Customs Broker License Guide in Saudi Arabia 2025: Requirements, Training, Exam, Earnings, Pros and Cons, and Everything You Need to Know

A comprehensive and detailed guide about the customs broker profession in Saudi Arabia. Includes definition of customs broker, license requirements, training and exam procedures at the Customs Academy, types of licenses, expected earnings, pros and cons of the profession, and the difference between working as an employee or owning a customs clearance company.

Introduction: Why is Customs Clearance One of the Most Important Professions in Saudi Arabia?

In light of the tremendous economic development Saudi Arabia is witnessing under Vision 2030, and the unprecedented increase in import and export activities, the customs clearance profession has become one of the most in-demand and important professions in the Saudi job market. The customs broker is the essential link between traders and importers on one hand, and official customs authorities on the other.

We wrote this article to be the most comprehensive and detailed reference about everything related to the customs broker profession in the Kingdom of Saudi Arabia. We will explain everything from A to Z: What is a customs broker? Who is qualified for this profession? How do you study and pass the exam? What are the types of licenses? What are the expected earnings? What are the pros and cons of this profession? And what is the difference between working as an employee in a clearance company or opening your own company?

First: What is a Customs Broker? A Comprehensive and Accurate Definition

A customs broker is any natural or legal person licensed by the Zakat, Tax and Customs Authority (ZATCA) to practice the customs clearance profession. This person prepares customs declarations, signs them, submits them to the customs department, and completes all customs procedures related to clearing goods for others in exchange for an agreed fee.

What Does a Customs Broker Actually Do?

The customs broker acts as a specialized intermediary between the goods owner and customs authorities. Their main tasks include: preparing the electronic customs declaration on the FASAH system, classifying goods according to the approved customs tariff, calculating customs duties and taxes due, submitting all required documents to customs, following up on inspection and examination processes, paying fees on behalf of the client, coordinating transportation from the port to the client's warehouses, and dealing with any issues or exceptions that may arise during clearance.

Why Do Traders Need Customs Brokers?

The customs clearance process is complex and requires specialized expertise and knowledge. A trader may not know how to classify their goods according to the Harmonized System of customs tariffs, may not be aware of the documents required for each type of goods, or may not have enough time to follow up on procedures at the port. This is where the customs broker comes in, saving time and effort and ensuring quick release of goods.

The Difference Between a Customs Broker and a Customs Officer

This is a common confusion many people make. A customs officer is a government employee working for the Zakat, Tax and Customs Authority, whose task is to verify the accuracy of data and documents, collect fees, and detect violations. A customs broker is a private sector person who represents the trader or importer before customs officers and helps them complete their procedures.

Second: Who is Qualified to Obtain a Customs Broker License?

The Zakat, Tax and Customs Authority has set clear and specific conditions for those who want to obtain a customs clearance license. These conditions vary according to the type of license required.

Basic Requirements for All License Types

The applicant must be a Saudi national or a citizen of GCC countries residing in the Kingdom of Saudi Arabia. The applicant must be at least 18 years old according to the Hijri calendar. Must hold at least a high school diploma or equivalent. Must be an owner of the establishment or an employee according to General Organization for Social Insurance (GOSI) records. Must not own another establishment with a valid customs clearance license. Must only practice the profession for the establishment they work for.

Additional Requirements for Specialized Positions

For the Classification Specialist position who creates customs declarations: must be at least 21 years old, must have an accounting diploma after high school from an institution accredited by the Ministry of Education, must pass professional exams organized by the Customs Academy or any other body accredited by the Authority.

Excluded Categories

Government employees cannot obtain a customs clearance license. Those whose licenses were previously cancelled for reasons related to misuse or smuggling cannot reapply until five years have passed and their reputation is restored. Those who have a final judgment against them in a crime against honor or trust or customs smuggling cannot obtain a license.

Required Documents for Application

Valid national ID copy. Copy of educational qualification certificate. Valid commercial registration with customs clearance activity added. Valid subscription certificate in GOSI. Criminal record clearance certificate. Drug test certificate from a government hospital proving no drug use. Customs clearance certificates issued by the Customs Academy. Clearance from previous employer for those who previously worked in another clearance establishment.

Third: Types of Customs Clearance Licenses in Saudi Arabia

The Zakat, Tax and Customs Authority has divided customs clearance licenses into two main categories, each with multiple sub-activities.

First Category: General Clearance License

This license allows the establishment to practice customs clearance for others (clients and traders). It includes the following activities: Import and Export activity which is the main activity for clearing imported and exported goods, Transit activity for goods passing through the Kingdom to other countries, Hazardous Materials clearance activity for specialized companies in this field, Land transport activity for air transit shipments, Express shipping activity for postal parcels.

Second Category: Special Clearance License

This license allows public and private sector entities to perform customs clearance tasks for their own shipments only. Meaning the company clears its own goods without needing an external clearance office. This requires having an authorized employee (special delegate) with the required qualifications.

License Validity

The customs clearance license is valid for three years from the date of issuance. The license is renewed before expiration by submitting a renewal application and meeting the required conditions.

2023 Updates: Cancellation of Fees and Bank Guarantee

In May 2023, the Authority adopted new rules that included major facilitations. The fees for issuing and renewing the customs clearance license of 3000 SAR were cancelled. The fees for adding an import/export branch of 1000 SAR were cancelled. The fees for adding a transit branch of 1000 SAR were cancelled. The bank guarantee requirement for import/export activity, which ranged from 100,000 to 200,000 SAR, was cancelled. The bank guarantee is now required only for transit activity at a minimum of 50,000 SAR. The requirement for having an office at each customs port was cancelled, and only one office in the Kingdom is sufficient.

Fourth: How to Study and Obtain the Customs Clearance Certificate?

Obtaining a customs clearance specialist certificate is the basic requirement for working in this field. The Zakat, Tax and Customs Authority has established a specialized academy for this purpose.

Saudi Customs Academy

The Customs Academy is the official body accredited by the Authority to qualify and train customs brokers. The Academy offers a comprehensive training program aimed at raising the level of efficiency and skills of workers in the customs clearance sector.

Training Program Content

The training program covers several basic topics: the Unified Customs Law of GCC countries and its executive regulations, customs tariff according to the international Harmonized System and how to classify goods, customs value and internationally approved valuation methods, customs procedures for import, export and transit, FASAH electronic system and how to prepare customs declarations, principles of financial accounting related to customs operations, principles of English for international customs terminology, immediate clearance and its modern mechanisms.

How to Register for the Program

Registration is done electronically through the Zakat, Tax and Customs Authority portal. Enter the Authority's website and choose customs clearance services. Choose registration in the basic training program for customs clearance. Create a new account or log in with your account. Complete the registration data and attach the required documents. Wait for approval of your application.

Nature of Training

The scientific material for the program has been prepared as interactive electronic content in a self-learning manner. This means you can study at any time that suits you and at the speed you prefer. The content is available around the clock through the Academy's electronic platform.

Professional Exam

After completing the study, you must pass the professional exam to obtain the certificate. The exam is organized by the Customs Academy or any other body accredited by the Authority. You can take the exam directly if you have previous experience, or join the training course then take the exam. Passing the exam is a basic requirement for granting the customs clearance specialist certificate. Those who have practiced clearance and customs procedures for five years are exempt from the exam.

Course Duration and Cost

The training course duration ranges from two weeks to a month depending on the study method. Courses held at the Customs Training Institute usually last two weeks intensively. Self-learning through the electronic platform depends on the trainee's speed. The cost varies according to the training provider, but is generally affordable.

Other Accredited Training Bodies

In addition to the Customs Academy, there are accredited private training bodies offering courses in customs clearance. Chambers of commerce in various regions of the Kingdom offer specialized courses. Private training institutes accredited by the Technical and Vocational Training Corporation. Always make sure the body is accredited by ZATCA before registering.

Fifth: Steps to Obtain a Customs Clearance License in Detail

After obtaining the training certificate and passing the exam, comes the stage of obtaining the actual license. Here are the detailed steps.

Step One: Prepare the Commercial Registration

If you want to open your own customs clearance company, you must first obtain a commercial registration from the Ministry of Commerce. Choose customs clearance activity from the list of available activities. The cost of commercial registration for establishments starts from 200 SAR annually. The cost of commercial registration for companies starts from 1,200 SAR annually. Chamber of commerce fees start from 300 SAR for establishments and 2,000 SAR for companies annually.

Step Two: Register in Social Insurance

Register your establishment in the General Organization for Social Insurance. Register yourself as an employer or as an employee if you will work for an existing establishment. Obtain a valid subscription certificate.

Step Three: Obtain Required Certificates

Complete the customs clearance course and pass the exam to obtain the customs clearance specialist certificate. Obtain a criminal record clearance certificate from Public Security (Criminal Evidence). Obtain a drug test certificate from a government hospital.

Step Four: Submit License Application Electronically

Enter the Zakat, Tax and Customs Authority electronic portal. Choose customs clearance services then issue a new customs clearance license. Complete filling out the form with all required data. Attach all required documents in clear electronic format. Review the data and ensure its accuracy then submit the application.

Step Five: Application Review

You will receive a message confirming receipt of the application via SMS and email. The Authority's team will review your application and documents. You may be contacted for any inquiries or additional documents requested. Review duration usually ranges from one to two weeks.

Step Six: Receive the License

After approval of your application, the customs clearance license will be issued in your establishment's name. The license is valid for three years. You will also receive an entry card authorizing you to enter customs departments.

Step Seven: Activate Activities

After issuing the license, the desired activity must be activated within 180 days. Choose the activities you want to practice (import/export, transit, hazardous materials, etc.). Each activity has additional requirements that may include hiring specialized employees.

Sixth: Earnings and Salaries of Customs Brokers - The Complete Truth

This section will answer the question everyone is interested in: How much can you earn from this profession?

Employee Salary in a Customs Clearance Company

If you work as an employee (clearance specialist or delegate) in an existing customs clearance company, salaries vary according to experience and position. Beginners in the first rank earn between 3,000 to 3,810 SAR monthly. Experienced professionals in the second rank earn between 3,430 to 4,420 SAR monthly. Specialists and managers can earn up to 7,000-10,000 SAR or more depending on company size. In addition to basic salary, there are usually allowances and incentives based on the number of shipments completed.

Profits of a Customs Clearance Company Owner

Here the equation is completely different because you are the business owner, not an employee. Profits depend on several factors: the volume of shipments you clear monthly, the prices you charge per shipment, operating costs (rent, employee salaries, administrative expenses), and your relationships with clients and the size of your client base.

Profit Calculation Example

Let's assume a customs clearance office processes 100 shipments monthly. Average fee per shipment is 500 SAR. Monthly revenue is 50,000 SAR (100 shipments x 500 SAR). If operating costs are 20,000 SAR monthly including office rent 3,000-5,000 SAR, employee salaries 10,000-12,000 SAR, and administrative and operational expenses 3,000-5,000 SAR. Net monthly profit is 30,000 SAR. Net profit margin is 60%, which is an excellent margin.

Customs Clearance Service Prices in the Market

Prices vary depending on the type and complexity of the shipment. Simple shipments may start from 300-500 SAR. Medium shipments range between 500-1,000 SAR. Complex or large shipments may reach 1,500-3,000 SAR or more. Shipments requiring special permits or laboratory tests are more expensive. Some companies charge a percentage of the shipment value instead of a fixed amount.

Factors for Increasing Profits

Geographic location as cities with major ports (Jeddah, Dammam, Riyadh) offer greater opportunities. Specializing in a specific type of goods increases expertise and efficiency. Building long-term relationships with major clients. Offering additional services such as transportation and storage. Good reputation and commitment to deadlines.

Seventh: Advantages of Working as a Customs Broker

The customs clearance profession carries many advantages that make it attractive to many.

Job Stability

As long as there is trade and import and export, there will be a need for customs brokers. With Vision 2030 and the Kingdom's direction to become a global logistics hub, demand for this profession is constantly increasing. The customs broker cannot be completely replaced by automation because human expertise is essential.

Good Income

Whether as an employee or company owner, income in this field is good compared to other professions. The possibility of increasing income through extra work or increasing the number of shipments. The opportunity to turn expertise into a successful business project.

Acquiring Diverse Skills

You will learn international trade systems and customs laws. You will deal with multiple local and international entities. You will acquire negotiation and problem-solving skills. You will learn about different types of goods and industries.

Travel and Communication Opportunities

The profession provides opportunities to communicate with traders and importers from various countries. Possibility of traveling for training or attending international conferences. Building a wide network of relationships in the world of trade.

Easy Career Advancement

You can start as a delegate then advance to specialist then branch manager. After gaining experience, you can open your own company. Experience in this field opens other doors such as consulting and training.

Work Flexibility

If you own a company, you enjoy flexibility in organizing your time. Possibility of working remotely in some administrative tasks. The variety of daily tasks makes work non-routine.

Eighth: Disadvantages and Challenges of the Customs Clearance Profession

Like any profession, there are negative aspects that should be known before entering this field.

Work Pressure and Urgency

Clients want their goods as quickly as possible, putting you under constant pressure. You may have to work long hours especially when large shipments arrive. Deadlines are strict and delays can cost the client storage penalties.

Dealing with Bureaucracy

Despite improvements, some procedures still take time. You may face complications with some types of shipments or goods. Systems and laws change constantly and require constant follow-up.

Legal Responsibility

The broker is legally and jointly liable for customs violations. Any error in data may expose you to financial penalties. Participating in a smuggling crime even unknowingly may revoke your license.

Intense Competition

The market has a large number of customs clearance companies. Some companies significantly lower their prices to get clients. Building a stable client base takes time and effort.

Dealing with Difficult Clients

Some clients don't understand the complexities of customs procedures. You may face clients blaming you for delays that are not your responsibility. Dealing with complaints and unrealistic client expectations.

Field Work Environment

Part of the work requires being at ports and customs outlets. You may be exposed to difficult weather conditions especially at land ports. Constant commuting between office and port.

Ninth: Employee in a Clearance Company or Company Owner? Detailed Comparison

This crucial decision requires a deep understanding of the differences between the two options.

Working as an Employee in a Customs Clearance Company

Advantages include fixed and guaranteed income at the end of each month. You don't bear financial risks or operational responsibility. You gain experience at the employer's expense. Social insurance and paid leave. No capital needed to start. Organized environment and supportive team. Disadvantages include limited ceiling for salary no matter how much your experience increases. You don't have freedom of decision or innovation. Bound to specific working hours. Advancement depends on opportunities available in the company. You may feel unappreciated sometimes.

Opening Your Own Customs Clearance Company

Advantages include no ceiling for profits as the more you work the more you earn. You are the decision-maker and visionary. Flexibility in organizing your time and work style. Building a brand and reputation in your name. Possibility of expansion and opening multiple branches. Hiring others and building your own team. Disadvantages include financial risks and bearing potential losses. Full responsibility for everything from employees to clients to government. Psychological and financial pressure especially in the beginning. You need capital for rent, equipment and operations. Difficulty building a client base from scratch. Competition with established companies that have reputation and clients.

Golden Advice

Start as an employee in a customs clearance company for 3-5 years. During this period, learn all the details of the profession. Build your relationships with clients, suppliers and customs employees. Save enough capital to start your project. After gaining sufficient experience, open your own company. This path reduces risks and significantly increases chances of success.

Tenth: How Does a Customs Broker Work? Step-by-Step Clearance Process Explanation

Let's understand exactly what a customs broker does on a normal working day.

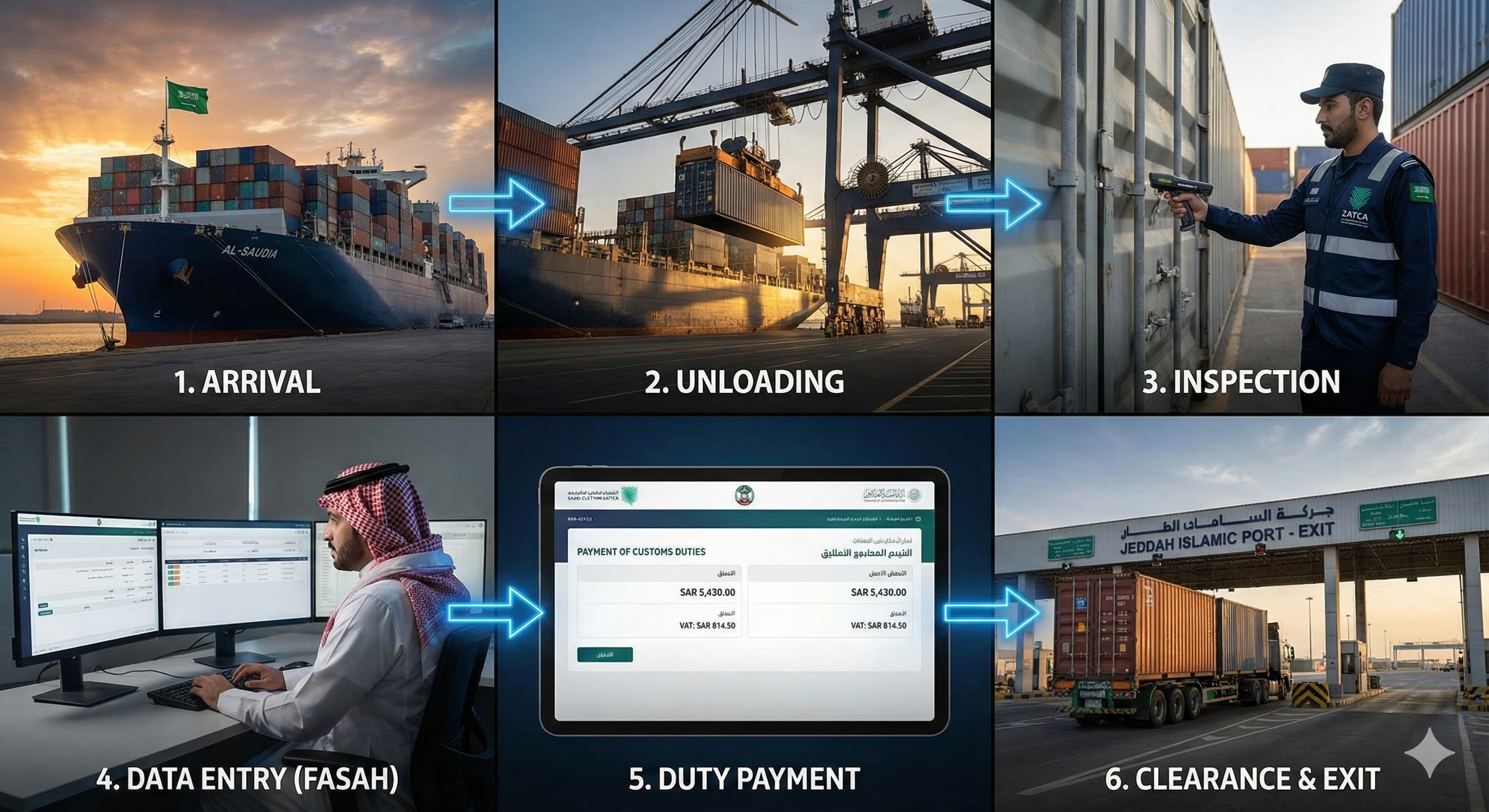

First Stage: Receiving Authorization and Documents

The client contacts the broker and authorizes them to clear their shipment. The broker receives copies of documents: commercial invoice, bill of lading, packing list, certificate of origin, any permits or certificates specific to the type of goods. The broker reviews documents and ensures they are complete and correct.

Second Stage: Classifying Goods

The broker determines the correct customs code for the goods according to the customs tariff. This step is crucial as it determines the percentage of customs duties. Error in classification may lead to fines or delays in clearance.

Third Stage: Preparing Customs Declaration

The broker logs into the FASAH electronic system. Creates a customs declaration containing all shipment details. Attaches required documents electronically. Submits the declaration to customs for review.

Fourth Stage: Paying Fees

After determining customs value, the system calculates dues. Fees include: customs duties according to type of goods, VAT 15%, any additional fees on certain goods. The broker pays fees on behalf of the client (or client pays directly).

Fifth Stage: Inspection and Examination

Some shipments are subject to random or mandatory inspection. The broker (or their delegate) attends the inspection process. Ensures the actual goods match the submitted documents. If differences are found, deals with them according to established procedures.

Sixth Stage: Release and Receipt

After meeting all requirements, the release order is issued. The broker coordinates with the transportation company to receive the shipment. Goods are transported from the port to the client's warehouses. The broker's role ends with delivering release documents to the client.

Time Duration for Clearance

Normal clearance takes 24 to 72 hours. Goods subject to laboratory tests may take 20 days. Immediate clearance for shipments meeting conditions may be completed within a few hours.

Eleventh: Golden Tips for Success in the Customs Clearance Profession

Invest in Continuous Learning

Customs systems change constantly. Attend periodic qualification courses organized by the Authority. Follow updates on the ZATCA website. Join customs broker groups to exchange experiences.

Build Your Reputation on Trust and Commitment

Stick to your deadlines with clients. Be honest and transparent in your dealings. Don't make promises you can't keep. Good reputation is the most important capital in this profession.

Specialize in a Specific Field

Instead of clearing all types of goods, specialize in a field. For example: food products, electronic devices, cars, industrial equipment. Specialization makes you an expert and distinguishes you from competitors.

Use Technology to Your Advantage

Master using FASAH system and all electronic systems. Use customer management software to track their shipments. Enable notifications to be the first to know of any updates.

Choose a Strategic Location for Your Office

If you own a company, choose a location close to the port or logistics area. Office proximity to potential clients makes it easier to reach you. A good location gives a professional impression.

Build a Strong Network of Relationships

Build good relationships with customs employees (professionally and legally). Connect with shipping and transportation companies. Join customs broker committees in chambers of commerce.

Frequently Asked Questions

Can a non-Saudi resident work as a customs broker?

No, the license is only available to Saudis and GCC citizens residing in the Kingdom. However, residents can work as employees in a Saudi clearance company in administrative or support tasks.

How long does it take to get a license from scratch?

Approximately two to three months including: training course (2-4 weeks), obtaining commercial registration (one week), gathering documents (two weeks), Authority review and license issuance (1-2 weeks).

Can I work at more than one customs port?

Yes, the license allows you to work at all customs ports in the Kingdom. However, you must activate the activity at each port you want to work at.

What is the difference between a Classification Specialist and a Clearance Specialist?

The Classification Specialist is the only employee authorized to create customs declarations on Authority systems, and requires a higher qualification (accounting diploma). The Clearance Specialist follows up on field procedures such as attending inspections and taking samples.

Can I combine customs clearance profession with import and export?

For establishments and companies: Yes, it is allowed to add import and export activity to customs clearance activity. For individuals: Individual customs brokers are not allowed to combine both professions.

What happens if I delay renewing my license?

If you don't renew within 6 months of the expiration date, the license is cancelled by law. There is a delay fine of 1,000 SAR for each month or part thereof.

Can I rent out my customs clearance license?

No, it is strictly prohibited to rent the license or cover up its use or transfer it without the Authority's approval. Proof of rental leads to immediate license cancellation.

Conclusion

The customs clearance profession is one of the promising professions in Saudi Arabia, and provides real opportunities for professional and financial success. Whether you choose to work as an employee to gain experience or decide to open your own company, this field rewards hardworking and committed individuals.

Start by obtaining the certificate from the Customs Academy, gain practical experience, build your reputation and network, and you will find yourself on the path to success. Remember that honesty, integrity and commitment to regulations are the foundation of this profession.

Share this guide with anyone thinking about entering this field, and don't hesitate to ask your questions and inquiries. We wish you success in your career!