Real Estate Financial Engineering for Individuals: Complete Guide to Commercial Financing and Refinancing (Buyout) in Saudi Arabia 2025

Advanced guide for individual real estate investors in Saudi Arabia. Covers commercial real estate financing for individuals, refinancing (Buyout) and mortgage transfer between banks, SAIBOR rate strategies, difference between Ijara and Tawarruq, and comparison of self-build vs off-plan purchase (WAFI program).

Introduction: Beyond the Subsidized Loan

Real estate financing for individuals in Saudi Arabia is no longer limited to the traditional "subsidized loan" for purchasing a residential villa. Today's individual investor has advanced and diverse options that enable building an income-generating real estate portfolio, restructuring debts to benefit from interest rate fluctuations (SAIBOR), or even releasing liquidity from existing properties to finance new investments.

In this advanced guide, we'll explore the "real estate financial engineering" tools available to individuals in the Saudi market, from commercial financing to refinancing (Buyout) strategies, through understanding loan pricing mechanisms and the impact of SAIBOR on your financial decisions.

First: Commercial Real Estate Financing for Individuals

Traditionally, financing for purchasing commercial buildings such as furnished apartment buildings, offices, warehouses, and commercial complexes was exclusive to companies and institutions. However, the landscape has changed dramatically in recent years, as major Saudi banks now offer commercial financing programs directed at individuals.

How Does Commercial Financing Differ from Residential?

The fundamental difference lies in the credit evaluation methodology. In traditional residential financing, the bank relies primarily on the client's salary and ability to repay from monthly income. In commercial financing for individuals, the bank considers the property's own "cash flows," known as the Rent Roll, in addition to the individual's financial solvency.

This means that income-generating property is evaluated based on its ability to cover its installments from its rents, known as the "Debt Service Coverage Ratio" (DSCR). If the property's monthly rents cover the monthly installment by 1.25 times or more, this enhances the chances of financing approval.

Acceptance Criteria for Commercial Financing for Individuals

Commercial financing conditions differ from residential in several key points. The down payment is much higher, typically ranging between 30% to 50% of the property value, compared to 10% to 15% for subsidized residential financing. In return, the income deduction ratio may be more flexible if the client proves that the property can cover its installments on its own.

The financing term is usually shorter, ranging between 10 to 20 years compared to 25 to 30 years for residential financing. Profit rates may also be slightly higher due to additional risks associated with commercial properties.

Types of Properties Eligible for Commercial Financing

Properties eligible for commercial financing for individuals include: multi-unit residential buildings, commercial buildings and offices, warehouses and storage facilities, small commercial complexes, and furnished and hotel apartments. The main goal of this type of financing is to enable individuals to own income-generating investment assets instead of just a private residence, enhancing the concept of "passive income" and long-term wealth building.

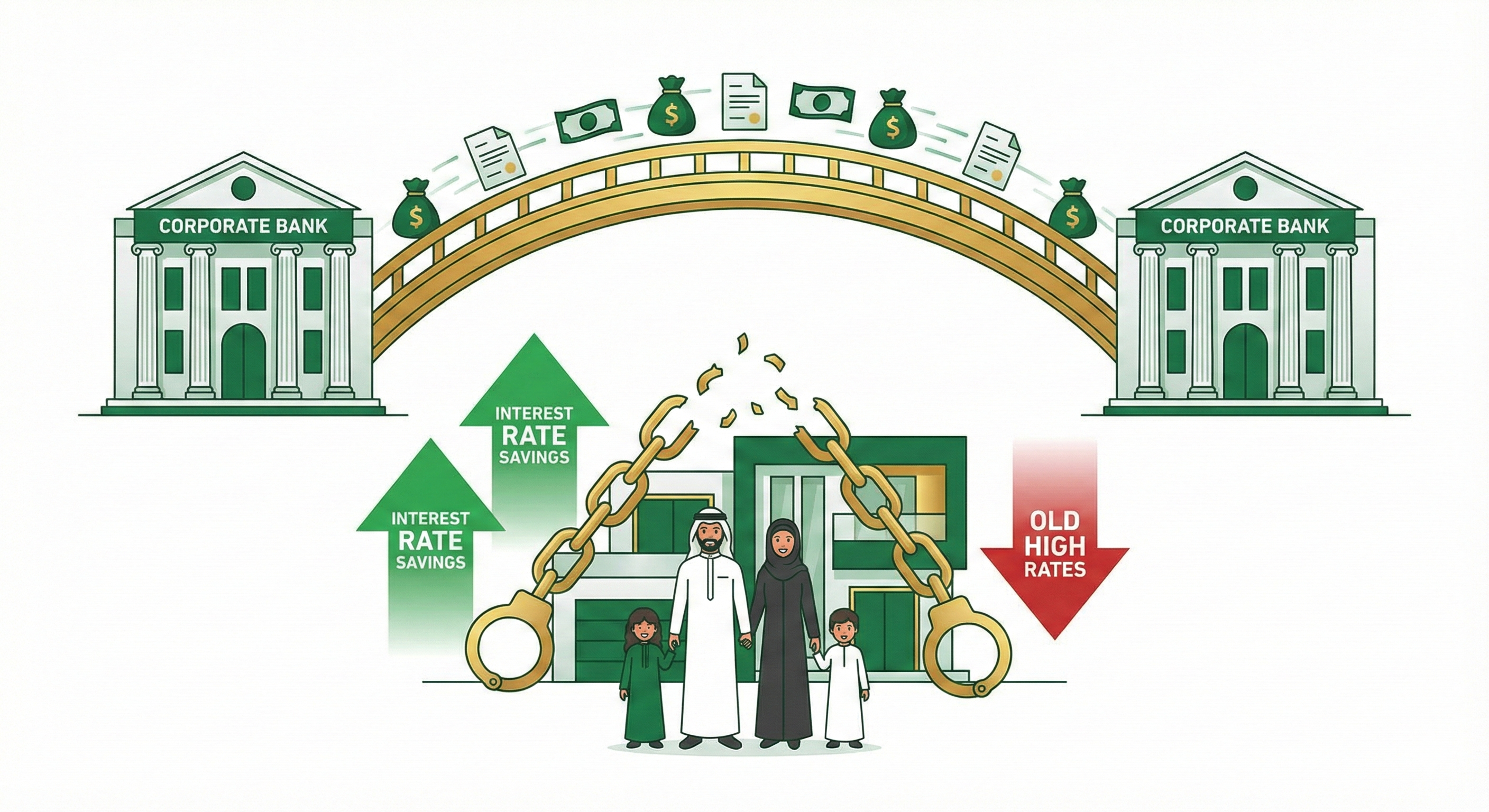

Second: Refinancing (Buyout) - Exit and Liquidity Strategy

The term "Buyout" or "debt purchase" means a new bank buying the client's debt from the current bank. This powerful financial tool has become widely available in the Saudi market, offered by most major banks such as Al Rajhi, Al Ahli, Alinma, Bank Albilad, SABB, and Banque Saudi Fransi.

When is Refinancing Beneficial?

There are two main cases that make refinancing a smart strategic option:

First Case: Declining Interest Rates

If you contracted for real estate financing during a period of high interest rates, and market rates subsequently decreased, moving to another bank with a lower profit rate can save you hundreds of thousands of riyals in the long term. For example, if you have financing of 2 million riyals at 6% profit rate for 20 years, and you move to another bank at 4.5%, the savings could reach 200,000 riyals or more.

Second Case: Liquidity Release (Equity Release / Cash Out)

If your property's market value has increased since purchase, you can refinance based on the new valuation and withdraw the difference as cash. This liquidity can be used for other investments, property finishing, purchasing additional property, or paying off other higher-interest debts.

Practical example: You bought a villa for one million riyals 5 years ago, and its market value is now 1.5 million riyals. If your remaining debt is 700,000 riyals, you can refinance based on the new value (1.5 million × 70% = 1,050,000 riyals), and withdraw the difference (1,050,000 - 700,000 = 350,000 riyals) as cash.

Mechanism of Debt Transfer Between Banks

The process begins by contacting the new bank and submitting a refinancing application. The new bank evaluates the property and your financial solvency, then issues preliminary approval. After that, you request a "no objection letter" from the current bank for debt transfer, which is mandatory according to Saudi Central Bank instructions. The new bank pays off the debt to the old bank directly, then you sign the new financing contract with the new bank.

Early Repayment Fees - The Biggest Obstacle

The biggest obstacle to refinancing is "early repayment fees." According to Saudi Central Bank (SAMA) regulations, the financier is entitled to compensation not exceeding "the term cost for the three months following repayment," calculated on a declining balance basis. This means fees are relatively limited, but the "break-even point" must be calculated accurately before making a decision.

The break-even point is the time period required for monthly installment savings to cover transition costs (early repayment fees + new financing fees + valuation fees). If the break-even point is less than two years, refinancing is usually a wise decision.

Third: Understanding SAIBOR and Its Impact on Your Decisions

SAIBOR stands for "Saudi Arabian Interbank Offered Rate," the reference rate for borrowing costs between Saudi banks in Saudi Riyals. It is updated daily based on market factors.

Why Does SAIBOR Matter to You?

In financing contracts with "Ijara ending in ownership" formula, the monthly installment is variable and linked to SAIBOR. The usual formula is: SAIBOR + fixed profit margin. If SAIBOR rises, your installments rise, and vice versa. In December 2025, the Saudi Central Bank reduced the repo rate to 4.25%, the lowest in more than three years, which positively reflected on SAIBOR rates.

Current SAIBOR (December 2025)

According to the latest data, SAIBOR rates are approximately: one month about 5.75%, three months about 6.19%, six months about 6.09%, and one year about 6.05%. These rates change daily and are affected by US Federal Reserve policies due to the Saudi Riyal's peg to the dollar.

Fourth: Ijara vs Tawarruq/Murabaha - Which is Right for You?

Understanding the difference between Sharia-compliant financing formulas is vital for making sound decisions, especially in light of interest rate fluctuations.

Ijara Ending in Ownership Formula

In this formula, the bank buys the property and rents it to you for monthly installments. Property ownership remains with the bank until the contract ends and the full amount is paid. The installment is usually variable and linked to SAIBOR.

Ijara advantages include: possibility of benefiting from declining interest rates, and greater flexibility in early repayment in some cases. However, its disadvantages include: risks of installment increases if SAIBOR rises, not officially owning the property until contract end, and there may be a large final payment for ownership.

Murabaha / Tawarruq Formula

In Murabaha, the bank buys the property and sells it to you at a price that includes a known profit margin. Monthly installments are paid on the total amount and are fixed throughout the contract term. In Tawarruq, a commodity (usually metals) is purchased and sold to provide liquidity.

Murabaha/Tawarruq advantages include: fixed and pre-known installments providing stability in financial planning, immediate transfer of property ownership to the buyer, and protection from interest rate fluctuations. However, its disadvantages include: not benefiting if interest rates decline, and total cost may be higher in a low-interest environment.

When to Switch from Ijara to Tawarruq?

Transitioning from "Ijara" financing with complex variables to "Tawarruq" with fixed rates can be a lifeline during SAIBOR volatility. If you expect continued interest rate increases, or if you prefer installment stability for long-term financial planning, switching to Tawarruq/Murabaha may be a wise decision.

Fifth: Comparing Self-Build vs Off-Plan Purchase (WAFI)

When thinking about owning a new home, beneficiaries face two main options: self-build or off-plan purchase through the "WAFI" program. Each option has its advantages and risks from a financing perspective.

Self-Build

In self-build, financing is disbursed in installments according to completion stages. The owner directly controls construction quality, design, and materials used. Cost is often lower if the process is managed smartly and with experience.

However, default risks are relatively high due to potential contractor mismanagement or cost miscalculation by the owner. Reports indicate that a significant portion of self-build beneficiaries have defaulted due to budget exhaustion before construction completion, contractor problems, or delays in obtaining permits.

Off-Plan Purchase (WAFI)

The "WAFI" program is a regulatory system launched by the Ministry of Municipal and Housing Affairs to regulate off-plan sales. In this system, financing is paid to the developer through a designated "escrow account," and is only disbursed according to actual completion rates.

Advantages include: legal protection for the buyer, guarantees extending up to 10 years on the building structure, fixed and predetermined price, and strong support from the Ministry of Housing and Real Estate Development Fund. Risks include potential delivery delays and dependence on developer integrity and compliance with specifications.

Comparison Table

In terms of financing mechanism, self-build is disbursed in installments according to completion while WAFI is paid to the developer through the escrow account. Default risks are high in self-build and medium in WAFI. Cost in self-build is often lower if managed smartly, while in WAFI it's predetermined. Quality in self-build is under the owner's direct control, and in WAFI depends on developer integrity and oversight. In terms of government support, self-build may face challenges in completing installments while WAFI is strongly supported by the Ministry of Housing.

Recommendation

For beginners in real estate or those without experience in managing construction projects, ready-made or off-plan purchase from major developers such as National Housing Company (NHC) or Roshn is a safer option. Those with experience and ability to manage projects may find self-build an opportunity to save costs and customize the home to their needs.

Sixth: Strategic Tips for Individual Real Estate Investors

1. Monitor SAIBOR Before Making Financing Decisions

Follow the SAIBOR index periodically, especially if you have Ijara-formula financing. US Federal decisions directly reflect on interest rates in Saudi Arabia.

2. Calculate Break-Even Point Before Refinancing

Don't move to another bank based on advertisements alone. Calculate precisely: early repayment fees + new financing fees + valuation fees, and compare to monthly savings to determine the time needed to recover costs.

3. Diversify Your Real Estate Portfolio

Don't put all your eggs in one basket. Think about diversifying between residential and commercial properties, and between different geographical areas.

4. Benefit from New Valuation

If your property value has increased, consider refinancing to release liquidity and invest it in new opportunities instead of leaving it "dormant" in ownership.

5. Understand Your Contract Well

Read the financing contract carefully, and understand the difference between Ijara and Murabaha/Tawarruq. Ask: Is the installment fixed or variable? What are early repayment fees? Is there an early repayment prohibition period?

Seventh: Real Estate Financing Rates in Saudi Banks 2025

According to the latest available data, real estate financing rates vary among Saudi banks. Saudi National Bank offers rates starting from about 2.99% for some categories, Bank AlJazira about 3.35%, Al Rajhi Bank about 2.32% for some programs, and Riyad Bank offers competitive rates as well. These rates change continuously and depend on several factors including: financing term, loan-to-value ratio (LTV), client's financial solvency, and property type.

It's always recommended to compare offers from several banks before making a decision, and focus on the "Annual Percentage Rate" (APR) and not just the advertised profit rate.

Conclusion

Real estate financial engineering is no longer exclusive to companies and professionals. Today's individual investor in Saudi Arabia has advanced tools to build sustainable real estate wealth: from commercial financing to purchase income-generating properties, to refinancing to benefit from market fluctuations, to understanding pricing mechanisms and choosing the most appropriate financing formula.

The key is continuous learning, careful planning, and not rushing into decisions. Consult experts, compare offers, and understand risks before opportunities. This way, you can transform real estate financing from a burden into a tool for building wealth and financial independence.