Mortgage Loan Exemption for Deceased Borrowers in Saudi Arabia 2025: Conditions, Procedures, Rejection Cases, and Everything Heirs Need to Know

Comprehensive guide on mortgage loan exemption for deceased borrowers in Saudi Arabia. Includes exemption conditions, required documents, the 90-day deadline, difference between direct loans and subsidized financing, rejection cases due to medical disclosure, death exceptions, and electronic application steps for heirs.

Introduction: The Fundamental Shift in Mortgage Loan Exemption System

For a long time, there was a deep-rooted societal belief that government mortgage loans automatically and directly fall upon the death of the borrower, as a royal gesture or sovereign right that doesn't require complex procedures. This belief was true during the period of direct loans from the Real Estate Development Fund, but reality has changed significantly in recent years with the shift towards the subsidized financing system in partnership with commercial banks.

Today, the issue of exempting the deceased from mortgage loans has become more complex than it used to be. Exemption is no longer a purely administrative decision issued by the Fund, but has become a contractual process subject to a life and disability insurance policy concluded by the financing entity with an insurance company. This article will reveal all the precise details that may deprive heirs of this right if they don't know them.

First: Types of Mortgage Loans in Saudi Arabia

Before we talk about exemption, you must understand the fundamental difference between two types of mortgage loans, because exemption procedures differ significantly between them.

Direct Mortgage Loan (Old System)

This type was prevalent before 2017, where the Real Estate Development Fund would lend citizens directly an amount up to 500,000 riyals without interest or profits. The borrower repays the Fund directly in monthly or annual installments. In case of death, the exemption was made by a decision from the Fund in implementation of the Royal High Order, and procedures were relatively simpler.

Subsidized Mortgage Financing (Current System)

Since 2017, the Fund has shifted to a partnership system with commercial banks and financing companies. In this system, the bank is the one that lends the citizen and mortgages the property in its name, and the Fund supports the profits at a rate ranging from 35% to 100% depending on the beneficiary's income. Here lies the problem: exemption is no longer a government decision, but has become payment of the remaining loan by the insurance company to the bank, and this is subject to the terms and exceptions of the insurance policy.

Second: Legal Framework for Exempting the Deceased

There are several royal orders and regulatory controls governing the issue of exempting the deceased from mortgage loans, and it's important to understand them to know your full rights.

High Order No. 15629/B of 1428H

This order issued by the Custodian of the Two Holy Mosques King Abdullah bin Abdulaziz, may God have mercy on him, decreed the exemption of all deceased borrowers, men and women, from all installments of Real Estate Development Fund loans for residential purposes, as well as Saudi Credit and Savings Bank loans for social purposes. The order also included future cases of those who were regular in payment before their death.

Royal Order No. A/18 of 1432H

This order confirmed the continuation of exemption coverage for the deceased from Real Estate Development Fund loans, and expanded the scope of application to include additional categories.

Saudi Central Bank Regulations (October 2018)

These regulations are the most important for subsidized financing through banks. Based on Clause Five of the collection controls and procedures for individual customers issued by the Saudi Central Bank (SAMA), the death of the customer results in the obligation to release the mortgage on the property deed by the financing entity in preparation for transferring its ownership to the heirs if they request it, with exempting them from paying the remainder of the obligation arising from the mortgage financing contract.

Third: Conditions for Mortgage Loan Exemption Upon Death

Exemption is not granted automatically upon death. There are specific conditions that must be met for heirs to be entitled to exemption and release of the mortgage on the property.

First Condition: Contract Signing Date

The mortgage financing contract must be concluded on October 1, 2018 or later. This date is the effective date of the new Saudi Central Bank regulations that obligated all financing entities to insure the borrower's life and exempt heirs upon death. Contracts signed before this date are subject to the terms agreed upon in each individual contract.

Second Condition: Cause of Death

The cause of the borrower's death must be natural and not one of the excluded causes of death stipulated in the insurance policy and Clause Five of the Central Bank regulations. We will detail these exceptions later in the article.

Third Condition: Payment Compliance Before Death

The deceased must have been regular in paying installments before their death. If there were late or defaulted installments, the heirs must pay them first before obtaining exemption from the remaining amount.

Fourth Condition: Correct Medical Disclosure

This condition is the most dangerous and most causing rejection of exemption requests. The borrower must have disclosed honestly and transparently about their health condition when signing the financing contract and insurance questionnaire. Any concealment of material medical information may lead to rejection of the insurance claim.

Fifth Condition: Submitting Application Within Specified Period

The exemption request and required documents must be submitted within a specified period from the date of death. This period varies by entity: some banks require 30 days, and some extend to 90 days. Delay may give the insurance company grounds to reject the claim.

Fourth: Death Cases Excluded from Exemption

This section is extremely important because it clarifies cases where heirs are not entitled to obtain exemption, meaning they will bear the loan payment or sell the property to pay it off.

Suicide

If the borrower's death was due to suicide, the insurance company refuses to pay the loan. Some policies exclude suicide only during the first two years from policy issuance, and it's covered thereafter. But this depends on each insurance policy's terms.

Drug and Alcohol Use

If it's proven that death occurred due to drug use, alcohol, or any intoxicating substances, the insurance claim is rejected and heirs bear the full loan.

Natural Disasters

Death due to natural disasters such as earthquakes, floods, and hurricanes may be excluded from insurance coverage, unless there's a special endorsement that includes them.

Terrorist Operations and Wars

Death resulting from terrorist operations, war acts, riots, or civil disturbances is often excluded from coverage.

Dangerous Sports

If the borrower died while practicing dangerous sports such as skydiving, mountain climbing, or motor sports, and these sports were not authorized in the insurance policy, exemption may be rejected.

Illegal Activities

Death while participating in illegal or criminal activities is excluded from insurance coverage.

Fifth: The Medical Disclosure Dilemma (Shocking Facts)

This is the most dangerous aspect that many borrowers and heirs alike are unaware of. Real stories show that the major obstacle is not in formal procedures, but in the due diligence investigation conducted by insurance companies after death.

How Does This Happen?

When signing the mortgage financing contract, the customer fills out a medical questionnaire, often by phone or electronically and quickly. They're asked about their current and previous illnesses and any medications they take. Many people don't give this questionnaire sufficient importance, or hide some information thinking it's unimportant or fearing financing rejection.

The Dangerous Scenario

If the customer dies from a heart attack, for example, the insurance company returns to their historical medical record and examines it carefully. If it's proven that the deceased was visiting heart clinics or taking blood pressure or cholesterol medications before signing the contract and didn't disclose this, the company considers the contract was built on fraud or concealment of material information. The result? The insurance company refuses to pay the loan.

Impact on Heirs

Heirs find themselves facing two bitter choices: either completing loan payment from the estate or their own pockets, or selling the property which may be their only residence to pay off the bank debt. This painful situation happens to many families who didn't know about this risk.

What Should You Disclose?

According to the unified medical disclosure form, you must disclose material diseases that have a direct impact on calculating the insurance premium value. These include benign and malignant tumors and cancer, autoimmune diseases and sclerosis, heart diseases of all types, kidney failure, viral hepatitis, and any hospital admission during the last 12 months.

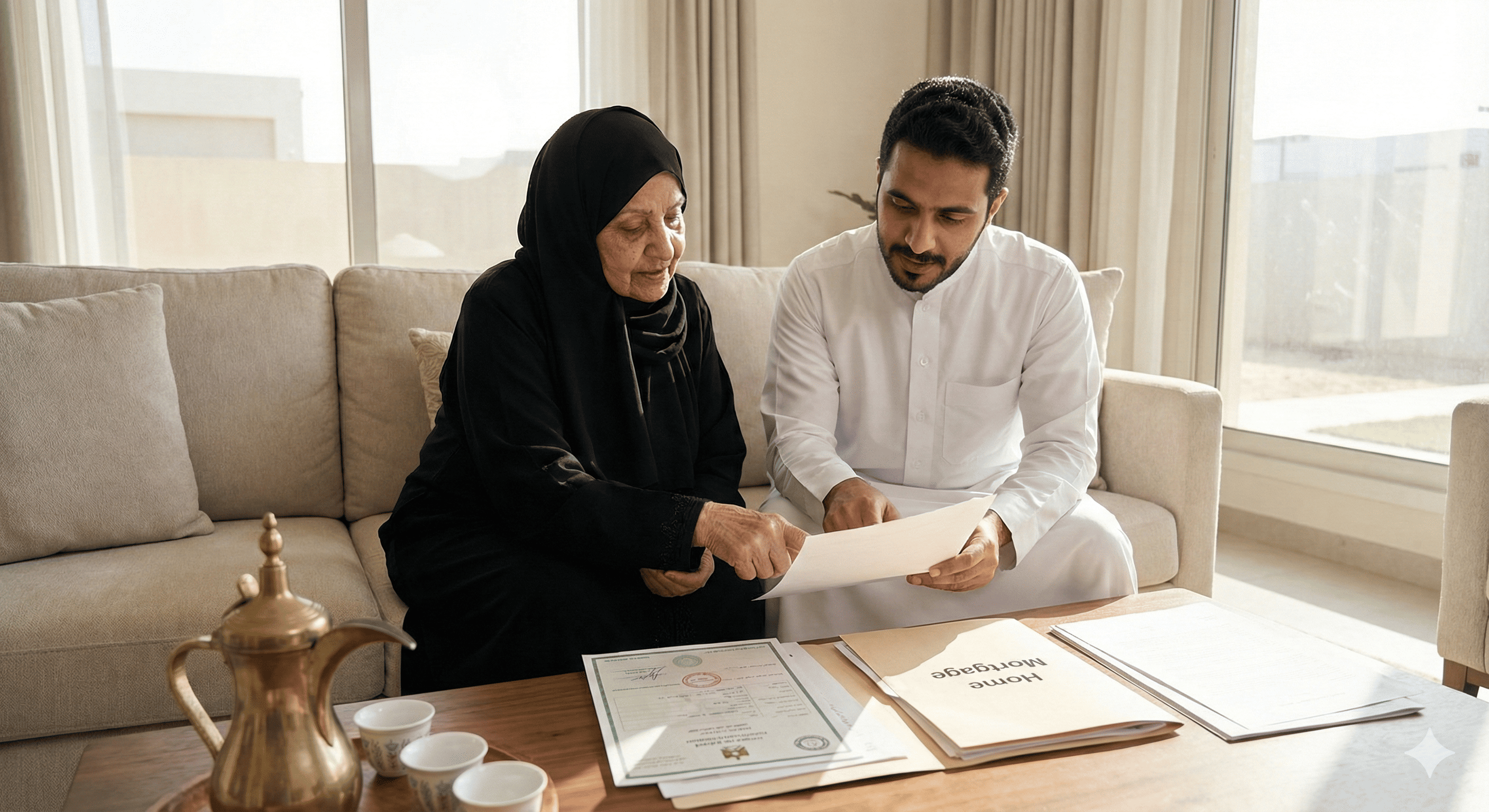

Sixth: Documents Required for Exemption Request

Preparing documents correctly and completely speeds up exemption procedures and reduces the possibility of rejection or delay.

For Direct Loans from the Real Estate Fund

Basic documents include the original death certificate or a certified copy of it, the legal heirs certificate, a copy of the deceased's national ID, a copy of the legal representative's or authorized heir's ID, and the IBAN bank account number to recover any excess amounts if any.

For Subsidized Financing Through Banks

In addition to the above documents, you need a detailed death certificate showing the direct cause of death, a medical report from the hospital if death was due to illness, a copy of the mortgage financing contract and payment schedule, a declaration from heirs accepting the estate, and a legal power of attorney from all heirs to one person to follow up on procedures.

For Total Disability

In case of total disability and not death, you need an approved medical report from an official medical committee proving permanent total disability, determining the disability percentage, and the disability must prevent the borrower from practicing any work for earning a living.

Seventh: Steps to Apply for Deceased Exemption

Application steps vary according to the loan type and lending entity. We will explain each path in detail.

Application Through Real Estate Development Fund (Direct Loans)

The first step is to access the National Single Sign-On portal via my.gov.sa. Log in using your Absher account. Search for the deceased exemption service or deceased exemption request. A page for death case registration requests will appear, click on add death case registration request. Enter the deceased's basic data such as ID number and name. Enter the loan data for which exemption is requested. Confirm the accuracy of data and save. Upload required files and documents then approve them. A message will appear confirming successful save, and you can follow up on request status through the same portal.

Application Through Social Development Bank (Credit Loans)

Enter the Social Development Bank website sdb.gov.sa. Log in via National Single Sign-On. Choose electronic services then request exemption for deceased. Follow the same previous steps of entering data and uploading documents.

Application for Commercial Banks (Subsidized Financing)

Here the procedure is different because exemption is done through an insurance claim. The legal representative of heirs must go to the nearest branch of the lending bank such as Al Rajhi, Al Ahli, or Riyad. Request a death case insurance claim form. Fill out the form and attach all required documents. The bank will communicate with the insurance company to process the claim. Wait for the response which may take from two weeks to two months. Some banks provide electronic channels to submit claims, inquire with the bank about this.

Inquiry About Exemption Request Status

You can inquire about loan exemption request status through the Ministry of Finance website mof.gov.sa through the loan exemption inquiry service. Enter the deceased's national ID number and the request status will appear.

Eighth: Critical Time Limits to Pay Attention To

Delay in application may cause you to lose your right to exemption. Here are the important time limits.

14-Day Deadline

Some banks like Al Ahli Bank require notifying the bank of death within only 14 days from the date of death. This initial notification preserves your right even if gathering documents takes longer.

30-Day Deadline

Many banks and insurance companies require submitting complete documents within 30 days from the date of death or disability. Your delay beyond this deadline weakens your legal position.

90-Day Deadline

Some executive regulations give a longer deadline of up to 90 days, but the sooner you apply the better. Delay may give the insurance company grounds to reject the claim on the pretext of delayed notification that may hinder verification of the cause of death.

Important Advice

Don't be too preoccupied with condolence ceremonies and estate distribution at the expense of these time limits. Delegate one of the heirs to start notification and application procedures immediately after death, even if documents are incomplete. Initial notification preserves the right.

Ninth: What Happens If Exemption Request Is Rejected?

In case the bank or insurance company rejects the exemption request, you have several options.

Know the Reason for Rejection

First, request from the rejecting entity a written clarification of reasons for rejection. This is your legal right. Understanding the reason helps you determine your next step.

Appeal to the Bank

If rejection is from the bank, you can submit a formal appeal to the bank's complaints department. The bank is obligated to respond to your appeal within a specified period.

Complaint to Saudi Central Bank

If your appeal is not responded to, you can submit a formal complaint to the Saudi Arabian Monetary Authority (Central Bank) via the SAMA Cares website samacares.sa. The Central Bank is the regulatory body over banks and insurance companies.

Insurance Disputes Committee

If the dispute is with the insurance company, you can file a case before the committees for resolving insurance disputes and violations via idc.gov.sa.

Resort to Judiciary

The last option is to file a lawsuit through the Najiz platform if you have exhausted all previous options without success.

Complete Payment or Sell Property

If rejection is proven legal and justified such as cases of concealing medical information or death due to an excluded cause, heirs will have no choice but to complete installment payments or negotiate with the bank to reschedule the debt or sell the property to pay off the remainder.

Tenth: Difference Between Total and Partial Disability

Exemption is not limited to death cases, but also includes total disability cases, but with precise conditions.

Permanent Total Disability

This is the type that qualifies for exemption. It's defined as disability that permanently prevents the borrower from practicing any work for earning a living. It must be proven by a report from an approved medical committee that determines the disability percentage. Usually, the disability percentage is required to be 100% or close to it.

Partial Disability

Partial disability does not qualify for full exemption in most cases. It may qualify for debt rescheduling or installment reduction according to bank policies, but not for full exemption. A patient with a chronic disease is not considered totally disabled unless proven that the disease completely prevented them from working.

Important Note

The Sakani system uses a points system for priorities, where patients with incurable diseases are given additional points, but this concerns eligibility for housing support and not necessarily exemption from payment for existing loans with banks.

Golden Tips for Current Borrowers

If you are a current mortgage loan borrower, here are important tips to protect your family in the future.

Review Financing Contract Carefully

Make sure there's an explicit clause stating heirs' exemption and mortgage release in case of death or total disability. If not present, discuss the matter with the bank before signing.

Be Honest in Medical Disclosure

Disclose all your current and previous diseases honestly in the insurance questionnaire. Concealment may save you a higher premium now, but it will deprive your family of exemption later. Honesty here is an investment in your family's peace of mind.

Keep Copies of All Documents

Keep a copy of the financing contract, insurance policy, and medical disclosure questionnaire in a safe place known to your family members. This facilitates procedures for them in case something happens.

Inform Your Family About Procedures

Tell your wife or one of your adult children about the loan's existence, lending bank, and required procedures in case of death, especially critical time limits.

Follow Up on Regular Installment Payment

Any delay in payment may complicate exemption procedures later. Maintain a clean payment record.

Frequently Asked Questions

Does the mortgage loan automatically fall upon borrower's death?

No, exemption is not automatic. Heirs must submit a formal request with required documents within the specified deadline. Without that, the loan remains outstanding and heirs are demanded to pay it.

What's the difference between Real Estate Fund exemption and bank exemption?

Real Estate Fund exemption for direct loans is done by government decision implementing the Royal Order. Bank exemption is done through the insurance company and is subject to insurance policy terms and exceptions.

Are heirs exempted if the deceased was defaulting on payment?

Heirs must pay any late or defaulted installments first before obtaining exemption from the remaining amount.

What if the borrower died from an undisclosed disease?

If proven that the borrower concealed material medical information when signing the contract, the insurance company has the right to reject the claim and heirs bear the loan.

Does subsidized mortgage financing include life insurance?

Yes, since October 2018, life and disability insurance became mandatory in mortgage financing contracts, and the financing entity bears its cost.

How long do exemption procedures take?

Duration varies by entity and document completeness. It may take from two weeks to three months. Early submission and complete documents speed up the process.

Do heirs have the right to live in the property during exemption procedures?

Yes, the property remains mortgaged but heirs have the right to live in it during exemption procedures. After exemption approval, the mortgage is released and ownership is transferred to heirs.

What if the bank rejects exemption without clear reason?

Submit a complaint to the Saudi Central Bank via the SAMA Cares website. The bank is obligated to apply Central Bank regulations, and any violation exposes it to penalties.

Conclusion

Exemption of the deceased from mortgage loans is a right guaranteed by the system for heirs, but it's not automatic and requires procedures, documents, and specific time limits. Correct understanding of conditions and exceptions, especially the medical disclosure issue, may make a big difference between the family getting their home free of debt or bearing a huge financial burden.

Our final advice: If you're a borrower, be honest in your medical disclosure and inform your family about loan details and procedures. And if you're an heir of a deceased person with a mortgage loan, don't waste time and start procedures immediately. Every day of delay may reduce your chances of getting your right.