Complete Real Estate Contributions Guide 2025: How to Establish a Real Estate Contribution? Licenses, Certificates, Capital, and Expected Returns

A comprehensive guide to the real estate contributions system in Saudi Arabia. Includes responsible authorities, steps to establish a real estate contribution, required licenses and certificates, capital classifications, investment methods, advantages and disadvantages, and everything developers and investors need to enter this promising investment field.

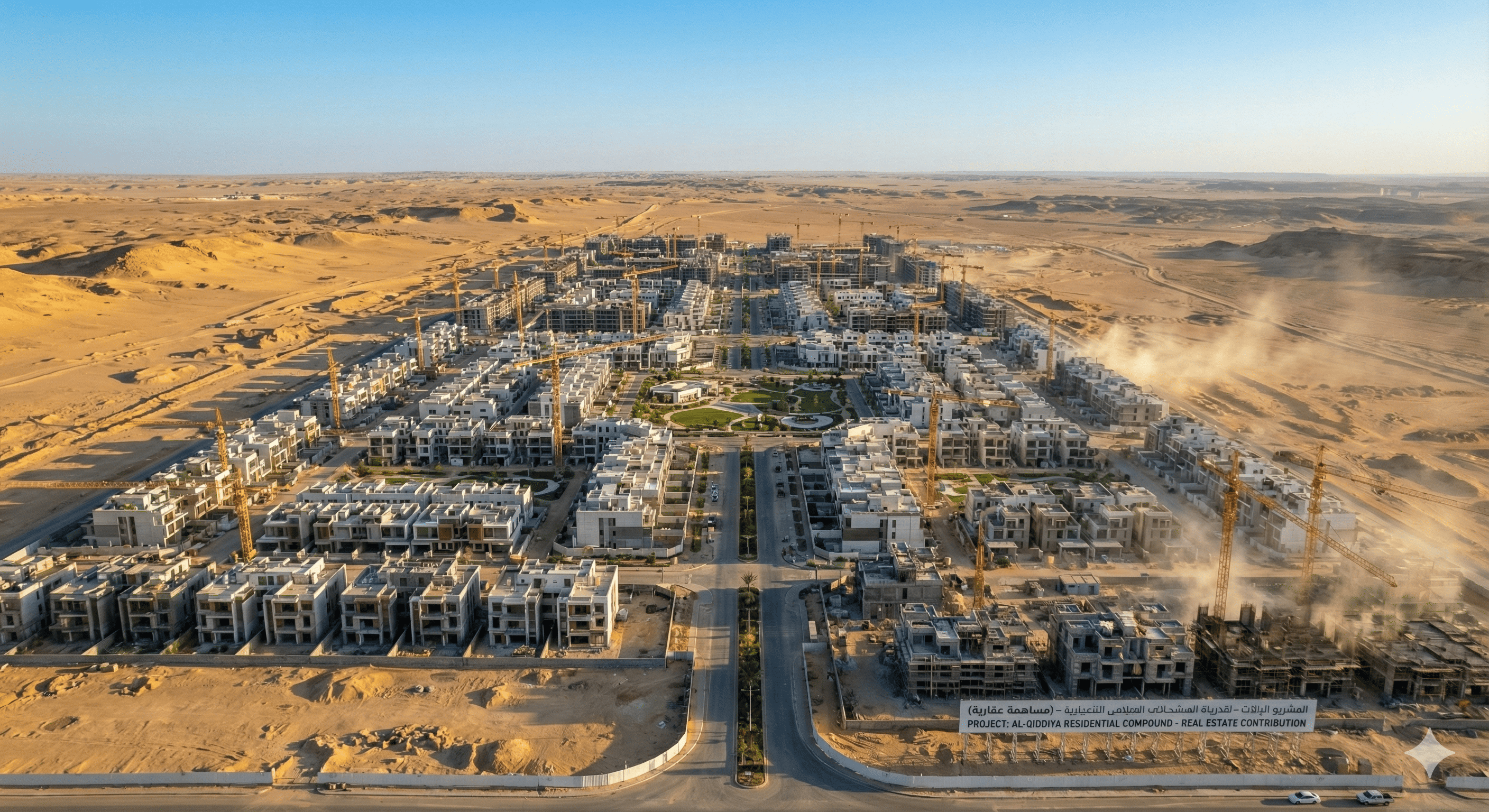

Introduction: A New Era for Real Estate Investment in the Kingdom

The Kingdom of Saudi Arabia has witnessed a qualitative leap in organizing the real estate sector, in line with the ambitious Vision 2030, which seeks to transform the Kingdom into a global investment destination. Among the most prominent developments is the issuance of the Real Estate Contributions System by Royal Decree No. (M/203) dated 28/12/1444H, which revolutionized the way major real estate projects are financed and managed.

This system came to eliminate the randomness that previously dominated real estate contributions and caused significant losses to investors. It provides a safe and transparent investment environment that protects the rights of all parties. Are you thinking about establishing a real estate contribution? Or perhaps you're looking for an opportunity to invest in this promising field? In this comprehensive guide, we'll take you on a detailed journey that answers all your questions.

First: What is a Real Estate Contribution?

A real estate contribution is a real estate development project in which a group of people (five or more) participate to achieve a common benefit. This is done by owning property and developing it into residential, commercial, industrial, agricultural, or other uses, then selling it and ending the contribution and distributing profits to contributors.

In simpler terms: instead of one investor bearing the burden of financing a huge real estate project alone, a group of investors share the financing, each receiving a share proportional to their contribution, then they share the profits when the project is completed and sold.

What Distinguishes Real Estate Contributions from Investment Funds?

It's important to differentiate between real estate contributions and Real Estate Investment Trusts (REITs). A real estate contribution is for a specific defined project (a particular land being developed), with a specific time period ending with the sale of the project and liquidation of the contribution. Investment funds are continuous financial instruments managed by a professional fund manager.

Objectives of the Real Estate Contributions System

This system was issued to achieve several strategic goals: Eliminating random and illegal real estate contributions that previously caused significant losses to investors. Enhancing investor confidence in the real estate sector through clear rules and provisions. Protecting the rights of all parties (developer, contributors, financing entities). Governing supervision and compliance work. Creating promising investment opportunities for small and medium enterprises. Providing a new and reliable real estate investment vehicle.

Second: Authorities Responsible for Real Estate Contributions

Real estate contributions are subject to supervision by two main authorities working in full coordination to ensure the safety of the investment process:

General Authority for Real Estate (REGA)

This is the main authority responsible for regulating real estate contributions in the Kingdom. The Authority handles the following tasks: Issuing, amending, and canceling real estate contribution licenses. Qualifying and classifying real estate developers wishing to practice the activity. Qualifying legal accountants and engineering consultants. Setting licensing conditions and requirements. Supervision and oversight of real estate contributions. Setting bases for licensee entitlements and commissions. Investigating violations and imposing penalties.

Capital Market Authority (CMA)

Real estate contributions may not be offered, advertised, marketed, or have funds collected without the approval of the Capital Market Authority. The Authority handles: Approving the offering of real estate contribution certificates. Regulating the offering process (public or private). Supervising licensed financial market institutions that handle offerings. Protecting investors from unfair practices.

Licensed Financial Market Institution

Real estate contribution certificates must be offered through a financial market institution licensed by the Capital Market Authority to practice arrangement activities. This institution acts as an intermediary between the developer and investors, handling: Receiving subscription applications. Managing the fundraising process. Providing sufficient information to investors. Organizing the contributors register.

Third: Classification of Real Estate Contributions by Capital

Real estate contributions are classified according to capital size into three categories:

Small Contribution

Capital less than 50 million Saudi Riyals. Suitable for limited real estate projects such as developing a small residential land or building a medium commercial complex. Requires relatively less complex procedures.

Medium Contribution

Capital not less than 50 million Riyals and not exceeding 300 million Riyals. Suitable for large real estate projects such as huge residential complexes or commercial centers. Requires stricter supervision and oversight.

Large Contribution

Capital exceeding 300 million Saudi Riyals. Designated for giant real estate projects such as integrated residential cities or huge commercial projects. Subject to the highest standards of supervision and governance.

Fourth: Types of Real Estate Contribution Certificate Offerings

The Capital Market Authority has specified two types of offerings:

Private Offering

An offering is private in the following cases: If certificates are offered only to qualified and institutional clients. If offering to retail investors is limited to 100 offerees or less. If the maximum amount payable by each retail investor does not exceed 200,000 Riyals. Private offerings require submitting an application to the Authority at least 10 days before the proposed date.

Public Offering

An offering is public if private offering conditions don't apply, meaning it's open to all investor categories without restrictions. Public offerings require stricter procedures and a review period of at least 30 days from the Capital Market Authority.

Fifth: Certificates and Documents Required for Licensing

To obtain a real estate contribution license, a comprehensive set of documents and certificates must be provided:

Entity Documents

Valid commercial registration including real estate development activity. Valid Chamber of Commerce membership certificate. Certificate from the General Organization for Social Insurance. List of employees on the payroll. Certificate from the Zakat, Tax and Customs Authority proving no outstanding dues. Localization certificate from the Ministry of Human Resources. Audited and approved financial statements for the previous two years.

Property Documents

Valid title deed with confirmed validity from the issuing authority. Real estate registry or ownership document for the project. Land planning approval with official certification from the competent authority (municipality). Regulatory approvals from relevant authorities. Agreement with the property owner (if the property will be purchased for the contribution's benefit).

Qualification Certificates

Real estate developer qualification certificate from REGA. Credit record clearance certificate. Approval of qualified engineering consultant from the Authority. Approval of qualified legal accountant from the Authority.

Sixth: Steps to Establish a Real Estate Contribution

The process of establishing a real estate contribution goes through sequential and organized stages:

Phase One: Qualification

Access the electronic services platform for real estate contributions on REGA's website. Create an account and fill out the entity profile. Apply for qualification as a real estate developer to practice real estate contribution activity. Submit all required documents. Wait for the Authority's approval of qualification.

Phase Two: License Application

After obtaining qualification, go to "Create License Application." Select "Real Estate Contribution License." Complete the application form with all details (property data, expected capital, development plan). Agree to declarations. Obtain engineering consultant approval through the platform. Obtain legal accountant approval through the platform. Submit the application.

Phase Three: Capital Market Authority Approval

After the license is issued by REGA, Capital Market Authority approval must be obtained for certificate offerings. Contract with a licensed financial market institution to arrange the offering. Submit offering application to the Capital Market Authority through the financial institution. Wait for approval (10 days for private offering, 30 days for public offering).

Phase Four: Opening the Escrow Account

Open an independent bank escrow account for the real estate contribution. All contributor amounts are deposited in this account. Withdrawals are only permitted according to specific controls and for project purposes only. Subject to Saudi Central Bank supervision.

Phase Five: Offering and Fundraising

Issue the prospectus explaining all project details. Offer contribution certificates to investors. Collect funds in the escrow account. If the offering is not completed within the specified period, funds are returned to subscribers without any deduction within 10 days.

Phase Six: Implementation and Management

Transfer property ownership to the real estate contribution (if not an in-kind share). Appoint a real estate contribution manager. Begin implementing the development plan. Submit periodic reports to contributors and the Authority. Hold contributor assembly meetings.

Phase Seven: Liquidation

Sell contribution assets after valuation by certified appraisers. Distribute profits to contributors. Liquidate and officially close the contribution.

Seventh: Main Parties in a Real Estate Contribution

Licensee (Real Estate Developer)

The legal entity that has obtained a real estate contribution license from the Authority. Bears full responsibility for the contribution to contributors and the Authority. Their share in the contribution must not be less than the percentage specified by regulations. Entitled to receive fees and commissions according to approved bases.

Real Estate Contribution Manager

Appointed by the licensee to manage the real estate contribution daily. Responsible for implementing the development plan and supervising the project. Can be dismissed by the licensee, Authority, or contributor assembly in case of abuse of powers.

Engineering Consultant

Engineering office qualified by REGA. Handles technical supervision of the project. Certifies engineering and construction work. Provides periodic technical reports.

Legal Accountant

Accounting office qualified by REGA. Handles financial supervision of the contribution. Audits financial statements. Monitors escrow account and disbursements.

Contributor Assembly

Consists of all contributors registered in the contribution register. Convened by the licensee's invitation or by request from contributors representing a certain percentage. Makes important decisions such as approving profit distribution or extending the contribution. First meeting requires two-thirds of capital attendance, second requires half.

Eighth: Escrow Account

The escrow account is the cornerstone of protecting contributors' funds:

Nature of Escrow Account

Independent bank account opened in the real estate contribution's name. All subscription amounts and revenues are deposited in it. Subject to Saudi Central Bank supervision. Cannot be seized or executed upon except for the contribution's benefit.

Escrow Account Withdrawal Controls

Withdrawals are only permitted for project purposes according to the approved disbursement plan. Withdrawals require approval from authorized parties. Every withdrawal is documented with proof of purpose. The Authority monitors withdrawal and deposit operations.

Ninth: How to Invest in Real Estate Contributions

For investors wishing to participate in real estate contributions:

Finding Opportunities

Follow announcements of licensed real estate contributions. Contact licensed financial market institutions. Review available prospectuses.

Studying the Opportunity

Read the prospectus carefully. Understand the project's nature, location, and development plan. Know the expected time period. Evaluate risks and expected returns. Verify the developer's record and previous experience.

Subscription

Submit subscription application through the licensed financial institution. Pay contribution value to the escrow account. Receive contribution certificate proving your share.

Follow-up

Attend contributor assembly meetings. Follow periodic reports. Vote on important decisions.

Receiving Returns

Interim profits (quarterly or semi-annually) can be distributed if the contribution agreement allows. Final profits are distributed upon contribution liquidation after project sale.

Tenth: Advantages of Real Estate Contributions

For Investors

Enter huge projects with less capital: Instead of buying an entire property for millions of Riyals, you can participate with a smaller amount in a large project. Portfolio diversification: You can distribute investments across several contributions instead of putting all your money in one property. Strong legal protection: The system provides significant guarantees to protect your rights. Transparency and follow-up: Periodic reports and regular meetings keep you informed. Possibility of receiving interim profits: Don't wait until the project ends. Professional management: Qualified developers and consultants manage the project.

For Developers

Financing large projects: Raising capital needed for huge projects they couldn't finance alone. Risk distribution: Risks are distributed among several contributors. Higher credibility: Official licensing enhances trust in the developer. Access to a wider range of investors: Through licensed financial market institutions.

For the National Economy

Stimulating urban development: Financing residential and commercial projects that meet market needs. Creating jobs: Large real estate projects employ thousands of workers. Market regulation: Eliminating randomness improves the investment environment. Supporting Vision 2030: Contributing to achieving housing and development goals.

Eleventh: Disadvantages and Risks of Real Estate Contributions

Market Risks

Real estate price fluctuations may affect project value at sale. Economic changes may slow real estate demand. Competition from other projects may affect prices.

Implementation Risks

Project delay from planned schedule. Construction costs exceeding estimates. Unexpected technical or engineering problems. Difficulties obtaining permits and approvals.

Management Risks

Poor project management by the developer. Disputes between partners or contributors. Lack of transparency in some cases despite supervision.

Limited Liquidity

Your funds are frozen throughout the project duration (may extend for years). Difficulty exiting before contribution ends. No active secondary market for trading shares currently.

Default Risks

In rare cases, the project may fail completely. Despite guarantees, investor returns may be affected. Penalties on violators may not fully compensate investor losses.

Twelfth: Penalties and Violations

The system has set strict penalties for violators:

Types of Penalties

Warning: For minor and first violations. License suspension: For up to one year for moderate violations. License cancellation: For serious or repeated violations. Financial fine: Up to 10 million Saudi Riyals.

Examples of Violations

Offering a real estate contribution without a license. Collecting funds without Capital Market Authority approval. Not adhering to the approved development plan. Misusing escrow account funds. Not submitting periodic reports. Misleading investors with incorrect information.

Thirteenth: Golden Tips for Developers and Investors

For Developers Wishing to Establish a Real Estate Contribution

Start with a realistic project: Choose a project you can successfully manage based on your experience. Prepare your file well: Ensure all documents and certificates are complete before applying. Choose a professional team: Qualified engineering consultant and legal accountant facilitate the process. Be transparent: Honesty with investors builds trust and avoids problems. Plan for emergencies: Have a backup plan to face unexpected challenges. Meet deadlines: Delays lose you the trust of investors and regulatory authorities.

For Investors

Verify the license: Only invest in contributions officially licensed by REGA. Read the prospectus carefully: Understand all details before making a decision. Know the developer: Research their record, experience, and previous projects. Don't put all your money in one contribution: Diversification protects you from risks. Allocate funds you don't need in the near term: Remember your funds will be frozen for a period. Follow your investments: Attend meetings and read reports. Consult a specialist: If unsure, seek a financial or legal advisor.

Frequently Asked Questions

What is the minimum contribution to a real estate project?

The minimum varies from contribution to contribution according to what the developer specifies in the prospectus. It may be tens of thousands or more depending on project size.

Can I withdraw from the contribution before it ends?

Generally, early withdrawal is difficult as there's no active secondary market. However, some agreements may allow selling the share to another investor under specific conditions.

What happens if the project fails?

REGA intervenes to protect contributors' rights. An alternative manager may be appointed or the contribution liquidated. Escrow account funds remain protected.

Are real estate contributions Sharia-compliant?

Yes, the system is designed to be Sharia-compliant. However, it's preferable to verify each contribution individually if this matters to you.

How long does a real estate contribution usually take?

It varies depending on project size and type, but typically ranges from 3 to 7 years for development projects.

Can foreigners participate in real estate contributions?

This is subject to foreign property ownership regulations in the Kingdom. It's advisable to verify specific conditions for each contribution.

Where can I find licensed real estate contributions?

You can inquire through REGA's website or contact licensed financial market institutions.

Conclusion

The real estate contributions system represents a qualitative leap in organizing collective real estate investment in Saudi Arabia. Thanks to strict supervision by REGA and the Capital Market Authority, investors can now participate in huge real estate projects with confidence and security.

Whether you're a developer seeking to finance your ambitious project, or an investor looking for an opportunity to grow your money in the real estate sector, the real estate contributions system provides you with the appropriate legal and regulatory framework. The key is compliance with regulations, careful selection of opportunities, and continuous follow-up of your investments.

We ask Allah for success and guidance for all who seek halal and beneficial investment, and that He blesses everyone's wealth and grows it.