Rent-to-Own 2025: Your Path to Home Ownership Without a Huge Down Payment

Complete rent-to-own guide 2025: Learn conditions, approved banks, difference from Murabaha, pros and cons, and how to own your home with easy installments.

Do you dream of owning your own home but a large down payment stands in your way? With rising property prices, owning a home has become difficult for many, but the Rent-to-Own system opens a new door to achieve this dream! This Sharia-compliant financing system allows you to rent your home and live in it immediately, then gradually own it with each installment you pay.

💡 What is Rent-to-Own?

A financing system where the financing entity purchases the property you choose, then rents it to you for monthly payments, and at the end of the contract, the property ownership transfers to you completely.

How Does the Rent-to-Own System Work?

The lease financing system goes through several clear and organized stages:

Process Steps:

1. Choose the Property: Start by selecting the property you want (villa, apartment, land)

2. Submit Application: Apply to the bank or financing company for financing

3. Property Purchase: The financing entity purchases the property and registers it in their name

4. Sign the Contract: The rent-to-own contract is signed

5. Pay Installments: You live in the property and pay monthly installments

6. Transfer Ownership: After paying the last installment, ownership transfers to you

Rent-to-Own Conditions

Saudi authorities have set specific conditions to benefit from this system:

Basic Requirements:

- Applicant must be a Saudi citizen

- Age must be at least 21 years

- Monthly income not less than SAR 5,000

- Employment contract valid for at least one year

- No previous financial defaults

- Ability to pay the required down payment (if any)

Property Requirements:

- Property must be fully constructed or under construction

- Must be free of mortgages and disputes

- Must comply with financing entity requirements

- Obtain an approved property valuation

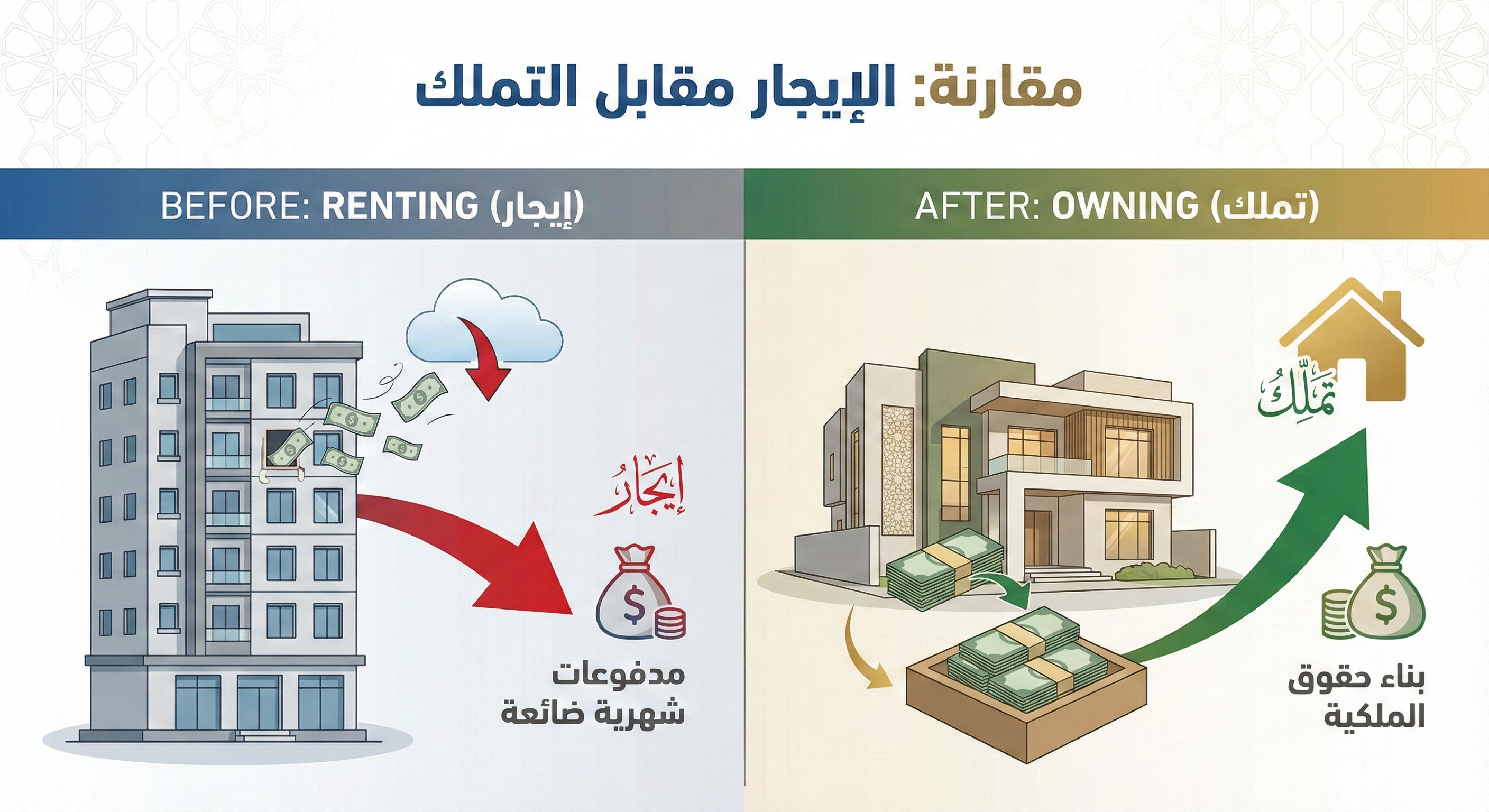

Difference Between Rent-to-Own and Murabaha

Many people confuse the two systems. Here are the key differences:

📊 Quick Comparison:

Rent-to-Own:

- Property remains in bank's name until last installment

- Installment may vary according to market

- Lower down payment (sometimes 0%)

- May have a large final payment for ownership

Murabaha (Islamic Mortgage):

- Property transfers to your name from the start

- Fixed installment throughout the period

- Higher down payment (10-30%)

- No final payment

Approved Banks and Institutions

Several banks and financing companies offer this service in the Kingdom:

1. Al Rajhi Bank

- Minimum Income: SAR 5,000

- Financing Period: Up to 25 years

- Maximum Financing: SAR 5 million

- Down Payment: 10% of property value

2. Saudi National Bank (SNB)

- Minimum Income: SAR 5,000

- Financing Period: Up to 30 years

- Interest Rate Starting From: 2.99%

- Compatible with Sakani support

3. Arab National Bank

- Minimum Income: SAR 5,000

- Financing Period: Up to 20 years

- Includes villas, apartments, and land

4. SABB Bank

- Competitive Interest Rate: 3.30%

- Flexible payment options

- Can be combined with housing support

5. Financing Companies

- Abdul Latif Jameel Finance

- Al Yusr Leasing and Finance

- Dar Al Tamleek

Advantages of Rent-to-Own

This system has several advantages that make it an ideal choice for many:

Main Advantages:

- Low Down Payment: No need to save a huge amount to start

- Immediate Housing: Move into the home directly after contracting

- Flexible Repayment: Payment periods up to 30 years

- Sharia Compliant: Approved by Sharia boards

- Inflation Protection: Property price is fixed from the start

- Early Repayment Option: Pay the remaining balance and own early

- Property Insurance: Borne by the lessor (bank)

Disadvantages and Risks to Know

No system is without drawbacks, and it's important to know them before deciding:

Potential Disadvantages:

- Delayed Ownership: Property doesn't transfer to your name until full payment

- Variable Installment: Installment may increase with market changes

- Final Payment: Some contracts require a large payment at the end

- Loss of Installments: In case of default, you may lose what you paid

- Total Cost: May be higher than Murabaha in the long term

- Modification Restrictions: Cannot modify property without owner's permission

⚠️ Important Tip: Read the contract very carefully and understand all clauses, especially those related to installment changes, final payment, and ownership conditions.

When is Rent-to-Own Right for You?

This system suits you if you:

- Don't have a large down payment: And want to start with a small amount

- Want immediate housing: Without waiting years to save

- Have stable income: And can commit to monthly installments

- Plan to stay long-term: In the same area and home

- Benefit from Sakani: Housing support can be combined with financing

Steps to Apply for Rent-to-Own

To obtain rent-to-own financing, follow these steps:

Required Documents:

- Valid national ID copy

- Salary certificate from employer

- Bank statement for last 3-6 months

- Property deed copy (if available)

- Property valuation report

Application Steps:

1. Choose the suitable property and verify its specifications

2. Compare offers from banks and financing companies

3. Submit financing application to chosen institution

4. Attach required documents

5. Wait for approval and property valuation

6. Review contract carefully before signing

7. Sign the contract and receive your home keys!

Golden Tips Before Signing

To avoid any future surprises, follow these tips:

- Compare Offers: Don't settle for one offer, compare 3-4 institutions

- Calculate Total Cost: Add all installments + final payment

- Ask About Variable Installments: Is the installment fixed or may it change?

- Read Default Clause: What happens if you're late on payment?

- Confirm Insurance: Who bears the property insurance cost?

- Inquire About Early Payment: Is there a penalty for early repayment?

- Consult a Lawyer: Especially for large contracts

Rent-to-Own with Sakani Support

You can combine this system with housing support to reduce costs:

- Check your eligibility for support via Sakani platform

- Choose a bank cooperating with Real Estate Development Fund

- Monthly support is transferred to cover part of the installment

- Support can reach 100% of financing profits for eligible beneficiaries

Conclusion

The rent-to-own system represents a real opportunity for anyone dreaming of owning a home without needing a huge down payment. But as with any major financial decision, options must be studied carefully, offers compared, and contracts read thoroughly. Remember that a home is not just a roof, but stability for you and your family, so choose wisely and make your decision based on your real financial situation and future plans. The dream home has become closer than ever!