Earnest Money (Arboun) System in Saudi Real Estate Authority 2025: Complete Guide to Protecting Your Rights in Property Transactions

Comprehensive guide to the Earnest Money (Arboun) system in Saudi Arabia's real estate brokerage contracts 2025. Learn about the maximum deposit limit (5%), refund and non-refund cases, broker commission (25%), and step-by-step procedures for paying and releasing deposits through the Fal platform. Everything buyers, sellers, tenants, and landlords need to protect their rights under the Real Estate Brokerage Law and its Executive Regulations.

Introduction: What is Earnest Money and Why Should You Care?

Have you ever paid a sum of money to reserve a property and then wondered: Can I get it back if I change my mind? Or perhaps you're a property owner asking: When does this amount become mine? These questions are repeated daily in the Saudi real estate market!

With the development of the Real Estate Brokerage Law and the launch of the Fal platform for real estate brokerage, there is now a clear legal framework regulating earnest money (Arboun) and defining the rights and obligations of all parties. In this comprehensive guide, we explain everything you need to know about the earnest money system in Saudi Arabia for 2025.

💡 Important: Any amount you pay is NOT considered "Arboun" (earnest money) unless it is explicitly stated in writing in the contract! Otherwise, it's an advance payment that is refundable upon contract termination.

What is Earnest Money (Arboun) in the Saudi Real Estate System?

Earnest money (Arboun) is a sum of money paid by the buyer or tenant as proof of their serious intention to complete the real estate transaction. Article 13 of the Real Estate Brokerage Law has precisely regulated earnest money provisions to protect all parties.

The Difference Between Earnest Money and Advance Payment

Many people confuse these two concepts. Here's the fundamental difference:

Earnest Money (Arboun): An amount paid as a guarantee of transaction seriousness, with special provisions governing its refund. It must be stated in writing and cannot exceed 5% of the transaction value when dealing through a real estate broker.

Advance Payment: Part of the transaction value paid in advance, fully refundable if the transaction is not completed (unless otherwise agreed). There is no maximum limit, and it is deducted from the total property value upon completion.

The 5% Rule: Maximum Earnest Money Limit

The Real Estate Brokerage Law has set a clear ceiling for earnest money in transactions conducted through a real estate broker:

The maximum is 5% of the total real estate transaction value.

What happens if the amount exceeds 5%? The excess amount is considered an "advance payment" for the transaction, not earnest money, and this has completely different legal implications in case of contract termination.

Practical Example

If the property value is 1 million SAR, the maximum earnest money is 50,000 SAR. If you pay 70,000 SAR, then 50,000 is considered earnest money and the excess 20,000 is considered an advance payment refundable upon contract termination.

📌 Note: You can agree on a percentage lower than 5%, as it is the maximum limit, not mandatory.

When is Earnest Money Refundable and When is it Not?

This is the most important question on every real estate participant's mind. The law is clear in defining the cases:

Cases Where Earnest Money is Non-Refundable (Seller/Landlord is Entitled)

When the transaction fails due to the buyer or tenant, provided there is no defect in the property. In this case, the seller or landlord keeps the entire earnest money as compensation for the lost opportunity and wasted time.

Examples include: The buyer backing out without a legitimate reason, inability to provide the remaining amount, or changing their mind after finding another more suitable property.

Cases Where Earnest Money is Fully Refundable

First: If the reason for the transaction failure is not attributable to either party, such as a government decision prohibiting the sale, discovering legal problems with property ownership, or force majeure circumstances.

Second: If the buyer discovers a major defect in the property that the seller did not previously disclose.

Third: If the seller or landlord breaches their contractual obligations or refuses to complete the transaction.

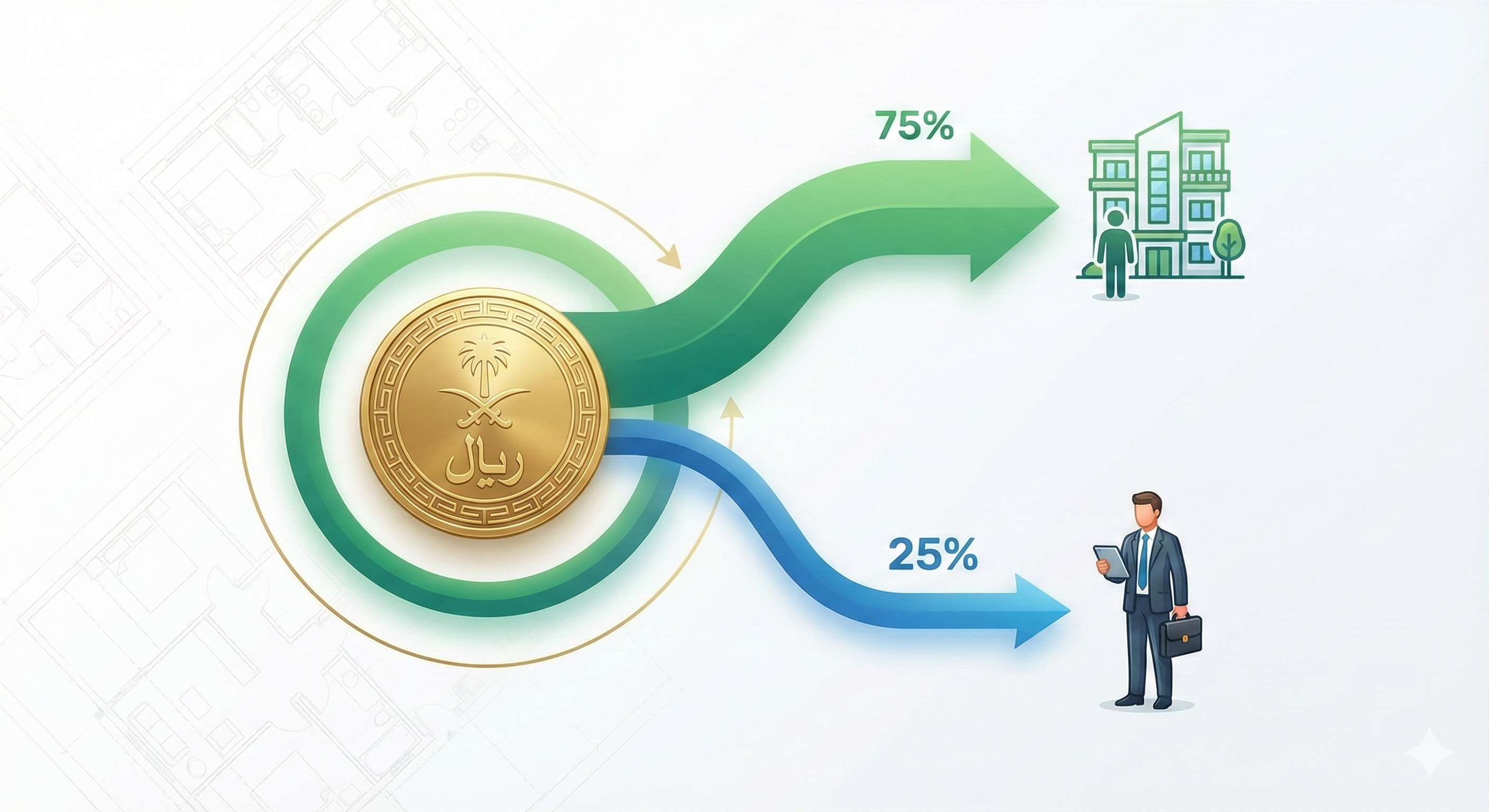

Real Estate Broker's Commission from Earnest Money

An important point for real estate brokers and transaction parties: According to the Executive Regulations of the Real Estate Brokerage Law:

The broker is entitled to a commission of 25% of the earnest money value if the seller or landlord is entitled to it without completing the transaction, unless the parties agree otherwise in the brokerage contract.

This means that even if the transaction is not completed, the broker receives a portion of the earnest money in exchange for their brokerage and marketing efforts.

⚠️ Important Warning: The real estate broker is not allowed to retain the earnest money as a guarantee for their rights. The earnest money must be delivered directly to the seller or landlord.

Steps to Pay Earnest Money Through Fal Platform

The General Authority for Real Estate has launched an electronic earnest money payment service through the Real Estate Brokerage Platform (Fal). Here are the detailed steps:

For the Real Estate Broker

Step One: Log in to the Real Estate Brokerage Platform (Fal).

Step Two: Go to the "Real Estate Contracts" page and create a new brokerage contract.

Step Three: At the end of the second stage after entering the property price, you will find the "Property Earnest Money" field.

Step Four: Enter the earnest money amount and specify the distribution ratio between the contract authorizer and broker.

Step Five: Send the contract to the other party for approval and endorsement.

For the Beneficiary (Buyer/Tenant)

Step One: Log in to the Real Estate Brokerage Platform.

Step Two: Go to the "Property Earnest Money" page.

Step Three: Click on "Pay New Earnest Money."

Step Four: Enter the contract information or real estate advertisement license number.

Step Five: Review the property details and contract parties.

Step Six: Choose the payment method and complete the process.

Available Payment Methods: Mada, Apple Pay, Visa, Mastercard, Sadad.

Earnest Money Release Service

When you need to release the held earnest money, whether by agreement or upon closing the deal, follow these steps:

Step One: Log in to the brokerage platform.

Step Two: Go to the "Property Earnest Money" page.

Step Three: Click on "Earnest Money Details" for the desired contract.

Step Four: Choose "Release Earnest Money" and select the reason from the list.

Step Five: Enter the verification code sent to your mobile.

Step Six: Wait for the other party's approval of the request.

Acceptable Reasons for Releasing Earnest Money

Acceptable reasons include: Successful completion of the transaction, mutual agreement to cancel the deal, expiration of the contract period, or issuance of a court ruling.

Golden Tips to Protect Your Rights

Tips for Buyers/Tenants

Always make sure the word "Arboun" (earnest money) is explicitly written in the contract, otherwise the amount will be considered an advance payment. Don't pay more than 5% of the property value as earnest money when dealing through a broker. Get an official documented receipt for the amount paid. Make sure to document the contract through the Fal platform. Thoroughly inspect the property before paying earnest money to avoid losing it later.

Tips for Sellers/Landlords

Document everything in writing in the brokerage contract. Clearly define the conditions for earnest money entitlement and cases where it is refundable. Verify the buyer's seriousness before reserving the property and rejecting other offers. Use the Fal platform to ensure your rights and officially document the transaction.

Tips for Real Estate Brokers

Make sure to explain earnest money provisions to all parties before concluding the contract. Do not keep the earnest money with you under any circumstances. Clearly document your share of the earnest money in the brokerage contract. Register all contracts on the Fal platform within 5 business days of conclusion.

🔑 Golden Rule: Written documentation is your primary protection! Everything written and documented is better than verbal agreements.

Frequently Asked Questions

Can we agree on an earnest money percentage less than 5%?

Yes, the 5% is the maximum limit, not mandatory. You can agree on any lower percentage as desired by both parties.

What if the seller refuses to complete the transaction after receiving the earnest money?

The buyer is entitled to a full refund of the earnest money and may be entitled to claim additional compensation for damages incurred as a result.

Is earnest money paid through Fal platform legally binding?

Yes, brokerage contracts documented through the Fal platform have full legal validity and are recognized by judicial authorities.

What is the maximum period for holding earnest money?

The period is specified in the brokerage contract, usually linked to the contract duration which defaults to 90 days if not otherwise agreed.

Can earnest money be paid in cash outside the platform?

Payment through the electronic platform is preferred for official documentation, but payment can be made by any agreed method with the necessity of clear written documentation.

What is the broker's share if the transaction is successfully completed?

If the transaction is completed, the broker receives their full commission (2.5% of the transaction value for sales, or from the first year's rent for leases), and the earnest money is calculated as part of the transaction value.

Conclusion

The earnest money system in the Saudi Real Estate Authority was established to protect all parties and ensure the seriousness of real estate transactions. The key is proper written documentation and using official platforms like the Fal platform.

Always remember: Earnest money is not just an amount you pay, but a legal obligation with specific consequences. Understand your rights, document your transactions, and protect yourself from any future disputes.

For more information, you can visit the official website of the General Authority for Real Estate (rega.gov.sa) or contact the beneficiary service center at 199011.