Family Waqf (Endowment) 2025: Complete Guide to Protecting Your Family Wealth from Fragmentation and Loss

A comprehensive guide to Family Waqf (Dhurri/Ahli Endowment) in Saudi Arabia. Includes how to protect family real estate wealth from fragmentation, documentation steps through Najiz platform, drafting the waqf deed, types of endowments, governance and nazara (trusteeship), and comparison between family, charitable, and mixed waqf.

Introduction: Why Do Family Fortunes Disappear?

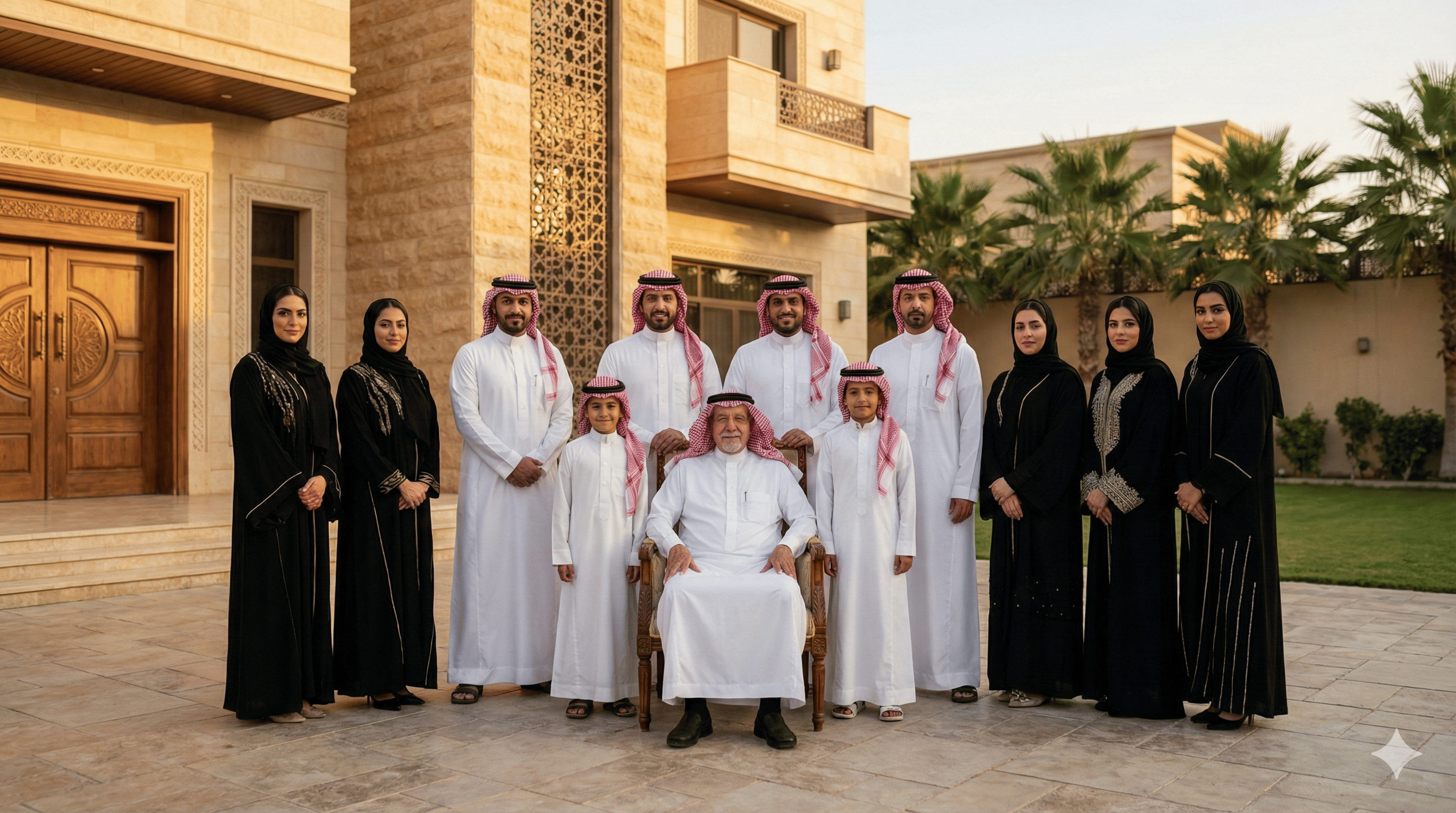

Have you ever wondered why real estate empires built by fathers and grandfathers through hard work turn into fading memories within two or three generations? The answer lies in two words: "ownership fragmentation." When a single property - whether a commercial building, residential complex, or farm - passes to dozens of heirs as shared ownership, the journey of decline begins: disputes over decisions, inability to maintain, then selling below market value or neglect until the property loses its value.

But our ancestors were not oblivious to this challenge. For centuries, Islamic jurisprudence created an ingenious tool to protect family wealth: the Family Waqf (Dhurri Endowment). Today, with legislative development and digitization in Saudi Arabia, this solution has become easier and more effective than ever.

In this comprehensive guide, we will take you on a complete journey to understand Family Waqf: What is it? How does it protect your wealth? What are the steps to create one? And how do you draft a solid waqf deed that fortifies your legacy for future generations?

First: Understanding the Problem - How Does Real Estate Wealth Fragment?

Before we discuss the solution, let's understand the problem deeply. Studies and court cases indicate that a large percentage of family real estate wealth dissipates as soon as it transfers to the second or third generation. The fundamental reason lies in what is called "ownership fragmentation."

A Realistic Fragmentation Scenario

Imagine this scenario: a businessman owns a commercial building worth 20 million riyals. He passes away leaving 8 children. The building is now shared ownership among the eight. After 20 years, some children pass away and their children inherit their shares. Now the building is divided among 25 heirs. Every decision - from changing a tenant to maintaining the elevator - needs everyone's approval. The result? Paralysis in management, neglect in maintenance, decline in value, then selling at a low price or bitter legal disputes.

Statistics Speak

According to global studies, more than 70% of family wealth dissipates by the second generation, and 90% disappears by the third generation. In Saudi Arabia, courts are filled with forced partition disputes among heirs, and many historical family properties have lost their value or been sold at prices that don't reflect their true worth.

Second: The Shariah and Legal Solution - What is Family Waqf?

Family Waqf - also called Ahli Waqf or Private Waqf - is a shariah and legal tool based on the principle of "freezing the asset and channeling the benefit." In simpler terms: freezing property ownership so it cannot be sold, inherited, or gifted, while distributing its returns (revenue) to descendants according to precise conditions set by the endower.

Legal Definition

According to the Saudi Waqf Law, Ahli Waqf is: "Every endowment whose benefit or revenue is designated for the endower or their descendants or for specific persons by name or description or their descendants." This definition gives the endower wide flexibility in determining beneficiaries and benefit conditions.

How Does Family Waqf Protect Your Wealth?

Family Waqf works as a protective shield for family wealth through several mechanisms. First: Preventing sale and fragmentation - the endowed property cannot be sold or divided among heirs, preserving its unity and investment strength. Second: Management continuity - the waqf is managed by a qualified trustee according to clear conditions, instead of chaotic decisions from dozens of owners. Third: Protection from creditors - the endowed property is protected against seizure or execution for paying any beneficiary's debts. Fourth: Fair distribution of benefit - all beneficiaries benefit from the waqf revenue without any of them having the right to dispose of the asset.

The Difference Between Inheritance and Waqf

In regular inheritance, property transfers to heirs with full ownership, allowing each of them to sell, mortgage, or dispose of their share. In Family Waqf, heirs benefit from the property's revenue without owning it, preserving the asset as unified and productive for future generations.

Third: Types of Waqf in the Saudi System

To understand Family Waqf more deeply, we need to know its position among the three types of waqf approved in the Saudi system:

Charitable Waqf (Waqf Khayri)

This is waqf whose revenue and benefit is designated for public charity such as mosques, schools, hospitals, and the poor. This type is subject to strict oversight from the General Authority for Awqaf, and cannot be revoked after establishment.

Family Waqf (Waqf Dhurri/Ahli)

This is our article's subject, where revenue is designated for the endower, their descendants, and relatives. It features greater flexibility in management, allowing the endower to set detailed conditions for revenue distribution and waqf management. It may be revoked with court approval in certain cases.

Mixed Waqf (Waqf Mushtarak)

This combines charitable and family waqf, where revenue is divided between descendants and charitable works. For example: 60% for children and grandchildren, and 40% for orphan sponsorship. This type achieves balance between preserving family wealth and gaining spiritual reward.

Comparison Table of Waqf Types

Charitable Waqf is designated for public charity organizations with the goal of spiritual reward and public benefit, subject to strict oversight from the General Authority for Awqaf, and cannot be revoked. Family Waqf is designated for descendants and relatives with the goal of preserving family wealth and care, subject to self-oversight from the trusteeship council with judicial supervision, and may be revoked with court approval. Mixed Waqf combines both descendants and charitable works to achieve balance between inheritance and charity.

Fourth: Drafting the Waqf Deed - Legal Engineering to Prevent Disputes

The power of waqf lies not in the property itself, but in the "waqf deed." Traditional brief deeds have caused bitter disputes between trustees and beneficiaries. Therefore, modern awareness is moving toward drafting detailed waqf deeds that function as a solid "family constitution."

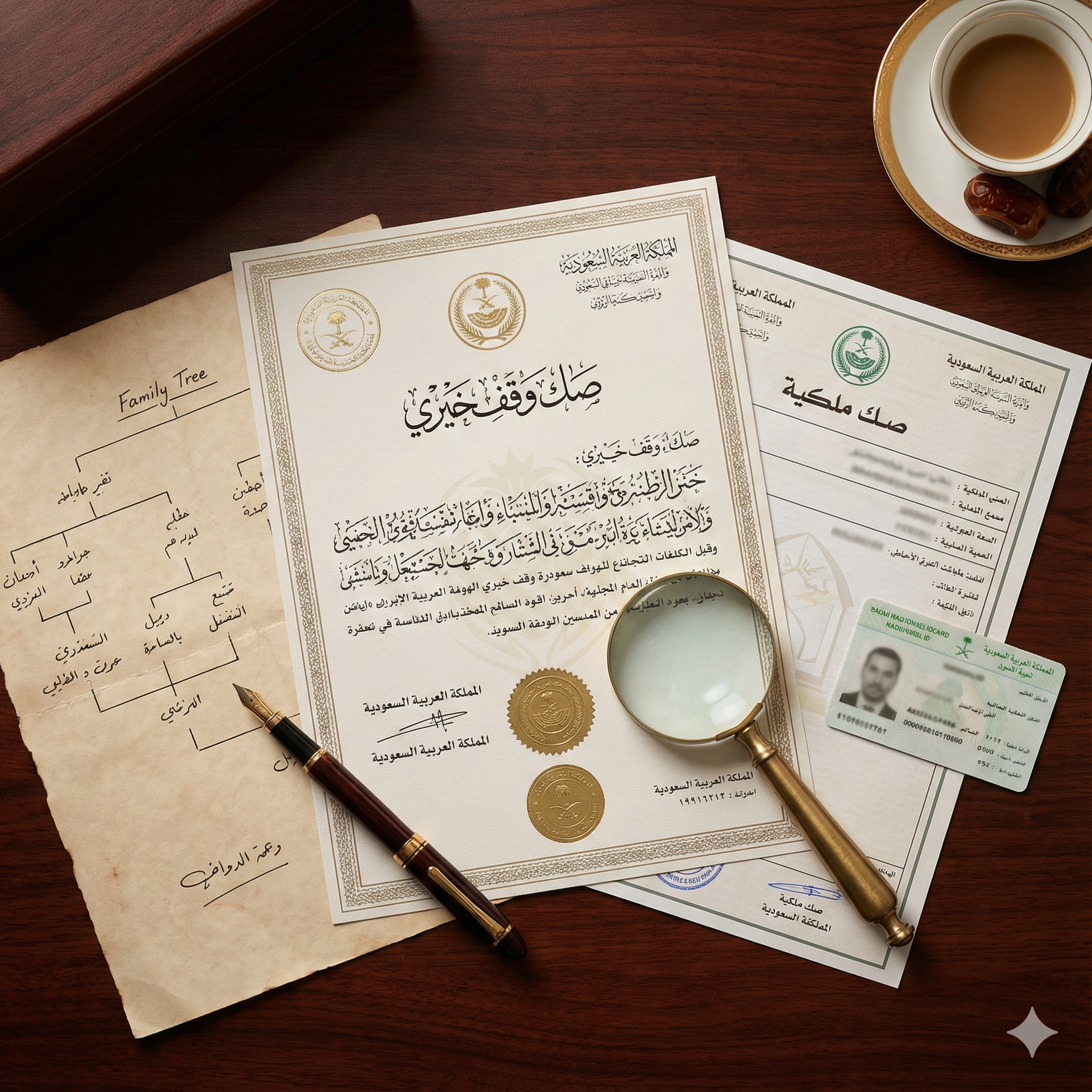

Essential Elements of a Modern Waqf Deed

First: Endower and Endowed Asset Data

The deed must include complete endower data, confirmation of full property ownership, and accurate property description including deed number, location, area, and boundaries.

Second: Type and Purpose of Waqf

Clear specification of whether it's family or mixed waqf, and its purpose (protecting family wealth, caring for descendants, combining descendants with charitable works).

Third: Precise Beneficiary Identification

This is the most important part and should include: specifying beneficiary layers (first generation, second, etc.). Clarifying whether it includes males and females equally or at different ratios. Addressing new situations such as extinction of a generation or presence of minors. Determining the fate of revenue if descendants are cut off (usually reverts to a charitable cause).

Fourth: Trusteeship and Governance Mechanism

Moving from appointing "the most mature then the next" (an ambiguous term that causes disputes) to establishing a "trusteeship council" with specific authorities. Must specify: number of trusteeship council members and their membership conditions. Voting and decision-making mechanism. Administrative and financial competency requirements. Procedures for removing trustee in case of breach. Trustee term duration and renewal or replacement mechanism.

Fifth: Substitution and Investment Condition

A modern waqf deed should include broad authorities for the trustee to "substitute" the property if its benefits are disrupted or its economic feasibility decreases. It's also recommended to stipulate reinvesting part of the revenue (e.g., 20-25%) in new assets to ensure waqf growth and prevent erosion due to inflation.

Sixth: Reports and Accounting

Stipulating the trustee's obligation to prepare periodic financial reports, and the mechanism for their review by beneficiaries or an independent accounting entity.

Simple Model Waqf Formula

"I, the endower (full name), Saudi national, by national ID number (...), have voluntarily endowed the property I own under deed number (...) dated (...) located at (detailed address), as a family waqf that cannot be sold, gifted, or inherited, with its revenue to be distributed to my descendants, male and female equally, then to my descendants' descendants, and so on as Allah wills. If my descendants are cut off, the waqf revenue reverts to the poor and needy. I have appointed (name) as trustee over this waqf, with authorities for management, leasing, maintenance, and asset substitution when interest requires."

Fifth: Digital Documentation Through Najiz Platform

Waqf documentation is no longer a difficult journey through court corridors. The Ministry of Justice has enabled electronic waqf documentation through the "Najiz" portal, saving time and effort while ensuring full legal protection.

Steps for Electronic Waqf Documentation

Step One: Log into Najiz portal (najiz.sa) using the National Access account. Step Two: Select "All Electronic Services" then navigate to "Social Status" category. Step Three: Select "Waqf Documentation" service and click "Use Service." Step Four: Select the documentation authority (Notary Public). Step Five: Enter complete endower data (whether principal or agent). Step Six: Enter appointed trustee data. Step Seven: Attach required documents. Step Eight: Click "Submit Request" and await approval.

Required Documents

For successful documentation you need: Valid property ownership deed for the property to be endowed. National ID of the endower (or valid residency for non-Saudis). Power of attorney document if submitted by an agent. Detailed written waqf formula. Appointed trustee data.

Registration with the General Authority for Awqaf

After documenting the waqf through Najiz, it's recommended to register it with the General Authority for Awqaf to obtain the National Unified Number (700). This registration gives the waqf an independent legal identity enabling it to open a bank account, deal with government entities, and benefit from the Authority's services. The Authority announced registering more than 13,000 waqfs by the end of 2024.

Sixth: Trusteeship and Governance - Professional Waqf Management

Trusteeship is the backbone of waqf. A competent trustee means a thriving waqf, and a failing trustee means a struggling waqf. Therefore, Saudi regulations pay great attention to organizing trusteeship work.

Who Can Be a Trustee?

According to the Trusteeship Work Regulation, the individual trustee must meet these conditions: Islam and full legal capacity. No conviction for crimes affecting honor or integrity. Possessing knowledge and qualification necessary for waqf management. No conflict of interest with the waqf. A legal entity (company or institution) can also be a trustee if certain conditions are met.

Trustee Authorities

The trustee is responsible for: Managing and maintaining waqf assets. Leasing endowed properties and collecting rents. Distributing revenue to beneficiaries according to endower conditions. Preparing periodic financial reports. Representing the waqf before official and judicial authorities. Investing revenue surpluses to develop the waqf.

Oversight of Trustees

The General Authority for Awqaf exercises oversight over trustees to ensure compliance with endower conditions and regulations. Beneficiaries have the right to file complaints against trustees who breach their duties, and the court can dismiss and replace trustees in cases of serious breach.

The Waqf Company Model

A modern trend adopted by some major families is converting the waqf into a "waqf company." In this model, the waqf is established then a company owned by the waqf is founded to manage assets and investments. This achieves several advantages: Separation of ownership from management. Clear institutional governance. Ease of attracting managerial talent from outside the family. Independent financial liability for the company protecting the waqf asset.

Seventh: Practical Steps to Create a Family Waqf

If you've decided to create a family waqf to protect your family wealth, here are the practical steps:

Phase One: Planning and Consultation

Consult a lawyer specializing in waqf to understand available options. Define your waqf objectives (protecting wealth, ensuring income for descendants, combining with charitable works). Evaluate assets to be endowed and their investment feasibility. Discuss the matter with key family members.

Phase Two: Drafting the Waqf Deed

Write the waqf deed in detail considering the elements we mentioned. Precisely identify beneficiaries and their layers. Establish a clear mechanism for trusteeship and governance. Include substitution and investment conditions. Review the draft with a lawyer and shariah consultant.

Phase Three: Official Documentation

Submit waqf documentation request through Najiz platform. Attach all required documents. Attend the documentation session at the Notary Public (or send an agent). Receive the documented waqf deed.

Phase Four: Registration and Activation

Register the waqf with the General Authority for Awqaf. Obtain the National Unified Number (700). Open a bank account in the waqf's name. Begin managing the waqf and distributing its revenue according to specified conditions.

Eighth: When Is Family Waqf the Optimal Choice?

Not every situation calls for creating a family waqf. Here are cases where it's the optimal choice:

Ideal Cases for Family Waqf

When you own a commercial property or residential complex with good income and want to protect it from fragmentation. When you have a large number of heirs and fear future disputes. When you want to ensure continuous income for your descendants even after your death. When some heirs are minors or unable to manage their money. When you want to protect wealth from some heirs' creditors.

Cases Where Family Waqf May Not Suit You

If the property is small or its revenue is limited. If heirs are few and harmonious and prefer direct ownership. If you need liquidity from selling the property in the near future. If the property needs massive development investments the waqf may not bear.

Ninth: Challenges and Solutions

Despite the great benefits of family waqf, there are challenges to consider:

Challenge One: Conflicting Beneficiary Interests

Beneficiaries may disagree on trustee decisions or revenue distribution. Solution: Clear conditions in the waqf deed, and establishing an internal dispute resolution mechanism before resorting to court.

Challenge Two: Trustee Competency

An incompetent trustee may harm the waqf's interest. Solution: Clear competency requirements for trustees, monitoring and accountability mechanisms, and possibility of dismissal in case of breach.

Challenge Three: Waqf Value Erosion

Inflation and market changes may reduce waqf value over time. Solution: Stipulating in the deed investing part of revenue in developing the waqf or purchasing new assets.

Challenge Four: Rigid Conditions

Conditions set decades ago may not suit current circumstances. Solution: Flexible conditions allowing adaptation to changes, with a mechanism to modify secondary conditions without affecting the waqf's essence.

Frequently Asked Questions

Can I revoke a family waqf after creating it?

Yes, the endower may revoke their family waqf wholly or partially, or change its conditions and expenditures, but this requires approval from the competent court and proof of legitimate interest.

Does family waqf include females?

Yes, the endower has the right to include females in the family waqf equally with males or at different ratios as they see fit. The law does not prevent this; it depends on the endower's condition.

What happens if the endowed property becomes non-functional or economically unfeasible?

If the waqf deed stipulates substitution authority, the trustee can sell the property and purchase a better alternative. If not stipulated, the matter is raised to the court or Authority for substitution permission.

Can I endow only part of a property?

Yes, it's permissible to endow a shared portion of property (e.g., 50% of it), while the remaining portion stays as regular ownership.

Who oversees family waqfs?

The General Authority for Awqaf exercises regulatory oversight over all waqfs, but oversight of family waqf is less strict than charitable waqf, where the appointed trustee has broad authorities unless violating endower conditions or law.

How much does waqf documentation cost?

Waqf documentation through Najiz platform is a free service. However, you may need to pay legal consultation fees if you hire a lawyer to draft the waqf deed.

Can I create a family waqf on a mortgaged property?

No, the endowed property must be fully owned and free of any third-party rights such as mortgage or seizure.

Conclusion

Family Waqf is not just an ancient legal tool; it's a modern and effective solution to one of the biggest challenges facing family wealth: fragmentation and loss. Through "freezing the asset and channeling the benefit," you can protect your real estate legacy for future generations, ensure continuous income for your descendants, and avoid partition disputes that devastate many families.

The key is good planning and solid drafting. Invest time and effort in preparing a comprehensive waqf deed that addresses all possible scenarios, choose a competent trustee or establish a professional trusteeship council, and take advantage of digital services provided by the Ministry of Justice and the General Authority for Awqaf.

Your wealth is the fruit of your lifetime, and family waqf is the fortress that protects it. Start today planning for your family's future, and make your legacy last for generations.