Rent or Buy in Saudi Arabia 2025? Your Complete Guide to Making the Right Decision

Is renting or buying better in Saudi Arabia 2025? A comprehensive guide to help you make the right decision based on your financial situation, with practical calculations and tips for housing support.

Should I continue paying rent or buy a home? A question that haunts every Saudi citizen. The decision is not easy, as it affects your financial life for the next 15-25 years. In this comprehensive guide, we help you make the right decision based on your actual financial situation, away from emotions and social pressures.

The Truth No One Tells You

The common saying "rent is wasted money" is not 100% accurate. In reality, both options have costs, and the right decision depends on your personal circumstances. Some people are suited for ownership while others are better off renting, and there's no shame in either choice.

Golden Rule: If the monthly mortgage payment exceeds 40% of your salary, renting might be the smarter choice temporarily until your financial situation improves.

When Is Buying the Right Decision?

Buying is right for you if you meet these conditions:

Job Stability: You have a stable job for more than two years

Down Payment: You have 10-20% of the property value as a down payment

Emergency Fund: You have savings covering 6 months of expenses

Geographic Stability: You don't plan to move to another city within 5 years

Payment Ratio: Monthly payment doesn't exceed 30-35% of your income

Advantages of Buying

Owning a home provides several important benefits:

Psychological Stability: The security feeling of having your own roof

Building Wealth: Every payment increases your share in a real asset

Freedom to Modify: You can renovate and modify your home as you wish

Protection from Rent Increases: Your payment is fixed while rents rise

Legacy for Children: The home passes to your family after you

Disadvantages of Buying You Should Know

Before deciding to buy, you should know the other side:

Hidden Costs: Maintenance, insurance, transfer fees (5% transaction tax)

Geographic Restriction: Difficulty moving if your work circumstances change

Long-term Commitment: Monthly payment for 15-25 years

Market Risks: Possibility of property value decline

Opportunity Cost: Down payment could have been invested

When Is Renting the Smarter Decision?

Renting is not "wasted money" in these cases:

Early Career: If you're in the first 3-5 years of your career

Job Instability: If your work requires moving between cities

No Down Payment: Better to save first than take a 100% loan

High Area Prices: If rent is much lower than mortgage payment

Future Plans: If you plan to travel or relocate soon

Advantages of Renting

Renting provides flexibility that ownership doesn't:

Flexibility: Freedom to move at the end of each contract

Low Initial Cost: No need for a large down payment

No Maintenance: Landlord is responsible for major repairs

Test the Area: Opportunity to know the neighborhood before buying

Financial Liquidity: Your money is available for investment or emergencies

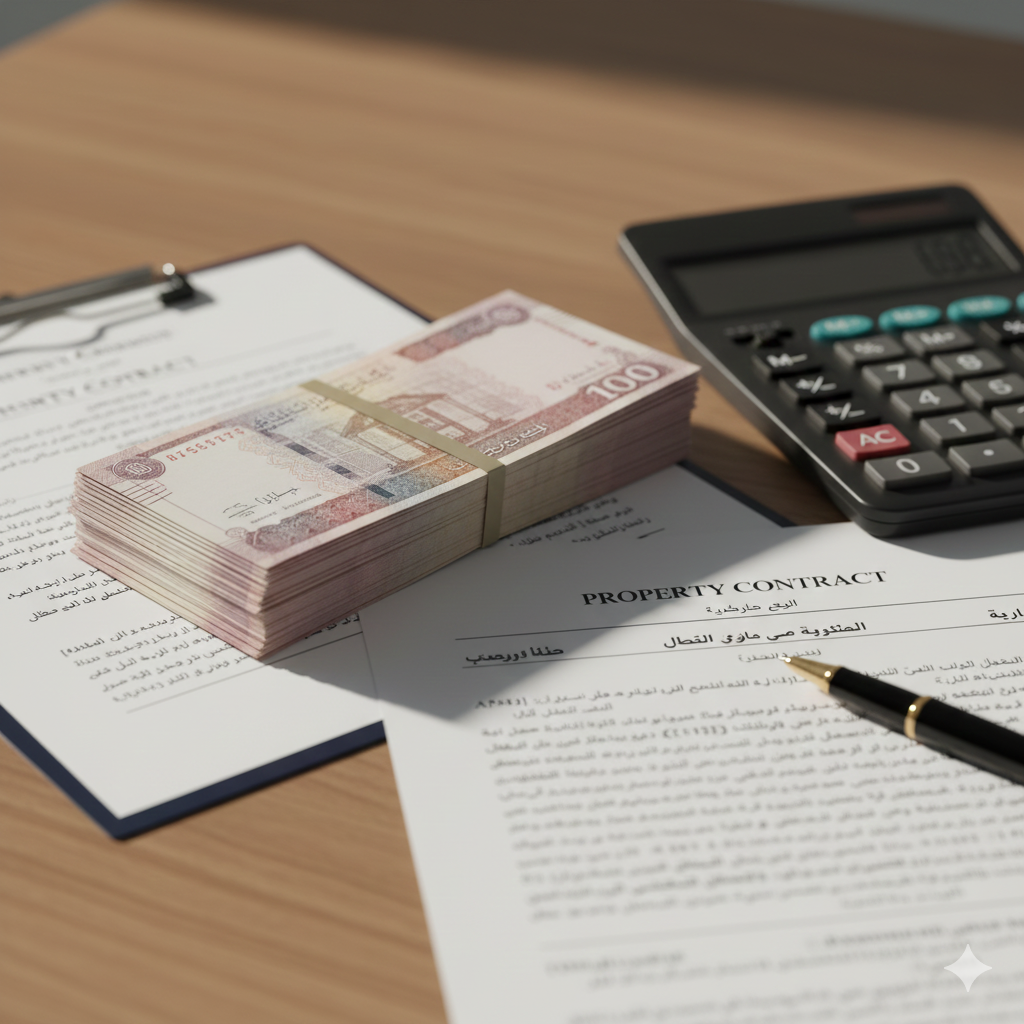

The Financial Calculation: How to Compare Correctly

Let's assume a house priced at 1,000,000 SAR:

Buying:

- Down payment 10%: 100,000 SAR

- Monthly payment (20 years): ~5,500 SAR

- Total paid: ~1,420,000 SAR

- Result: Own an asset worth potentially 1,500,000+ SAR

Renting:

- Monthly rent: 3,500 SAR

- Total over 20 years: 840,000 SAR

- Monthly savings difference: 2,000 SAR

- If invested: Could reach 800,000+ SAR

Housing Support: An Opportunity Not to Miss

If you're eligible, the Sakani program may change the equation in favor of buying:

Financial Support: Up to 100% of profits for eligible categories

Lump Sum Support: Up to 150,000 SAR for land

Military Support: ~140,000 SAR upfront

New Age Requirement: Reduced from 25 to 20 years

Check Your Eligibility: Via Sakani platform sakani.sa

7 Questions to Ask Yourself Before Deciding

Answer these questions honestly:

1. Do I have a 10-20% down payment ready?

2. Is the monthly payment less than 35% of my salary?

3. Do I have an emergency fund for 6 months?

4. Do I plan to stay in this city for 5+ years?

5. Is my job stable?

6. Have I checked my eligibility for housing support?

7. Have I studied the area well (services, schools, transportation)?

Golden Advice

Don't let social pressure force you into a decision you're not ready for. Many bought homes under pressure and later regretted it due to burdensome payments. Renting for a few extra years while saving and investing may be smarter than a loan that weighs on you for 25 years.

Conclusion

There is no single right answer for everyone. Buying is excellent for those with financial, job, and geographic stability. Renting is smart for those who need flexibility or are still building their financial situation. The right decision is one that suits your circumstances, not your neighbor's or friend's. Take your time, calculate well, and consult experts before signing any long-term commitment.