Payment Gateways in Saudi Arabia Guide 2025: Requirements, Fees, Registration Steps, and Comprehensive Comparison

A detailed and comprehensive guide to approved payment gateways in Saudi Arabia. Includes requirements explanation (commercial registration or freelance document), fees and commissions comparison, registration steps for Moyasar, Tap, HyperPay, and PayTabs, required banks, and installment services Tabby and Tamara.

Introduction: Why Do You Need a Payment Gateway for Your Store?

If you're thinking about starting an online store or already have one and want to accept electronic payments, you're in the right place. We wrote this article to be the comprehensive reference that answers all your questions about payment gateways in Saudi Arabia.

We will explain everything in a simple and detailed way: What are the approved payment gateways? Do you need a commercial registration or is a freelance work document enough? What are the actual fees for each gateway? Are there monthly fees or setup fees? And which banks do you need to work with?

By the end of this article, you will have a complete picture that enables you to make the right decision for your store.

First: What is an Electronic Payment Gateway?

An electronic payment gateway is a technical intermediary between you and your customers. When a customer wants to pay in your store, the gateway processes the transaction securely: it takes the card data, verifies its validity, deducts the amount from the customer's account, then transfers it to your bank account.

Without a payment gateway, you won't be able to accept payment with mada, Visa, Mastercard, Apple Pay, or STC Pay cards in your store. You'll have to rely on manual bank transfers or cash on delivery only, which loses you a large segment of customers.

How Does a Payment Gateway Work?

The process takes just seconds: The customer enters their card details on the payment page. The gateway encrypts the data and sends it to the card-issuing bank. The bank verifies the balance and approves or rejects. The gateway notifies you of the result. The amount is held then transferred to your account within specified days.

Why Can't I Accept Payments Directly?

Because accepting payment cards requires global security certificates like PCI DSS, integration with Visa, Mastercard, and mada networks, and agreements with banks. This costs millions of riyals and needs a specialized technical team. Payment gateways provide all this for you in exchange for a simple commission on each transaction.

Second: Basic Requirements - Commercial Registration or Freelance Document?

This question confuses many people. The good news is that most payment gateways in Saudi Arabia accept both options. But let's understand the difference:

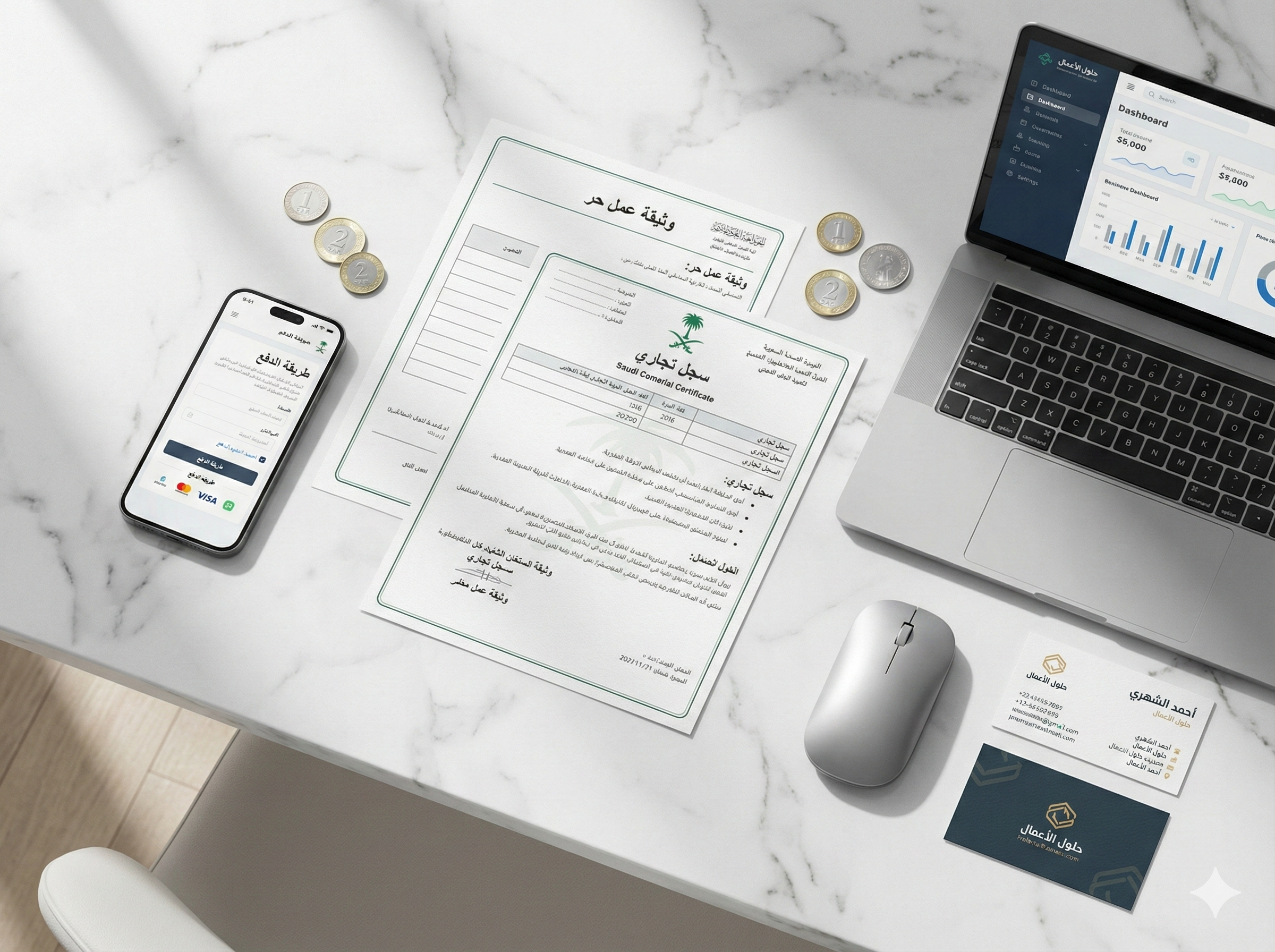

Commercial Registration

Commercial registration is an official document from the Ministry of Commerce proving you're a licensed merchant. Required if you have a business entity (company or sole proprietorship). Its fees are 200 SAR annually for the main registration. Issued electronically through the Saudi Business Center website. Requires a minimum capital of 5,000 SAR. Government employees cannot issue it without their employer's approval.

Freelance Work Document

The freelance work document is a free document from the Ministry of Human Resources for individuals who want to practice an activity without commercial registration. Ideal for beginners and government employees. Completely free without any fees. Issued within 24-48 hours from the freelance platform. Valid for one year and renews for free. Allows opening a commercial bank account. Includes more than 140 freelance professions including e-commerce.

Which Should You Choose?

If you're a government employee wanting extra income: The freelance work document is your only option. If you're a beginner wanting to try e-commerce: Start with the freelance document because it's free. If your sales volume is large or you deal with government entities: Commercial registration is better as it gives more credibility. If you have a physical store or warehouse: Commercial registration is mandatory.

Common Requirements for All Gateways

Regardless of document type, you will need: Valid national ID or residency for residents. Commercial bank account in one of the supported Saudi banks. Website or online store ready for integration. Email and mobile number for communication.

Third: Approved Payment Gateways in Saudi Arabia

The Saudi Central Bank (SAMA) oversees the licensing and monitoring of all payment service providers in the Kingdom. Here are the most important licensed gateways:

1. Moyasar

A Saudi company licensed by the Central Bank, headquartered in Riyadh, established in 2015. Considered one of the easiest gateways for beginners.

Supported payment methods: mada, Visa, Mastercard, American Express, Apple Pay, STC Pay, Samsung Pay, SADAD.

Fees: Setup fees up to 1,500 SAR for some packages. Monthly fees may reach 200 SAR depending on the package. Transaction commission: 2.2% + 1 SAR for credit cards. mada commission: 1.5% + 1 SAR (less than credit cards).

Supported banks: All Saudi banks including Al Rajhi, Al Ahli, Riyad, Al Inma, Al Bilad, and others.

Settlement duration: mada: 24 hours to 3 business days. Credit cards: 7 to 14 business days.

Moyasar advantages: Easy Arabic dashboard. Ready plugins for Salla, Zid, WooCommerce, and Shopify platforms. Fast technical support. Test environment for developers.

2. Tap Payments

A Kuwait-origin company expanded to Saudi Arabia, characterized by easy setup and quick integration.

Supported payment methods: mada, Visa, Mastercard, Apple Pay, Google Pay, Samsung Pay.

Fees: No setup fees for basic packages. Monthly fees vary by package. Transaction commission: Starting from 2.9% up to 3.94% depending on card type (local or international). Fixed commission of 1-2 SAR per transaction.

Important note: Tap sets a specific number of transactions in some packages, and any additional transaction has a 2 SAR processing fee.

Tap advantage: Does not require commercial registration in some cases, making it an option for beginners.

3. HyperPay

One of the oldest and largest payment gateways in the region, approved by the Saudi Central Bank, targeting medium and large companies.

Supported payment methods: mada, Visa, Mastercard, American Express, Apple Pay, STC Pay, SADAD.

Fees: Setup fees: approximately 1,500 SAR. Monthly fees: approximately 250 SAR. Transaction commission: 2.75% + 1 SAR for credit cards. mada commission: 1.5% + 1 SAR.

Required banks: HyperPay requires opening a merchant account with specific banks like Al Inma Bank. The bank may charge additional monthly fees.

HyperPay advantages: Advanced fraud protection. Detailed reports and analytics. Support for large companies and high transaction volumes.

4. PayTabs

A leading Saudi company in the region, offering comprehensive payment solutions.

Supported payment methods: mada, Visa, Mastercard, American Express, Apple Pay, SADAD.

Fees: Two package options: Basic package: $49 monthly without commission on transactions (suitable for sales less than $2,000 monthly). Commission package: No monthly fees, 2.85% - 3.5% commission on each transaction (suitable for higher sales).

Note: PayTabs requires a tax card to activate the account, which requires commercial registration.

Supported banks: Al Ahli, Al Rajhi, Riyad, SABB.

5. Amazon Payment Services (PayFort)

An Amazon-owned gateway, very reliable and used by major companies.

Supported payment methods: mada, Visa, Mastercard, American Express, Apple Pay, SADAD.

Fees: mada commission: 1.75% + 1 SAR. Credit card commission: Varies by agreement.

Contracted banks: Al Ahli, Riyad, Al Rajhi, SABB.

Advantages: Very high reliability. 3D Secure technology for security. Installment payment support.

6. Al Rajhi Bank Payment Gateway

A gateway directly from Al Rajhi Bank, suitable for Al Rajhi customers.

Fees: Credit card commission: 2.2% + 0.5 SAR. mada commission: 1.4% + 0.5 SAR.

Advantage: No setup fees or monthly fees. Direct transfer to Al Rajhi account.

Disadvantage: Supports only Al Rajhi Bank and Arab Bank.

Fourth: Comprehensive Gateway Comparison Table

To make comparison easier for you, here's a summary of the most important information:

Setup Fees

Moyasar: 0 - 1,500 SAR depending on package. Tap: Free. HyperPay: 1,500 SAR. PayTabs: Administrative fees upon registration. Al Rajhi: Free.

Monthly Fees

Moyasar: 0 - 200 SAR. Tap: 0 - Variable. HyperPay: 250 SAR. PayTabs: $49 or none. Al Rajhi: Free.

Credit Card Commission

Moyasar: 2.2% + 1 SAR. Tap: 2.9% - 3.94% + 1-2 SAR. HyperPay: 2.75% + 1 SAR. PayTabs: 2.85% - 3.5%. Al Rajhi: 2.2% + 0.5 SAR.

mada Commission

Moyasar: 1.5% + 1 SAR. Tap: Less than credit cards. HyperPay: 1.5% + 1 SAR. PayTabs: Variable. Al Rajhi: 1.4% + 0.5 SAR.

Registration Requirements

Moyasar: Commercial registration or freelance document. Tap: May not require commercial registration. HyperPay: Commercial registration. PayTabs: Commercial registration + tax card. Al Rajhi: Commercial registration.

Fifth: "Buy Now Pay Later" Services - Tabby and Tamara

These services are not traditional payment gateways, but they have become essential for any online store to increase sales.

Tabby

A Saudi company approved by the Central Bank, allowing customers to split their purchases into 4 interest-free payments.

How it works for the customer: Customer chooses Tabby at checkout. Pays 25% as first payment. The rest is divided into 3 monthly payments. No interest or late fees.

How it works for the merchant: Tabby pays you the full amount immediately. Tabby bears the collection risk from the customer. Tabby takes a commission from the merchant (varies by agreement).

Merchant registration requirements: Commercial registration, business license, or freelance document. Verified online store. No setup fees.

Tamara

A strong competitor to Tabby, offering the same service with some differences.

How it works: Split into 3 or 4 payments. "Pay within 30 days" option with one payment.

Why add them to your store? Increase average order value by up to 30%. Attract customers who don't want to pay in full immediately. Reduce cart abandonment rate. You receive the full amount from Tabby/Tamara.

Sixth: Payment Gateway Registration Steps

We'll use Moyasar as an example since it's the most commonly used, and the steps are similar across most gateways:

Step One: Create an Account

Go to the gateway's website (e.g., moyasar.com). Click on "Register" or "Create Account." Enter your details: email, username, company/business name, password, mobile number, your website or store link.

Step Two: Confirm Email

You'll receive an OTP code to confirm your email. Enter the code to activate your account.

Step Three: Complete Business Information

After logging in, you'll need to submit: Copy of commercial registration or freelance document. Copy of national ID. Bank account information (IBAN number). Description of your business activity.

Step Four: Application Review

The gateway team will review your application and documents. They may contact you for any inquiries or additional documents. Duration: From one day to a week depending on the gateway.

Step Five: Sign Contract and Receive API Keys

After approval, you'll sign the service contract electronically or in paper. You'll receive API Keys which are: Public Key (for frontend). Secret Key (for server). Webhook URL (for transaction notifications).

Step Six: Link Gateway to Your Store

If you're on a ready platform (Salla, Zid, Shopify): There's usually a ready option to add the gateway from payment settings. Enter the API keys and save settings. If you're on WooCommerce: Download the gateway plugin from their website. Activate the plugin and enter the keys. If you have a custom website: You'll need a developer to integrate the gateway's API with your site.

Step Seven: Test Payment

Before launching, use the test environment to ensure everything works. Try a dummy purchase. Ensure order notifications are received.

Seventh: Financial Settlement - When Will You Get Your Money?

This is a very important point many overlook when choosing a gateway:

What is Settlement?

Settlement is transferring the funds collected from your customers to your bank account. Calculated in days and expressed as T+N (where T is the transaction day and N is the number of days).

Settlement Periods by Gateway and Payment Type

mada transactions: T+1 to T+3 (1 to 3 business days). Credit cards: T+7 to T+14 (one to two weeks). Note: Does not include weekends (Friday and Saturday).

Why Are Credit Cards Slower?

Because banks hold the amount longer to ensure there are no disputes or chargeback requests from the customer.

Important Tip

If cash flow is important to you (e.g., for buying inventory), choose a gateway with fast settlement and rely on mada transactions more than credit cards.

Eighth: Supported Payment Methods - What Do Your Customers Need?

Let's understand each payment method:

mada Cards

Saudi ATM cards linked to the current account. Most used in Saudi Arabia. Deducted from balance immediately. Lower commission than credit cards. Faster settlement.

Credit Cards (Visa/Mastercard)

Credit purchase cards. Required for foreign customers. Higher commission because they go through international networks.

Apple Pay and Samsung Pay

Digital wallets on phone. Customer pays with one touch without entering card details. Increases purchase completion rate because it's faster.

STC Pay

Digital wallet from STC. Has a large user base in Saudi Arabia. Important for targeting a wider segment.

SADAD

Government bill payment system. Used for large or recurring payments. Needs a biller number from SADAD.

Which Should You Activate?

Minimum: mada + Visa/Mastercard. Recommended: Add Apple Pay and STC Pay. For large sales: Add Tabby/Tamara for installments.

Ninth: How to Choose the Right Gateway?

Ask yourself these questions:

What is Your Expected Sales Volume?

Less than 5,000 SAR monthly: Choose a gateway without monthly fees even if its commission is slightly higher. More than 20,000 SAR monthly: Fixed monthly fees may save you if the commission is lower.

Do You Have Commercial Registration?

No: Choose Tap or Moyasar as they accept freelance documents. Yes: All options are available to you.

Which Bank Do You Use?

Al Rajhi: Al Rajhi gateway is excellent for you (no fees). Al Ahli or Riyad: PayTabs or Amazon are good options. Any bank: Moyasar supports all banks.

What Platform Does Your Store Run On?

Salla or Zid: All gateways have ready integration. WooCommerce: Ensure there's a ready plugin. Custom website: Ensure API documentation quality.

Are You Targeting International Customers?

Yes: Choose a gateway that supports multiple currencies like PayTabs or Tap.

Tenth: Golden Tips to Save on Fees

Negotiate Fees

If your sales volume is large (more than 50,000 SAR monthly), contact the sales department and ask for a discount. Most gateways offer special prices for high volume.

Encourage Customers to Use mada

mada commission is 0.5% - 1% less than credit cards. You can offer a small discount for those who pay with mada.

Calculate Actual Cost

Don't just look at the commission. Calculate: Setup fees + (Monthly fees × 12) + (Transaction commission × Annual sales volume). Compare the final number between gateways.

Start with One Gateway

Don't complicate things. Choose one gateway and start. You can add other gateways later if needed.

Frequently Asked Questions

Can I Use More Than One Payment Gateway in the Same Store?

Yes, some stores use two or more gateways. But this complicates accounting. It's better to stick with one gateway unless you have a strong reason.

What If a Customer Requests a Refund?

You can make a full or partial refund from the gateway control panel. Some gateways deduct refund fees from your account (up to 20 SAR), and some don't.

Are Payment Gateways Safe?

Yes, all gateways licensed by SAMA comply with global PCI DSS security standards. Card data is encrypted and not stored on your servers.

How Long Does Activation Take?

Ranges from one day to two weeks depending on: Your speed in submitting documents. Gateway's review speed. Whether you need to open a new bank account or not.

Can I Accept Payment Without a Website?

Yes, some gateways offer "Payment Links." You create a link and send it to the customer via WhatsApp or email and they pay through it. Useful for services and small businesses.

What's the Difference Between Payment Gateway and Payment Processor?

Payment gateway is the interface your store deals with. Payment processor is what actually executes the transaction with banks. Most companies offer both services together.

Can Residents Open a Payment Gateway?

Yes, provided they have a valid residency and valid commercial registration or freelance work document.

Conclusion

Choosing the right payment gateway is an important decision for your online store's success. There is no "best gateway" absolutely, the best is the one that suits your needs, business size, and budget.

For beginners with freelance documents: Start with Moyasar or Tap. For Al Rajhi customers: Al Rajhi gateway is an excellent and free option. For large companies: HyperPay or PayTabs offer advanced features. To increase sales: Add Tabby or Tamara for installments.

Share this guide with anyone thinking about starting e-commerce. And if you need any additional help, don't hesitate to ask. We wish you success in your business journey!