REITs 2025: Your Complete Guide to Real Estate Investment Without Buying Property

Simple guide to REITs 2025: What are they? How do they work? Pros & cons, best Saudi funds, and how to start investing with small amounts.

Have you ever dreamed of owning a share in a luxurious commercial tower or upscale residential complex, but the millions required stopped you? What if I told you that you could become a "property owner" with as little as 100 SAR? This is exactly what Real Estate Investment Trusts (REITs) offer you! In this comprehensive guide, we'll explain everything you need to know about REITs in simple, clear language, away from financial complexities.

💡 Why Are REITs Important?

- 20+ Billion SAR: Total assets of Saudi REITs

- 20 Funds: Listed in the Saudi market

- 229 Properties: Managed by these funds

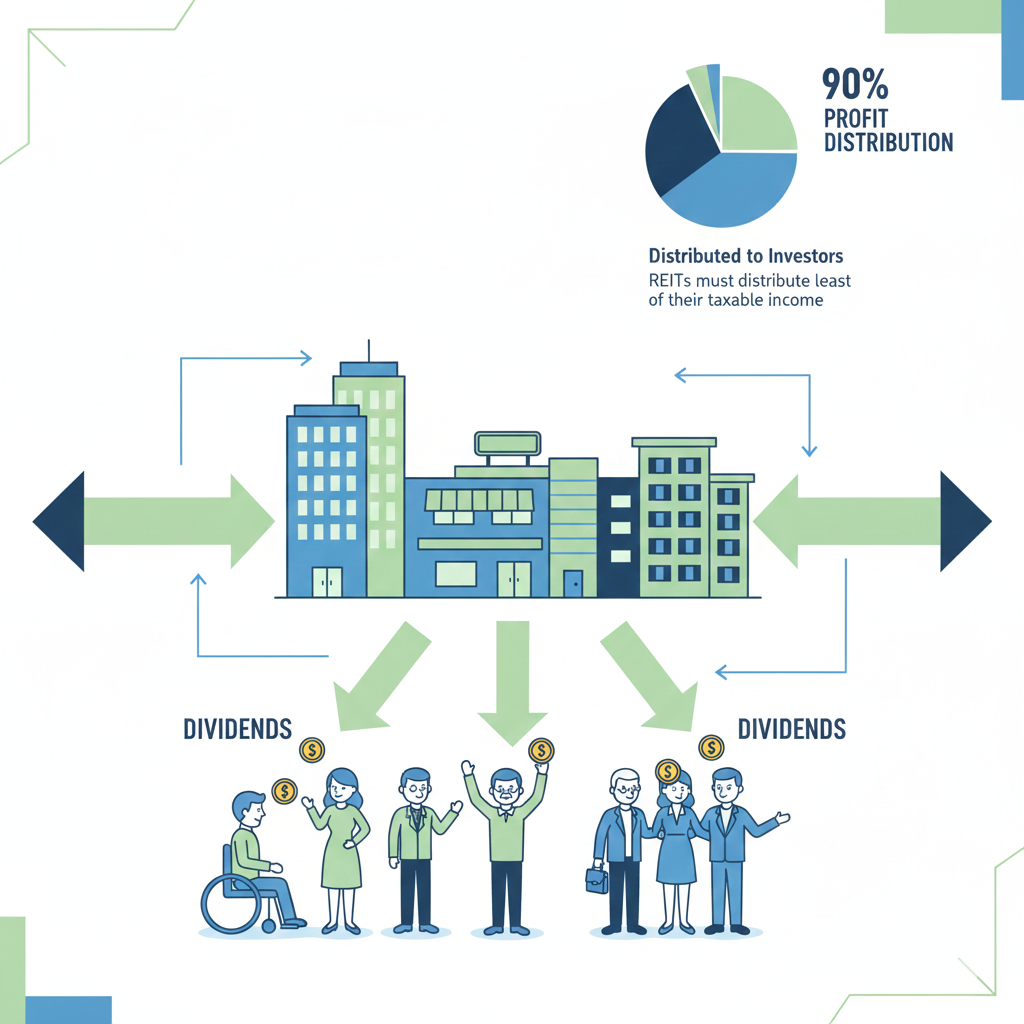

- 90% of Profits: Distributed to investors

- Quarterly Dividends: Regular income every 3 months

What Are REITs? (Simple Explanation)

Imagine you and your friends want to buy a commercial building for 10 million SAR. None of you has that amount, but if 1,000 people gathered, each paying only 10,000 SAR, you could buy the building! Then, the building is rented to shops and companies, and the rent is distributed to everyone according to their share. This is exactly what REITs do!

REIT stands for Real Estate Investment Trust. It's a company that owns, operates, or finances income-generating real estate.

How Do REITs Work?

The process is very simple:

1. Raising Capital: A licensed investment company (like Alrajhi Capital or Jadwa Investment) collects money from investors.

2. Buying Properties: With this money, the company buys income-generating properties: office towers, shopping centers, hotels, warehouses, or even hospitals.

3. Renting Properties: The properties are leased to companies and individuals, and rent is collected.

4. Distributing Profits: At least 90% of net profits are distributed to investors (you!) every 3 or 6 months.

5. Trading: Your units in the fund are traded on the Saudi Stock Exchange (Tadawul) like any regular stock. You can sell or buy more at any time.

💡 Difference Between REITs and Traditional Real Estate:

Traditional Real Estate: You need millions, deal with tenants, maintenance, legal issues, and selling takes months.

REITs: Start with 100 SAR, a professional company manages everything, and you sell your units in seconds!

Advantages of REITs (Why Invest?)

1. Regular and Continuous Income

The most important feature! REITs are legally required to distribute 90% of their profits to investors. This means stable income every 3 or 6 months, almost like a salary! Some funds distribute even 5-8% annually of your investment value.

2. Investment with Small Amounts

You don't need millions to own property. The unit price in most Saudi REITs ranges between 7-15 SAR only! With 1,000 SAR, you can own a share in huge towers and commercial complexes.

3. High Liquidity

Unlike traditional real estate that may take months or years to sell, REIT units sell in seconds through the trading app! Need your money? Sell your units now and receive the amount within two days.

4. Investment Diversification

Instead of putting all your money in one property, a single REIT fund owns dozens of properties in different cities and areas. If one property is affected, the rest compensate for the loss.

5. Professional Management

No need to deal with tenants, maintenance, or legal problems. Professional investment companies manage everything on your behalf.

6. High Transparency

REITs are required to publish periodic financial reports, property valuations, and occupancy rates. Everything is clear and visible, under the supervision of the Capital Market Authority.

7. Inflation Protection

Property values and rents rise over time, protecting your investment from the erosion of money value due to inflation.

8. Sharia Compliant

Most Saudi REITs are compliant with Islamic Sharia principles and are subject to oversight by approved Sharia boards.

Disadvantages and Risks of REITs (Be Aware!)

Like any investment, REITs have negative aspects you should know:

1. Price Volatility

Although real estate is relatively stable, REIT unit prices in the market are affected by supply and demand and may decrease sometimes. But if your goal is distributions rather than speculation, this doesn't affect much.

2. Management Fees

The management company takes annual management fees (usually 0.5%-1.5% of asset value). These fees are deducted before distributing profits.

3. Slow Growth

Because 90% of profits are distributed, little remains to expand the fund and buy new properties. Growth is slower than regular stocks.

4. Economic Impact

In economic crises, rents may decrease or vacancy rates increase, affecting distributions.

5. Interest Rates

Rising interest rates negatively affect REITs for two reasons: increased financing costs, and some investors shifting to bank deposits.

⚠️ Important Tip:

REITs are suitable for long-term investors looking for regular income. If you're looking for quick profits within weeks, REITs may not be for you.

Types of REITs

REITs vary according to the type of properties they invest in:

Office REITs: Invest in towers and office buildings. Example: Al-Faisaliah Tower, business towers.

Retail REITs: Invest in shopping centers and malls. Affected by shopping movement and e-commerce.

Residential REITs: Invest in residential complexes and apartments. Stable income but usually lower returns.

Hospitality REITs: Invest in hotels and serviced apartments. High returns but affected by tourism.

Industrial REITs: Invest in warehouses and factories. Strong growth with e-commerce boom.

Diversified REITs: Combine several types of properties. Greater diversification and lower risks.

Best Saudi REITs 2025

The Saudi market includes 20 traded REIT funds. Here are the most prominent:

1. Riyad REIT (4330)

Manager: Riyad Capital

Capital: 1.63 billion SAR

Distributions: Quarterly

Portfolio: Rafal Tower, The Residence, Saudi Electronic University building, and assets in the USA

Features: Won best investment return award, Sharia compliant

2. Jadwa REIT Saudi (4332)

Manager: Jadwa Investment

Capital: 2.06 billion SAR

Distributions: Quarterly (about 2% per quarter)

Portfolio: Diverse properties in Makkah, Madinah, and Riyadh

Features: One of the oldest and largest REITs, Sharia compliant

3. Alrajhi REIT (4331)

Manager: Alrajhi Capital

Capital: 1.22 billion SAR

Distributions: Quarterly

Features: Trusted Alrajhi name, fully Sharia compliant (pure)

4. Derayah REIT (4339)

Manager: Derayah Financial

Distributions: Among the highest distribution rates (0.72 SAR per unit)

Features: Outstanding performance in recent years

5. SEDCO Capital REIT (4337)

Manager: SEDCO Capital

Distributions: Good (0.63 SAR per unit)

Portfolio: Commercial and office properties

Features: Sharia compliant

6. Musharaka REIT (4334)

Manager: Musharaka Capital

Features: Listed in FTSE Global Real Estate Index, Sharia compliant

7. Alinma Retail REIT (4347)

Manager: Alinma Investment

Distributions: About 5.12% annually

Portfolio: Retail properties in strategic locations

Features: Long and fixed lease contracts, stable distributions

💡 Important Tip:

Always make sure the fund is "pure" meaning 100% compliant with Islamic Sharia. Some funds may invest in non-compliant activities.

How to Start Investing in REITs?

Getting started is very easy and requires no prior experience:

Step 1: Open an Investment Portfolio

Go to any Saudi bank (Alrajhi, Alinma, Riyad, SNB...) and request opening an investment portfolio. The process is done online in minutes and is free at most banks.

Step 2: Transfer Funds to the Portfolio

From the bank app, transfer the amount you want to invest from your current account to the investment portfolio.

Step 3: Search for the REIT Fund

From the trading app (Tadawulaty, Alrajhi Tadawul, Alinma Tadawul...), search for the fund by its code (e.g., 4330 for Riyad REIT) or by name.

Step 4: Buy Units

Specify the number of units you want to buy and click "Buy." The units will be added to your portfolio immediately!

Step 5: Wait for Distributions

Every 3 or 6 months, profits will be deposited into your account automatically. Follow the fund's announcements on Tadawul.

Golden Tips for Beginners

1. Start Small: Don't put all your savings at once. Start with a small amount and learn, then increase gradually.

2. Diversify Your Investments: Don't put all your money in one fund. Distribute across 2-3 different funds.

3. Think Long-Term: REITs are not for quick speculation. Invest for years and enjoy accumulated distributions.

4. Reinvest Profits: Instead of spending distributions, use them to buy additional units to grow your investment.

5. Follow Fund News: Read quarterly reports and follow occupancy rates and property news.

6. Don't Sell at a Loss: If the price drops, don't panic! Remember you're investing for distributions, not speculation.

7. Verify Sharia Compliance: Review the list of pure funds before buying if this matters to you.

Comparison: REITs vs Traditional Real Estate vs Stocks

Required Capital:

REITs: From 100 SAR | Real Estate: Millions | Stocks: From 100 SAR

Liquidity:

REITs: Very High (seconds) | Real Estate: Low (months) | Stocks: Very High

Regular Income:

REITs: Excellent (90% distributions) | Real Estate: Good (rent) | Stocks: Variable

Management:

REITs: Zero effort | Real Estate: Significant effort | Stocks: Monitoring required

Diversification:

REITs: High (dozens of properties) | Real Estate: Zero (one property) | Stocks: Your choice

Frequently Asked Questions

What's the minimum investment?

One unit! Most funds have unit prices between 7-15 SAR.

When do I receive profits?

Most funds distribute every 3 months (quarterly), and some every 6 months.

Can I lose my capital?

Yes, the unit price may decrease. But if you hold long-term, distributions compensate for any temporary decline.

Are REITs halal?

"Pure" Sharia-compliant funds are halal. Make sure to review the list of pure funds.

Which is better: REIT or traditional real estate?

Depends on your circumstances. REITs are better for liquidity, diversification, and starting with small amounts. Traditional real estate is better if you have large capital and want complete control.

Conclusion

REITs are the smart way to enter the world of real estate investment without needing millions or prior experience. Regular income, high liquidity, professional management, and automatic diversification - all with a simple amount and a button click! If you're looking for a relatively safe investment that provides you with regular additional income, REITs may be the perfect choice for you. Start today with a small amount, learn, and watch your money grow over time!