How Real Estate Platforms Shape Your Price Expectations: An In-Depth Analysis of Psychological Anchoring and Property Price Inflation in Saudi Arabia 2026

A scientific and practical analysis of how real estate advertising platforms shape buyer expectations and inflate prices. Includes explanation of psychological anchoring effect, the gap between listed and real prices, herd behavior in the market, and government solutions like the Real Estate Balance Platform.

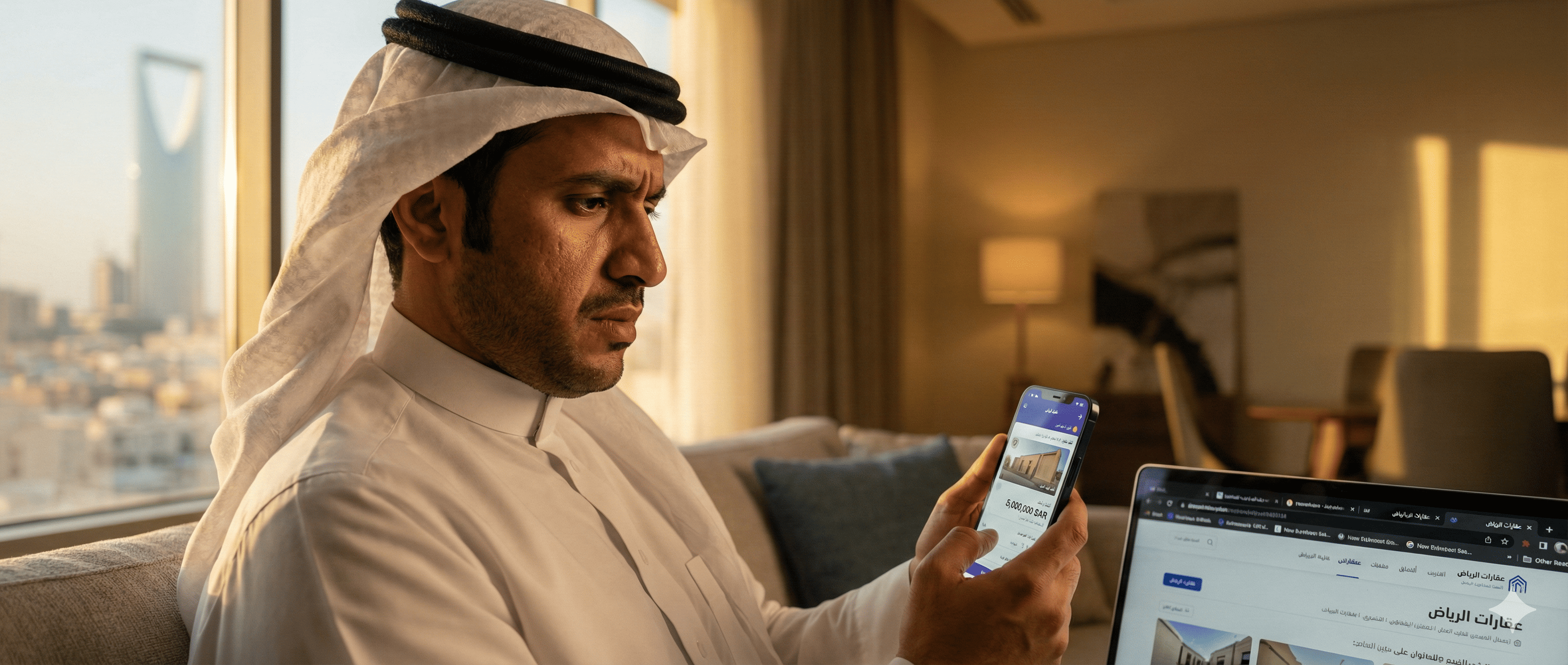

Introduction: When the Listed Number Becomes the Truth

Imagine this scene: You open a real estate app on your phone searching for an apartment in a certain Riyadh neighborhood. The first listing shows 1,200,000 SAR. The second at 1,150,000 SAR. The third at 1,300,000 SAR. Without realizing it, your brain now believes that the "normal price" for apartments in this neighborhood is around 1.2 million SAR. But is this really the fair price? Or have you fallen victim to a psychological phenomenon called the "Anchoring Effect"?

In this article, we'll dive deep into a topic few discuss: how real estate advertising platforms reshape our price expectations, and how they contribute - intentionally or not - to property price inflation. We'll review scientific research, analyze Saudi market realities, and reveal the hidden mechanisms that make you accept prices far higher than actual value.

First: Understanding the Anchoring Effect - The Most Powerful Psychological Weapon in Pricing

In 1974, psychologists Daniel Kahneman and Amos Tversky discovered a phenomenon that changed our understanding of human decision-making. They called it the "Anchoring Effect." The idea is simple but profound: when a person encounters a number as their first piece of information, this number becomes a mental "anchor" that influences all subsequent estimates.

How Does Anchoring Work in Real Estate?

In a famous 1987 study by Northcraft and Neale, professional real estate experts and ordinary people were asked to estimate the value of a specific house. They were divided into groups, each given a different listing price for the same property. The result was shocking: even professional experts were significantly influenced by the advertised price, despite having the knowledge and experience to estimate real value.

This means that when you see an apartment listed at 1,500,000 SAR, then negotiate and get it for 1,350,000 SAR, you feel victorious. But what if its actual value was only 1,100,000 SAR? The initial price "anchored" your expectations and made you accept a price 250,000 SAR above fair value.

Why Is Anchoring Hard to Resist?

Anchoring operates at an unconscious level. Even when you know the listed price might be inflated, your brain still uses it as a reference point. Studies show that simply "ignoring" the initial number isn't enough to cancel its effect. This is what makes real estate advertising platforms powerful tools in shaping entire market expectations.

Second: The Role of Real Estate Platforms in Shaping Price Expectations

Real estate advertising platforms in Saudi Arabia - whether apps or websites - have become the primary source of price information for buyers and renters. But these platforms face a fundamental issue: they display the prices owners want, not the prices the market actually deserves.

The Mechanism of Accumulated Inflation

Let's assume an owner wants to sell their apartment. They open the platform and see similar apartments listed at 900,000 SAR. They think: my apartment is slightly better, I'll list it at 950,000 SAR. Another owner sees this new listing and lists theirs at 980,000 SAR. And so listed prices escalate gradually, each listing building on the previous one, until listed prices become completely detached from actual value.

The Problem of Missing Actual Transaction Data

The fundamental difference between the listed price and the price at which properties actually sell can be enormous. But most buyers only see listed prices. This creates a dangerous information gap: platforms show you what sellers want, not what they actually get.

According to Saudi market data, the average price per square meter for apartments in Riyadh rose from 10,500 SAR in 2024 to 14,200 SAR in 2025, an increase exceeding 35%. Part of this increase is real and justified by increased demand, but another part is expectation inflation fed by prices listed on platforms.

Undisclosed Agreements

There's another phenomenon few discuss: some owners and brokers agree to keep prices high in listings even if properties don't sell. The goal? Maintaining the "perceived value" of properties in the area. If one significantly lowers their price, others feel their property values have decreased. This implicit collusion - even if unintentional - keeps listed prices artificially high.

Third: Herd Behavior and Fear of Missing Out

Anchoring isn't the only psychological mechanism inflating prices. There's also what's known as "herd behavior" and "Fear of Missing Out" or FOMO.

When Everyone Buys, You Buy

Imagine seeing news about rising property prices, hearing from friends that they've bought, and seeing ads about projects "selling fast." All these signals trigger your herd instinct. You start thinking: if everyone's buying, there must be a good reason. And if I don't buy now, prices will rise more and I'll lose the opportunity.

This behavior pushes buyers to accept high prices and forgo thorough inspection or serious negotiation. Some make hasty decisions without adequate research, just fearing they'll "miss the opportunity."

How Platforms Amplify FOMO

Real estate platforms amplify this feeling in several ways: counters showing view numbers ("500 people viewed this property"). Messages like "This property is getting high interest." Notifications that a property you were following "has been sold." All these tools - even if truthful - trigger fear of missing out and push buyers to make faster, less rational decisions.

The Bubble of Rising Expectations

When everyone expects prices to rise, they act in ways that make prices actually rise. This is a self-fulfilling prophecy. Buyers rush to purchase fearing increases, demand rises, prices increase, expectations are confirmed. And platforms feed this cycle by constantly displaying high prices.

Fourth: The Gap Between Listed Price and Real Value

One of the most dangerous aspects of price inflation through platforms is the growing gap between what's asked and what the property actually deserves. This gap is sometimes called "price distortion."

How Did Price Distortions Emerge?

In Riyadh, for example, some neighborhoods witnessed price increases reaching 24% in Q1 2025 alone. In Al-Muhammadiyah, the price per meter rose from 11,546 SAR to 14,383 SAR. But the question: does this increase reflect real added value? Or is it the result of accumulated inflated expectations?

The answer is mostly: a mix of both. There's genuine increased demand due to population growth exceeding 5% annually in Riyadh, and Vision 2030 projects. But there's also expectation inflation fed by platforms and advertisements, creating listed prices above fair value.

Indicators of Price Distortion

How do you know there's price distortion in a certain area? Here are some indicators: Properties remain listed for long periods without selling. Large difference between listed price and final price after negotiation. Rental prices don't match sale prices (very low rental yield). Large variation in prices of similar properties in the same neighborhood.

The Real Estate Balance Report: Proof of Distortion

The recent government intervention through Crown Prince Mohammed bin Salman's directives for real estate balance in Riyadh was official recognition of price distortions. Announcing land supply at prices not exceeding 1,500 SAR per meter caused immediate drops in some neighborhoods reaching 31%, revealing the real gap between listed prices and fair value.

Fifth: The Role of Real Estate Advertising Controls

The Saudi Real Estate General Authority recognized the danger of uncontrolled advertisements and issued Real Estate Advertising Controls aimed at reducing fake and misleading ads.

What Do the Controls Require?

New controls require advertisers to be Saudi nationals registered through National Access. They must be property owners or legal representatives or licensed brokers. Listings must contain clear information including price, location, and license number. Advertising through social media is prohibited except through licensed platforms.

Are Controls Enough?

Controls are a positive step in the right direction, but they don't address the root problem: platforms publish what owners want, and owners set whatever price they wish. There's no requirement for listed prices to be close to actual market value. This means the anchoring effect continues even with full compliance with controls.

Sixth: The Real Estate Balance Platform - An Alternative Model

In September 2025, the Royal Commission for Riyadh City launched the "Real Estate Balance Platform" directed by Crown Prince Mohammed bin Salman. This platform represents a completely different model in dealing with real estate pricing.

How Does the Platform Work?

The platform offers planned and developed residential lands at predetermined prices not exceeding 1,500 SAR per square meter. Prices aren't the result of what sellers want, but government estimates of fair value. The goal is to provide 10,000 to 40,000 plots annually over five years.

Impact on the Market

Launching this platform shook the real estate market. Some neighborhoods suffering from price inflation saw drops ranging from 8% to 31%. This reveals that a large portion of previously listed prices was inflated and didn't reflect real value.

Lessons Learned

The Real Estate Balance Platform proves that fair pricing is possible when there's a reliable source of price information. The problem isn't the market itself, but the mechanism of price formation and spread. When there's an objective reference for prices, distortions are exposed and corrected.

Seventh: How to Protect Yourself from the Price Anchoring Trap

Since platforms will remain the primary source for property searches, how can you protect yourself from falling victim to inflated prices?

Strategy 1: Search for Actual Transaction Prices

Don't settle for listed prices. Search for actual sale prices through the Saudi Real Estate Exchange which provides executed transaction data. This gives you a more accurate picture of real value.

Strategy 2: Compare with Rental Yield

Simple rule: if annual rental yield is less than 4-5% of property price, the price may be inflated. Example: apartment listed at 1,000,000 SAR with annual rent of 35,000 SAR, yield is only 3.5%, this indicates price inflation.

Strategy 3: Ignore the Initial Price

Before seeing the listed price, try to estimate the value yourself based on area, location, and condition. Write your estimate, then compare with the listed price. If the difference is large, research why before adjusting your expectations.

Strategy 4: Take Your Time

Don't let fear of missing out push you to hasty decisions. The right property will come. Prices don't rise forever. Rushing is price inflation's best friend.

Strategy 5: Consult Independent Specialists

Real estate brokers may have interest in completing deals at any price. Seek an independent property appraiser or consultant who gives you an objective opinion on real value.

Strategy 6: Monitor Listing Duration

If a property has been listed for months at the same price without selling, this is a strong indicator the price is inflated. The owner may be ready for serious negotiation.

Eighth: The Future of Real Estate Platforms - Is There Hope?

Real estate platforms aren't necessarily evil. They can be powerful tools for achieving transparency if developed correctly.

What Could Change?

Platforms could display actual transaction prices alongside listing prices. They could provide indicators on listing duration and price reduction percentages. They could offer objective market value estimates based on actual data. They could alert buyers when listed prices are much higher than similar property averages.

Role of Regulatory Authorities

The Real Estate Authority could require platforms to display more transparent data. They could establish official price indices based on actual transactions. They could monitor listed prices and identify obvious exaggerations.

Ninth: Frequently Asked Questions

Are real estate platforms colluding to raise prices?

Not necessarily intentionally. Platforms display what owners post. But their operating mechanism facilitates accumulated price inflation because they show only the supply side without actual demand or real sale prices.

Why do owners set high prices?

Multiple reasons: being influenced by other listed prices (anchoring). Emotional attachment to the property. Expecting negotiation so starting higher. Sometimes no real desire to sell except at an exceptional price.

Will prices drop after real estate balance decisions?

In neighborhoods with obvious inflation, yes. But the drop will be a correction of distortions, not a collapse. Neighborhoods with originally balanced prices will remain stable.

How do I know the real price of a specific property?

Use multiple sources: Real Estate Exchange for actual transactions. Compare rental yields. Consult independent appraisers. Monitor listing duration and price change history.

Conclusion: Be Aware and Don't Be a Victim

Real estate advertising platforms have changed how we search for properties, but they've also changed how our price expectations are formed. Psychological anchoring, herd behavior, and fear of missing out are all mechanisms working silently to make us accept prices far higher than actual value.

Awareness is the first line of defense. When you understand how platforms shape your expectations, you can resist this influence and make more rational decisions. Search for real data, compare multiple sources, take your time, and don't let a number on a screen determine your most important financial decision.

Real estate balance doesn't come only from government decisions, but from aware buyers who refuse to be swept by inflated prices. Be part of the solution, not part of the problem.