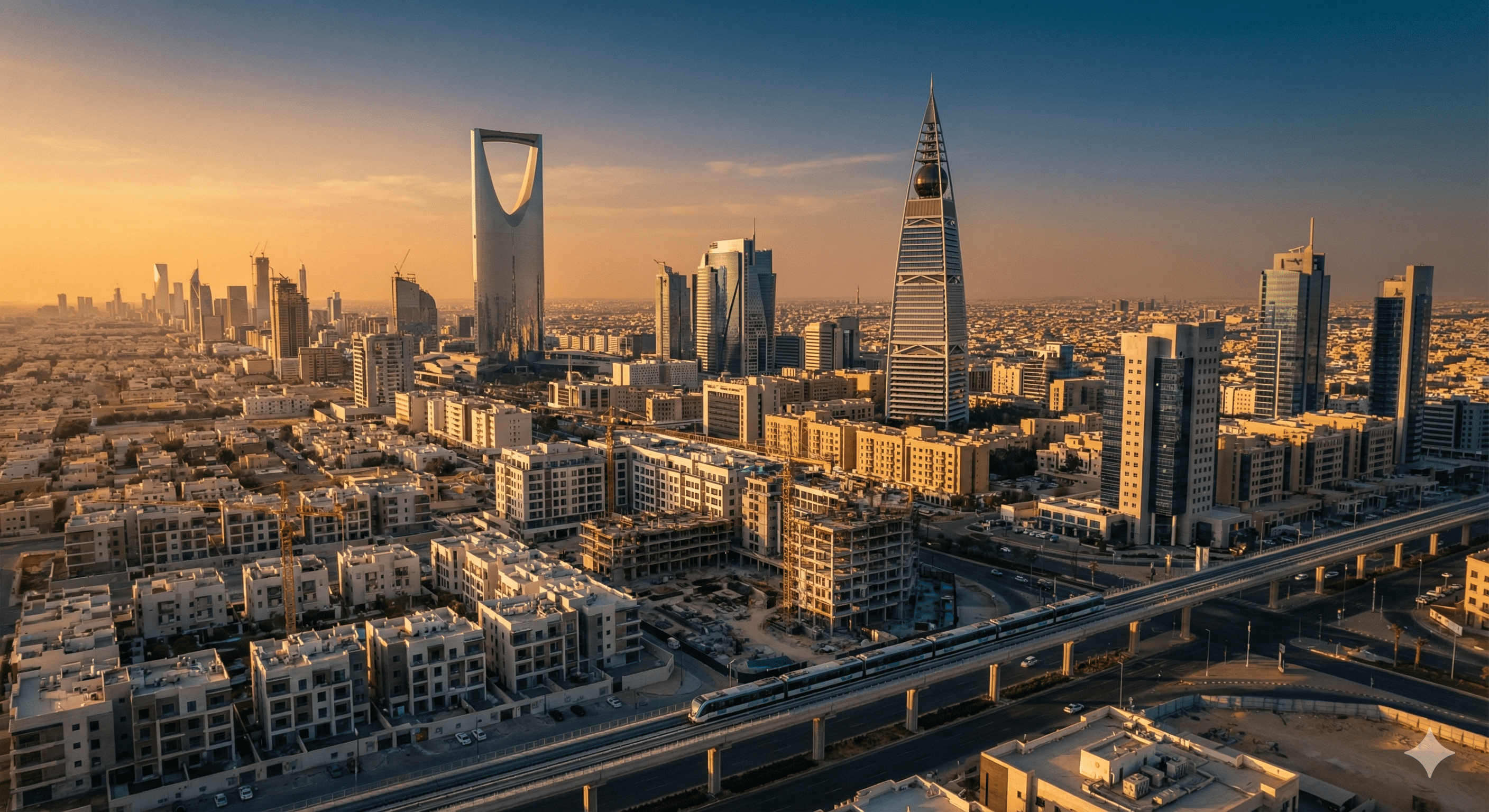

Introduction: A Year of Historic Transformations in Saudi Real Estate

2025 stands as an exceptional year in Saudi real estate history. We witnessed unprecedented government decisions that completely reshaped the sector, from lifting restrictions on over 81 million square meters in Riyadh, to freezing rents for 5 years, and raising white land fees from 2.5% to 10%. These transformations came in response to directives from His Royal Highness Crown Prince Mohammed bin Salman, aimed at achieving balance in the real estate sector and enabling citizens to own homes.

In this comprehensive report, we provide a detailed analysis of everything that happened in the Saudi real estate market during 2025, from official statistics and figures, through government decisions and their impacts, to future forecasts. This report serves as a comprehensive reference for every investor or citizen seeking to understand the dynamics of the Kingdom's real estate market.

First: Overview of 2025 Real Estate Index Performance

The General Authority for Statistics issued detailed data on the real estate index performance during 2025, showing a fundamental shift in price trajectory. After years of continuous increases, the market began witnessing a clear correction phase, especially in the second half of the year.

Q1 2025 Performance

The real estate price index recorded a 4.3% year-on-year increase compared to Q1 2024. The residential sector was the main driver of this growth with a 5.1% rise, followed by the commercial sector at 2.5%, while agricultural property prices declined by 1.1%. The residential sector alone constitutes 72.7% of the overall index weight, making it the most significant influence on price movements.

Q2 2025 Performance

The second quarter witnessed a clear slowdown in growth, with the overall index recording only 3.2% year-on-year growth, down from 4.3% in Q1. More importantly, the residential sector recorded only 0.4% growth, after being 5.1% in the previous quarter. This sharp slowdown came as the first official reaction to the Crown Prince's directives issued on March 29, 2025.

In contrast, the commercial sector jumped remarkably, recording 11.7% growth, driven by a 12.7% increase in commercial land prices. This reflects the shift of liquidity from the residential sector, which witnessed strict regulatory decisions, to the commercial sector.

Q3 2025 Performance

In a historic shift, the residential sector recorded its first decline in many years. Residential property prices fell by 0.9% year-on-year, and 1.1% quarter-on-quarter compared to Q2. This decline was driven by a 0.9% drop in residential land prices, a 1.7% decrease in apartment prices, and a 2.5% quarterly decline in villa prices.

Analysts described this phase as a healthy market correction after years of unjustified increases, and that the market is heading toward real estate maturity based on real demand and price fairness.

Second: Crown Prince's Historic Directives - March 29, 2025

On Saturday, 29 Ramadan 1446H corresponding to March 29, 2025, historic directives were issued by His Royal Highness Crown Prince Mohammed bin Salman bin Abdulaziz Al Saud, including 5 fundamental measures to achieve balance in the real estate sector in Riyadh. These directives came after extensive study by the Royal Commission for Riyadh City and the Council of Economic and Development Affairs.

First Measure: Lifting Restrictions on 81.48 Million Square Meters

Restrictions were lifted on sale, purchase, subdivision, and fragmentation transactions, building permits, and planning approvals for vast areas north of Riyadh. The first area is located north of Riyadh covering 17 square kilometers, bounded by King Khalid Road to the west, Prince Saud bin Abdullah bin Jalawi Road to the south, Asma bint Malik Street to the north, and Al-Arid district to the east. The second area is located north of King Salman Road covering 16.2 square kilometers.

With these additions to the two areas previously released totaling 48.28 square kilometers, the total area released in Riyadh reached 81.48 square kilometers, equivalent to over 81 million square meters of developable land.

Second Measure: Providing Residential Land at Reduced Prices

The Crown Prince directed the provision of planned and developed residential land to citizens, ranging from 10,000 to 40,000 plots annually, at prices not exceeding 1,500 SAR per square meter. This price is very low compared to market prices that exceeded 6,000 SAR per meter in some Riyadh neighborhoods, and reached 8,000 SAR per square meter in areas like Al-Muruj.

Third Measure: Launching Two New Residential Suburbs

The announcement of Al-Fursan suburb and the second phase of Khuzam suburb, which together will provide 80,000 residential units starting from 350,000 SAR. Khuzam suburb will include the second largest park in Riyadh after King Salman Park, covering an area exceeding 5 million square meters.

Fourth Measure: Updating White Land Fees System

A directive was issued to update the white land fees system to incentivize owners to develop their land rather than holding it idle. Full details of this system were issued later in April 2025.

Fifth Measure: Regulating Landlord-Tenant Relations

A directive was issued to prepare regulations governing the relationship between landlords and tenants and limiting unjustified rent increases. This directive was implemented in September 2025 with the rent freeze decision.

October 2025 Decision: Lifting Additional Restrictions

In October 2025, an additional decision was issued lifting restrictions on 33.24 million square meters in western Riyadh, bringing the total released areas to over 114 million square meters within one year.

Third: 5-Year Rent Freeze - The Historic Decision

On September 25, 2025 (3 Rabi Al-Thani 1447H), the Cabinet decision and Royal Decree were issued approving the regulatory provisions governing the landlord-tenant relationship. This decision is the most impactful on the rental market in the Kingdom's history.

Decision Details

First Decision: Freeze annual rent increases for both residential and commercial properties, whether existing or new contracts, within Riyadh's urban boundary for 5 years starting September 25, 2025. Under this decision, landlords cannot increase the agreed total rent in existing or new contracts throughout this period.

Second Decision: Fix rent values for vacant properties that were previously rented according to the last contract registered in the Ejar network. For properties never rented before, values are determined by mutual agreement.

Third Decision: Mandatory registration of all rental contracts in the Ejar electronic network, with both landlord and tenant having the right to register the contract and object within 60 days of registration.

Fourth Decision: Automatic contract renewal unless either party notifies of non-renewal at least 60 days before contract expiration.

Penalties and Fines

The system imposed strict fines on violators reaching up to one full year's rent. The system also specified only three cases allowing the owner to reclaim the property: tenant payment default, structural defects threatening safety, or the owner and first-degree relatives wanting to use the property for personal residence.

Expected Impact

According to Al-Eqtisadiah's financial analysis unit, the average annual rent increase in Riyadh over the past four years was approximately 16%. This means a family renting an apartment for 30,000 SAR annually could have faced rent doubling to about 62,300 SAR after 5 years, an increase exceeding 108%. With the price freeze, this expected increase was completely curbed.

Fourth: New White Land Fees - From 2.5% to 10%

On April 29, 2025, the Saudi Cabinet, chaired by the Crown Prince, approved fundamental amendments to the white land fees system. These amendments are the most radical since the system was enacted in 2015.

Key Amendments

First Amendment: Raising annual fees from 2.5% to 10% of land value. This significant increase aims to incentivize owners to develop or sell their land rather than holding it idle for years.

Second Amendment: Reducing the minimum area covered from 10,000 to 5,000 square meters, which doubled the number of owners subject to the system.

Third Amendment: Imposing annual fees on vacant unused properties for the first time. Vacant properties are defined as buildings ready for use and occupancy within the urban boundary that are unused for extended periods without acceptable justification. The fee rate on vacant properties reaches 5% of property value.

Fourth Amendment: Unifying implementation phases, with fees imposed on all land of 5,000 square meters or more within the specified geographic area, regardless of previous use type.

Fifth: Riyadh Metro - A Revolution in Real Estate Prices

Riyadh Metro, the longest metro network in the Middle East and North Africa, has brought fundamental transformation to the capital's real estate map. The project, with investments of $25 billion (94 billion SAR), extends 176 kilometers through 6 lines and 85 stations.

Immediate Success

The metro achieved immediate success since opening, transporting over 100 million passengers during the first nine months of operation. The integrated bus networks also transported 23 million passengers in Q1 2025, a 34% increase compared to Q4 2024.

Metro Premium on Real Estate Prices

A study by Knight Frank real estate consultancy revealed the metro premium phenomenon, where property prices near stations rose at rates far exceeding distant areas. The study compared villa prices in three different neighborhoods between homes within 15-minute walking distance from stations and those farther away.

In Tuwaiq: Home values near stations rose 20% between Q2 2023 and Q2 2025, compared to only 10% growth in more distant areas.

In Yarmouk: The impact was most dramatic, with prices near the metro jumping 78%, versus only 22% in peripheral areas.

In Malqa: Property values near the metro rose 20%, despite being one of Riyadh's most established and stable neighborhoods.

Population Coverage

Knight Frank estimated that approximately 1.5 million of Riyadh's 8.3 million residents live within a 15-minute walk of at least one metro station, equivalent to 18% of the city's population. This means one in five people benefits from easy access to the metro network.

Sixth: Property Prices in Major Cities

Riyadh - The Capital

Riyadh witnessed the highest price growth rates in early 2025, before the correction phase began. In Q1, the capital recorded a 10.7% year-on-year increase. But in Q2, after government directives, prices dropped 3.1% quarter-on-quarter, and annual growth fell to 3.6%, the lowest level since 2021.

Apartment prices in Riyadh: Rose 10.3% year-on-year to reach 6,501 SAR per square meter in Q3 2025.

Villa prices in Riyadh: Rose 9.6% to reach 6,810 SAR per square meter.

Luxury villa prices: Averaged 10,223 SAR per square meter.

Average apartment price per meter: Approximately 4,971 SAR on average, with notable differences between neighborhoods.

Jeddah - Bride of the Red Sea

Jeddah recorded more varied performance during 2025. Apartment prices fell 2.8% year-on-year to reach 4,477 SAR per square meter in Q3. Conversely, villa prices rose 3.1% to reach 6,668 SAR per square meter.

Transaction volume: Jeddah witnessed notable quarterly sales growth, with transactions increasing 10% to 7,500 deals in Q3, totaling 8.7 billion SAR.

Housing supply: Total residential unit inventory in Jeddah reached 1.23 million units, with 4,320 new units completed during Q3 2025.

Dammam Metropolitan - Eastern Province

Dammam emerged as a prominent and surprising growth center in 2025. The coastal city recorded approximately 60% year-on-year increase in transaction numbers, and 37% compared to Q2. Transactions reached 3,000 deals in Q3, valued at 3.2 billion SAR.

Housing supply: Total residential unit inventory reached 725,810 units, with 400 additional units expected before year-end.

Growth drivers: This growth is attributed to price affordability compared to Riyadh and Jeddah, and increasing investor interest in the region.

Seventh: Transaction Volume and Real Estate Trading

H1 2025 Statistics

The Saudi real estate market recorded approximately 216,000 transactions during H1 2025, exceeding 167 billion SAR ($44.5 billion) in value. This represents a 17.3% value decrease compared to H1 2024, which reached 202 billion SAR ($53.9 billion).

However, H1 2025 transactions covered a vast area of approximately 2 billion square meters, a notable increase from 1.3 billion square meters in H1 2024. This means transactions shifted from expensive central lands to wider areas in development zones at lower prices.

Q2 2025 Statistics

Total residential and commercial sales transactions reached 135.5 billion SAR. Residential transactions: 71.8 billion SAR from 62,488 deals. Commercial transactions: 63.7 billion SAR from 4,454 deals. Agricultural transactions: 3.3 billion SAR from 1,850 deals.

Real Estate Contribution to Economy

Real estate sector contribution (real estate activities, construction, and building) to the Kingdom's GDP reached 13.8% during Q2 2025. Construction activity alone contributed 7.7%, up 0.3% compared to Q2 2024.

Eighth: Mortgage Financing and Housing Support

Mortgage Growth

The residential mortgage market witnessed strong growth in early 2025. Through February 2025, new individual mortgages increased 28.3% year-on-year, driven by demand for apartment financing. In Q2 2025, new residential mortgage value from banks grew 3.7% compared to the same period in 2024, reaching 19.6 billion SAR.

Total Outstanding Mortgages

Outstanding mortgage value reached 961.44 billion SAR by Q2 2025. Commercial bank loan value growth reached 14.5% compared to Q2 2024. Finance company loan growth reached 4.1% for the same period.

Real Estate Development Fund

The Real Estate Development Fund deposited a total of 12.4 billion SAR into housing support program beneficiaries' accounts from January through December 2025. This support is allocated to subsidize various housing support program contracts, supporting and improving beneficiaries' ability to own homes in line with the Housing Program targets under Vision 2030.

Ninth: Housing Supply and New Units

Riyadh

Total market inventory of residential units in Riyadh reached approximately 2.18 million units by end of Q3 2025. An additional 9,468 units are expected in the remaining period of the year, bringing total units delivered during 2025 to 16,000 units. More importantly, Riyadh has approximately 57,000 residential units under development for delivery during 2026-2027.

Jeddah

Supply reached approximately 1.23 million units, with 5,000 new units expected by end of 2025. Total units under development for delivery during 2026-2027 reaches 36,000 units.

Dammam

Total residential unit inventory reached 725,810 units, with 1,800 new units expected by end of 2025. Total units under development for delivery during 2026-2027 reaches 12,000 units.

Expected Total

New residential units expected to be delivered over the next two years, totaling approximately 105,000 units in the three cities combined, are expected to help ease price pressures and improve supply-demand balance.

Tenth: Non-Saudi Ownership System 2026

Among the most anticipated developments is the new system for non-Saudi property ownership, which comes into effect in January 2026. This system allows foreign individuals and companies to own properties in specified areas under strict regulations. This system is expected to inject new international liquidity into the market and stimulate buyer activity.

Eleventh: 2026 and Beyond Forecasts

Price Forecasts

Some experts expect price stability with potential slight decreases in some areas, especially with new units entering the market. Others point to continued growth in the real estate sector due to major projects and Vision 2030. Estimates indicate moderate growth between 2-5% annually over the coming years.

Expected Market Size

The Saudi real estate market is likely to expand from $71.8 billion in 2024 to over $2.31 trillion by 2029, with compound annual growth between 6.9% to 8%. The construction sector is estimated at approximately $100 billion in 2025, with expected annual growth of 5.4% until 2029.

Major Upcoming Events

The Kingdom is preparing to host major global events that will positively impact the real estate sector, including Expo 2030 and World Cup 2034. This requires expansion of tourism and hotel infrastructure, with plans to increase hotel rooms to 426,000.

Twelfth: Tips for Investors and Buyers

For Investors

Monitor areas near metro stations for value premium opportunities. Wait for white land fee executive regulations before making major decisions. Focus on high-quality real estate assets and long-term development. Track areas where restrictions were lifted in north and west Riyadh.

For Buyers

Take advantage of the current price correction phase. Compare prices between different neighborhoods as differences are significant. Follow Al-Fursan and Khuzam suburbs for units at suitable prices. Benefit from the new Tamkeen program with 30-year repayment period.

For Riyadh Renters

Document your contract in the Ejar network to guarantee your rights. Benefit from the 5-year rent freeze decision. Landlords cannot raise rent throughout this period. Keep a copy of your last registered rental contract.

Conclusion

2025 witnessed fundamental transformations in the Saudi real estate market, most notably lifting restrictions on over 114 million square meters in Riyadh, freezing rents for 5 years, raising white land fees to 10%, and launching Riyadh Metro service. These decisions led to the beginning of a price correction phase, especially in the residential sector which recorded its first decline in years.

The figures indicate the market is heading toward maturity and balance, away from speculation and unjustified increases. With over 105,000 new residential units entering in 2026-2027, the new foreign ownership system, and preparation for major global events, the future looks promising for the Saudi real estate sector within Vision 2030.

We hope this report serves as a useful reference for understanding real estate market developments and making your investment and housing decisions with wisdom and awareness.