Complete Guide to Foreign Property Ownership in Saudi Arabia 2025: Requirements, Fees & Procedures

Complete guide to foreign property ownership in Saudi Arabia 2025. Learn about requirements, fees, Absher application steps, and available mortgage options for residents.

Are you considering buying property in Saudi Arabia as a resident or foreign investor? With the significant developments in Vision 2030, the dream of owning property in Saudi Arabia is closer than ever. In this comprehensive guide, we'll take you through everything you need to know about the non-Saudi property ownership system, from requirements and fees to application steps and financing options.

Overview of the New 2026 System

In a historic move reflecting the Kingdom's openness to foreign investment, the Saudi Council of Ministers approved the updated system for non-Saudi property ownership in July 2025, which officially takes effect in January 2026. This system represents a quantum leap in the Saudi real estate market, opening new horizons for residents and investors from around the world.

💡 Important Note: The new system allows residents to own one residential unit, while commercial, industrial, and agricultural sectors are open for ownership in all cities of the Kingdom without exception!

Who Can Own Property? Eligible Categories

Before we dive into details, let's understand the different categories and their respective rights:

1. Residents in the Kingdom (Valid Residency Holders)

If you're a resident in Saudi Arabia with a valid residency permit, you have the right to own property for personal residence. However, there are specific conditions you should know:

What you're allowed:

• Own only one residential property (apartment, villa, floor, duplex)

- Own in all cities except Mecca and Medina

- Property area not exceeding 3,000 square meters

- If the property is land, you must build within 6 years

What you're not allowed:

• Own more than one property

- Sell the property before 4 years from registration date

- Own within Mecca and Medina boundaries (rental only for 2 years, renewable twice)

2. Foreign Investors (Investment License Holders)

If you're a foreign investor licensed by the Ministry of Investment, you have broader authorities:

• Own properties necessary for your professional or commercial activity

- Own private residence for you and your family

- Own housing for your employees

- Invest in real estate development with minimum 30 million SAR

⚠️ Investor Alert: If your license includes purchasing land for construction and investment, the total project cost (land and building) must be at least 30 million SAR, and the property must be invested within 5 years of ownership.

3. GCC Citizens

Citizens of Gulf Cooperation Council countries enjoy additional advantages:

• Own up to 3 properties in the Kingdom

- Each property area not exceeding 3,000 square meters

- Ownership for residential purposes

- Same restrictions for Mecca and Medina

4. Companies and Investment Funds

The new system grants companies listed on the Saudi stock market and investment funds the right to own property in all regions of the Kingdom without geographic exceptions, according to Capital Market Authority regulations.

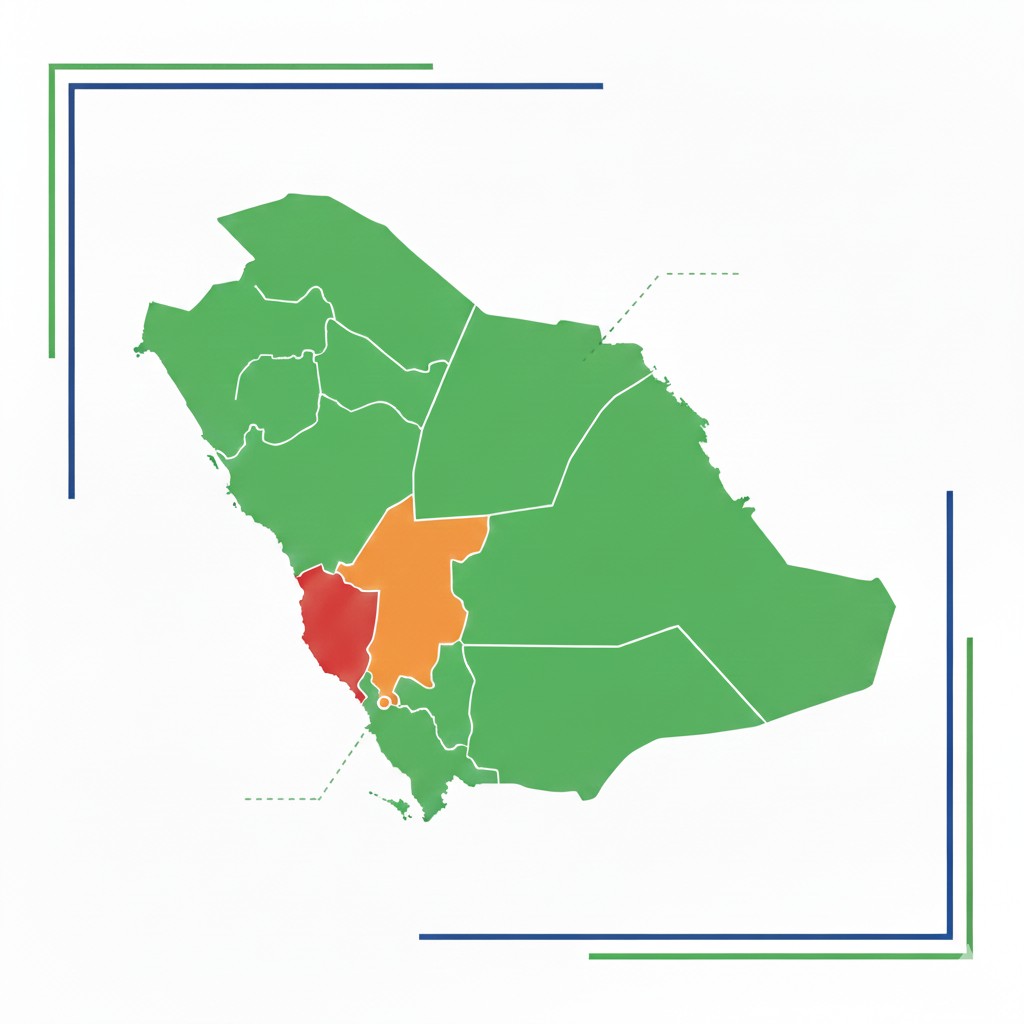

Geographic Zones: Where Can You Own?

Understanding the geographic division is crucial before making a purchase decision:

Fully Open Zones (For Residential Properties)

All cities and regions of the Kingdom except four major cities: Mecca, Medina, Riyadh, and Jeddah. In these areas, residents can own directly after meeting the requirements.

Special Regulation Zones (Riyadh and Jeddah)

In Riyadh and Jeddah, specific geographic areas will be designated where foreigners from outside the Kingdom can own property. Residents have the right to own a residential unit within approved zones.

Restricted Zones (Mecca and Medina)

Due to the religious significance of these two holy cities, rules differ:

• Non-Muslims are not allowed to own within their boundaries

- Non-Saudi Muslims have special regulations outlined in the executive regulations

- Rental is allowed for maximum 2 years, renewable twice

- Listed companies have exceptions according to specific regulations

Commercial, Industrial, and Agricultural Properties

Good news! Ownership in these sectors is open to foreigners in all cities of the Kingdom without any geographic exceptions, reflecting the Kingdom's desire to attract investments and diversify the economy.

Fees and Taxes: How Much Will You Pay?

Understanding financial costs is essential for proper planning. Here's the fee breakdown:

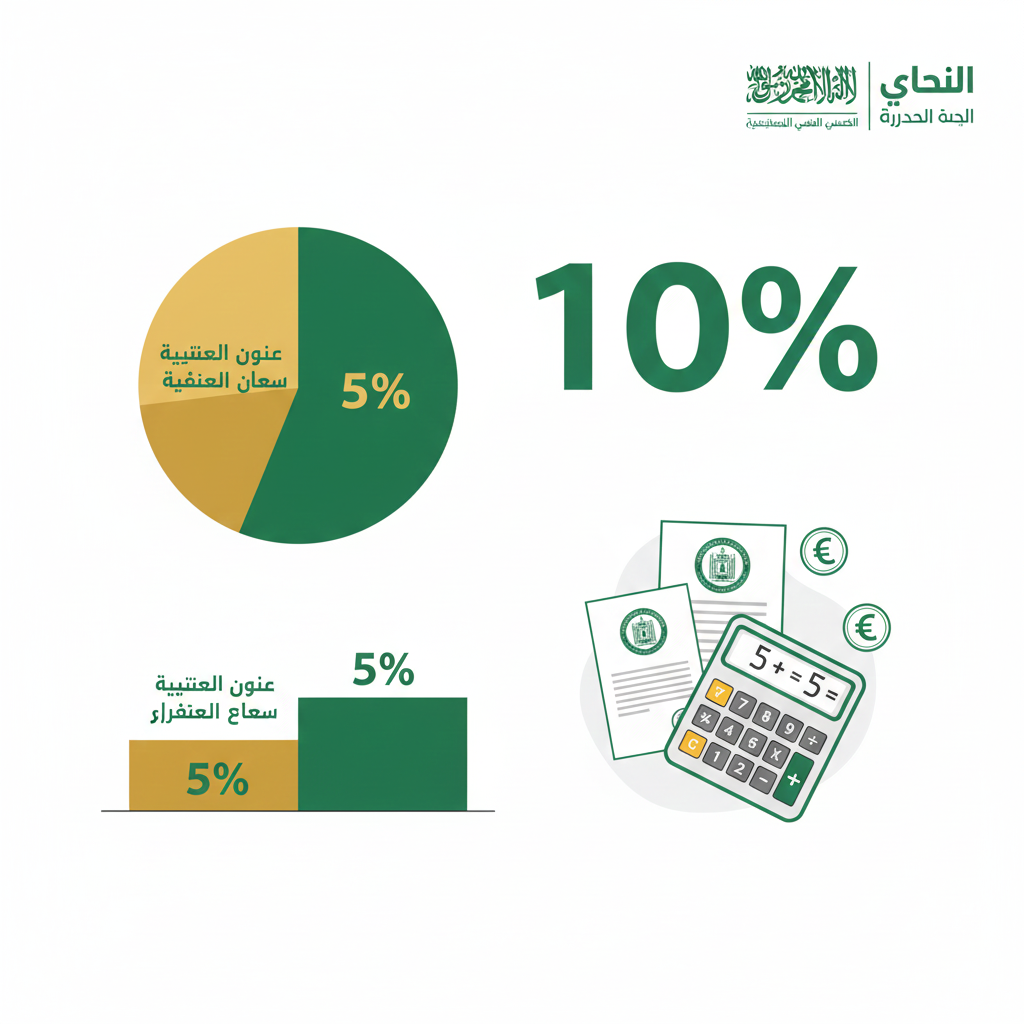

1. Real Estate Transaction Tax (For Everyone)

Applied to all real estate transactions in the Kingdom at 5% of the property value. This tax applies to:

• Buying and selling

- Gifts (in some cases)

- Exchange

- Any form of ownership transfer

2. Non-Saudi Ownership Fee (New)

Under the new system, an additional fee not exceeding 5% of the transaction value is imposed on non-Saudis. This fee is collected by the General Authority for Real Estate.

📊 Total Cost: Combined fees and taxes may reach 10% of the property value (5% transaction tax + 5% foreigner fee)

3. Other Administrative Fees

• Notary documentation fees

- Property registration fees in the real estate registry

- Property valuation fees (if required)

- Real estate broker fees (usually 2.5%)

Practical Cost Example

Let's assume you're buying an apartment worth 1 million SAR:

• Real Estate Transaction Tax (5%): 50,000 SAR

- Non-Saudi Ownership Fee (5%): 50,000 SAR

- Broker Fees (2.5%): 25,000 SAR

- Estimated Administrative Fees: 5,000 SAR

- Approximate Total: 130,000 SAR (13% of property value)

Application Steps Through Absher

The process is now fully electronic through the Absher platform. Here are the detailed steps:

Step 1: Preparation and Eligibility Check

Before starting, ensure you have:

• Valid residency permit

- Activated account on Absher platform

- Mobile number registered in Absher

- Updated national address

Step 2: Log into Absher Platform

• Visit Absher website (absher.sa)

- Log in with your personal account

- Select "My Services" then "General Services"

- Search for "Property ownership request for non-Saudis"

Step 3: Submit Application

• Read ownership conditions carefully and agree

- Click "New Request"

- Enter required property data:

- Property deed number

- Property type (apartment, villa, land, etc.)

- Region, city, and neighborhood

- Current owner's ID number

- Property area in square meters

Step 4: Attach Documents

• Copy of property deed (both sides)

- Property location sketch

- Any additional required documents

Step 5: Follow-up and Approval

• Review entered data

- Confirm and submit the request

- Keep the request number for tracking

- Wait for Ministry of Interior approval

⏱️ Processing Time: Approval usually takes two weeks to a month, and may take longer in cases requiring additional review.

Step 6: Complete the Transfer

After obtaining approval:

• Book an appointment at notary or through "Najiz" platform

- Pay the real estate transaction tax

- Pay the non-Saudi ownership fee

- Complete ownership transfer and register the property in your name

Mortgage Financing for Residents: Can You Get a Loan?

Yes! Some Saudi banks offer mortgage programs for residents, but with different conditions than citizens.

Banks Offering Financing for Residents

• Alinma Bank

- Saudi National Bank (SNB)

- Riyad Bank

- Some real estate financing companies

General Financing Conditions

• Valid residency (preferably at least 2 years remaining)

- Salary transfer to the financing bank

- Minimum salary: 7,000 - 10,000 SAR depending on bank

- Minimum 6 months of service at employer

- Employment at bank-approved company

- Good credit record (SIMAH)

Available Financing Rates

• Financing up to 70% of property value (30% down payment)

- Repayment period up to 25 years

- Annual profit rate ranging from 3.5% - 5%

💰 Financial Tip: Compare offers from different banks, and pay attention to administrative fees and early repayment fees. Use mortgage calculators available on bank websites to estimate monthly installments.

Difference Between Citizen and Resident Financing

• Citizen: Government support from Real Estate Development Fund, financing up to 90%, lower profit rates

- Resident: No government support, financing up to 70%, additional guarantees required, stricter conditions

Required Documents for Ownership

Prepare these documents before starting the procedures:

For Residents (Personal Housing)

• Copy of valid residency permit

- Passport copy

- Letter from employer stating salary and service duration

- Bank statement for last 6 months

- National address

- Deed of property to be purchased

- Property location sketch

For Investors

• Investment license from Ministry of Investment

- Commercial registration

- Feasibility study for the project (if for development)

- Proof of financial capability

- Investment plan and timeline

Penalties and Violations

The new system includes strict penalties for violators:

• Warning: For minor violations

- Financial Fine: Up to 5% of property value, maximum 10 million SAR

- Forced Sale: By court order with deduction of fines and fees

- Fraud Penalty: Fine up to 10 million SAR + property sale for those providing misleading information

⚖️ Legal Warning: Any ownership without following proper procedures exposes you to public auction sale of the property with 10% fine + 35% of property value and construction costs deducted!

Golden Tips Before Buying

1. Verify Deed Authenticity

Ensure the property deed is electronic and documented, and free from any mortgages or legal disputes.

2. Hire a Specialized Lawyer

Especially for large transactions, a lawyer will ensure your rights are protected and review contracts.

3. Inspect the Property Thoroughly

Conduct a comprehensive technical inspection before buying to ensure building and facility safety.

4. Calculate All Costs

Don't forget fees, taxes, maintenance, and insurance when calculating your budget.

5. Deal with Reliable Parties

Choose a licensed real estate broker registered with the General Authority for Real Estate.

6. Understand Resale Restrictions

Remember you cannot sell the property before 4 years from registration date.

Frequently Asked Questions

Can I rent out the property I own?

Yes, non-Saudi owners have the right to rent their property according to regulatory lease contracts, with necessary licenses for commercial or tourism activities.

What happens to the property when residency expires?

You must renew your residency to maintain ownership rights. If not renewed, you may be required to dispose of the property within a specified period.

Can the property be inherited?

Yes, the property can be inherited by non-Saudi heirs provided ownership conditions apply to them. If conditions don't apply, the property must be sold within a specified period.

Can I buy land and build on it?

Yes, but you must build on the land within 6 years of registration date, otherwise you may face penalties.

When does the new system take effect?

Implementation begins in January 2026, and executive regulations will be issued within 180 days of system publication to clarify detailed specifications.

Conclusion

The new system for non-Saudi property ownership represents a historic opportunity for residents and investors to own real estate in Saudi Arabia. With clear conditions and simplified electronic procedures, the dream is closer to reality. The key is proper planning, understanding fees and costs, and complying with regulations to avoid future problems.

Whether you're looking for family housing or a promising investment opportunity, the Saudi real estate market offers diverse options to suit different needs and budgets. Start your journey today with proper planning and expert assistance, and you'll find that owning property in the Kingdom is not difficult!