Complete Guide to Real Estate Risk Assessment 2026: Scientific Formulas, Methodologies, and Applications in the Saudi Market

A comprehensive scientific and practical guide to measuring and evaluating real estate risks. Includes essential mathematical formulas like Cap Rate, NOI, DSCR, and LTV, weighted assessment methodologies, Monte Carlo simulation, property age and location factors, and specific applications for the Saudi real estate market according to Saudi Authority for Accredited Valuers standards.

Introduction: Why Measure Real Estate Risks?

Real estate investment is not just about buying and selling; it is a science based on precise numbers, formulas, and methodologies. In a world where the Saudi real estate market value exceeds $74 billion in 2025 and is expected to reach over $100 billion by 2030, understanding how to measure risks becomes a necessity, not a luxury. The difference between a successful investor and a losing one often lies in the ability to analyze risks before making decisions.

This guide takes you on a scientific and practical journey to understand how professionals measure real estate risks. We will start with basic concepts and global formulas, then move to advanced methodologies, and finally apply everything to the Saudi market according to the Saudi Authority for Accredited Valuers (Taqeem) standards. Whether you are a beginner or professional investor, you will find here what enriches your knowledge and improves your decisions.

Part One: Understanding Types of Real Estate Risks

Before diving into formulas, we must first understand what risks we are trying to measure. Real estate risks are not a single type but an integrated system of interconnected factors that affect property value and returns.

Market Risk

This relates to changes in the overall real estate market conditions. It includes price fluctuations due to supply and demand, the impact of interest rates on real estate financing, economic cycles and their effect on the real estate sector, and changes in government policies and regulations.

Location Risk

Location is the most important factor in real estate, and its risks include changes in neighborhood character over time whether positive or negative, proximity to sources of disturbance or pollution, quality of infrastructure and surrounding services, and crime rates in the area.

Property-Specific Risk

This relates to the property's own characteristics and includes building age and structural condition, construction quality and materials used, design and its suitability for current use, and maintenance and operating costs.

Financial Risk

This is associated with the property's financing structure and includes debt-to-value ratio, ability to make payments, interest rate fluctuations for variable loans, and refinancing risks at loan maturity.

Operational Risk

This relates to property management and operation and includes occupancy and vacancy rates, tenant quality and their ability to pay, management and maintenance costs, and handling emergencies and repairs.

Part Two: Basic Formulas for Measuring Real Estate Risks

Now we enter the core of the subject: the mathematical formulas that professionals use to measure risks and evaluate investment opportunities. These formulas are not just theoretical but practical tools used daily in decisions worth millions of riyals.

Net Operating Income (NOI)

This formula is the cornerstone in evaluating income-producing properties. Net Operating Income equals total property revenue minus operating expenses. Total revenue includes monthly rents, service fees, and any additional income. Operating expenses include maintenance, insurance, management, property taxes, and utilities, but do not include loan payments or depreciation.

Practical example: A residential building with annual rents of 500,000 SAR and operating expenses of 150,000 SAR. Net Operating Income equals 350,000 SAR. This number tells you the property's actual ability to generate income before debt service.

Capitalization Rate (Cap Rate)

One of the most important indicators for evaluating property risks and returns. Cap Rate equals Net Operating Income divided by the property's market value multiplied by 100. This ratio gives you the expected annual return on your investment if you bought the property in cash without financing.

The general rule says that a low cap rate indicates lower risks but also lower returns, while a high cap rate indicates higher risks with potential for higher returns. In the Saudi market, cap rates typically range between 5% and 10% depending on property type and location.

Example: A property with NOI of 350,000 SAR and market value of 5,000,000 SAR. Cap Rate equals 7%. This means you will achieve an annual return of 7% on your investment.

Loan to Value Ratio (LTV)

A fundamental indicator for measuring financial risks. LTV equals the loan amount divided by the property's market value multiplied by 100. The higher this ratio, the greater the risks for both investor and lender.

Saudi banks typically require this ratio not to exceed 70-80% for investment properties. If the property value is 2,000,000 SAR and you get a loan of 1,500,000 SAR, the LTV ratio equals 75%. This means you own 25% of the property as net equity, and any decrease in property value by more than 25% will leave you owing more than the property's value.

Debt Service Coverage Ratio (DSCR)

This ratio measures the property's ability to pay its financing obligations. DSCR equals Net Operating Income divided by total annual debt service. Debt service includes principal loan payments and interest.

If the ratio is less than 1, the property is not generating enough income to pay its installments, which is a major risk indicator. Banks typically require a ratio of at least 1.2 or 1.25. Example: A property with NOI of 350,000 SAR and annual payments of 250,000 SAR. DSCR equals 1.4, which is a healthy ratio meaning the property generates 40% more than it needs to pay its installments.

Cash-on-Cash Return

This measures the actual return on the amount you paid from your own pocket. Cash-on-Cash Return equals annual cash flow divided by total cash invested multiplied by 100. Cash flow is Net Operating Income minus debt service. Cash invested includes down payment, closing costs, and renovations.

Example: You bought a property for 2,000,000 SAR, paid 600,000 cash as down payment and costs. NOI is 350,000 SAR and debt service is 200,000 SAR. Cash flow equals 150,000 SAR. Cash-on-Cash Return equals 25%. This is an excellent return that exceeds most traditional investments.

Gross Rent Multiplier (GRM)

A quick tool for comparing properties. GRM equals property price divided by annual gross rent. This number tells you how many years you need to recover the property price from gross rents. The lower the number, the better the property in terms of return.

Example: A property at 3,000,000 SAR with annual rent of 300,000 SAR. GRM equals 10 years. In the Saudi market, GRM between 8 and 12 is considered a reasonable range for residential properties.

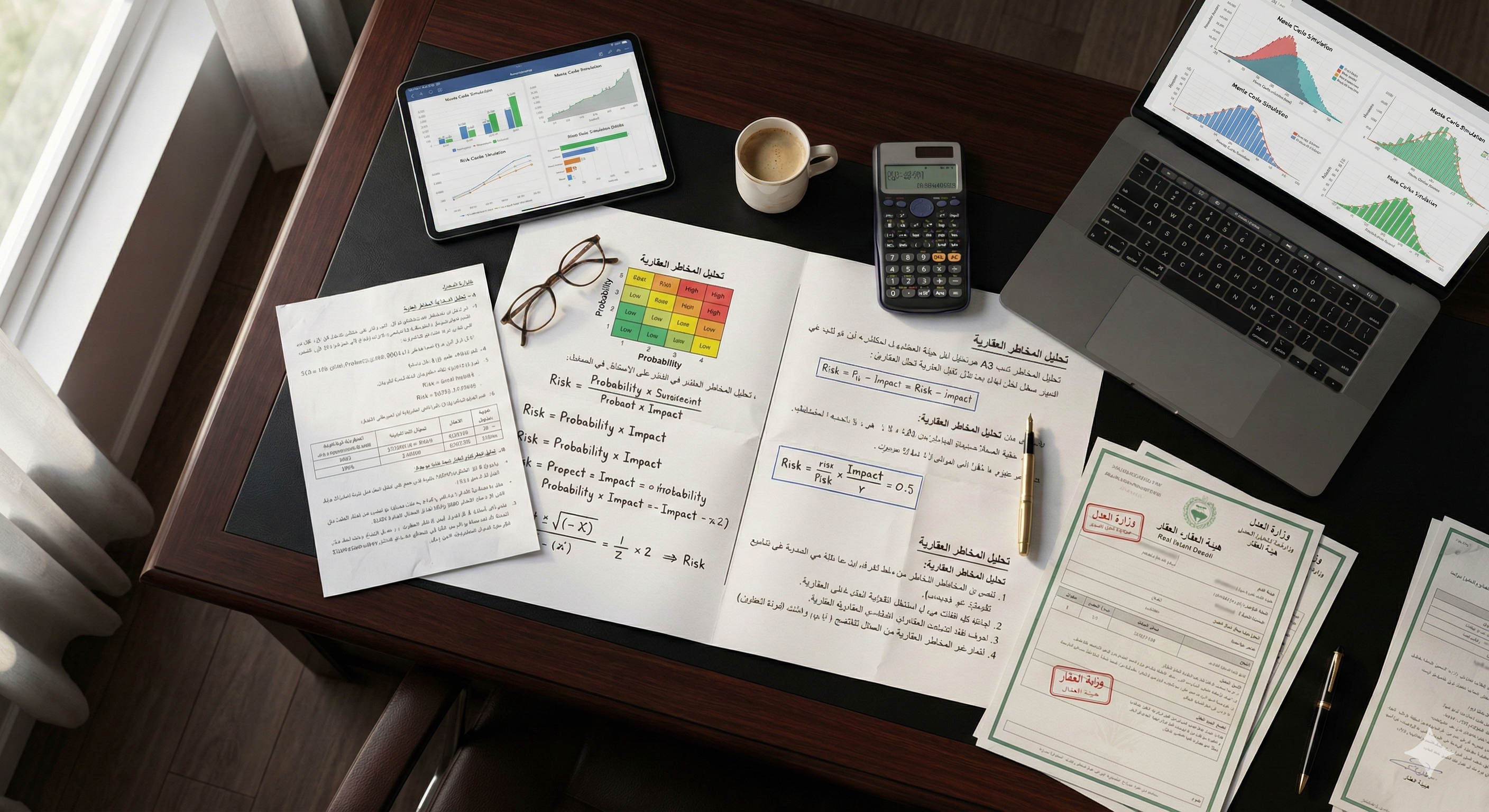

Part Three: Weighted Risk Scoring Model

The previous formulas measure specific aspects, but how do we combine all factors into one comprehensive risk score? This is where the weighted scoring model comes in, a scientific methodology used by financial institutions, insurance companies, and professional investors.

How the Model Works

The idea is simple but powerful: we identify different risk factors, assign each factor a weight reflecting its relative importance, then rate each factor with a score, and finally calculate the weighted sum. The basic formula is that the total risk score equals the sum of each factor's score multiplied by its weight.

Practical Example: Residential Property Assessment Model

Let's assume we are evaluating a residential villa in Riyadh. We identify the following factors with their weights: location and neighborhood at 25%, property age at 20%, structural condition at 15%, expected return at 15%, liquidity and ease of sale at 10%, tenant quality at 10%, and regulatory compliance at 5%. The sum of weights must equal 100%.

We rate each factor from 1 to 10 where 1 is highest risk and 10 is lowest risk. Let's assume: location scored 8, property age 6, structural condition 7, return 7, liquidity 5, tenant quality 8, and compliance 9.

Total risk score equals 8 times 0.25 plus 6 times 0.20 plus 7 times 0.15 plus 7 times 0.15 plus 5 times 0.10 plus 8 times 0.10 plus 9 times 0.05. The result equals 7.05 out of 10.

This score places the property in the medium to low risk category. This model can be used to compare several properties and choose the best one.

Part Four: Property Age Factor and Depreciation

Property age is one of the most important factors affecting risks, but it is also one of the most complex. Not every old property is bad, and not every new property is excellent. Proper understanding of the relationship between age, value, and risks is essential for any investor.

Depreciation Rates According to Global Studies

Scientific research indicates that the annual depreciation rate for residential properties ranges between 0.4% and 2.4% depending on the market and maintenance. Commercial properties depreciate at a higher rate reaching up to 3% annually for office buildings. Hotels and retail have the highest depreciation rates reaching 14-17% annually due to rapid changes in industry standards.

A 2015 MIT study found that properties actually depreciate at a rate of 7% annually, much faster than official accounting rates. This means the actual lifespan of a building may be 19 years for residential and 20 years for commercial, not 27.5 and 39 years as in tax systems.

Effective Age vs Chronological Age

The most important concept in evaluating property age is differentiating between chronological age and effective age. Chronological age is simply the number of years since construction, but effective age takes into account the property's actual condition.

A 20-year-old property that has undergone comprehensive renovation may have an effective age of only 5 years. The opposite is also true: a 10-year-old neglected property may have an effective age of 25 years. The professional appraiser estimates effective age based on field inspection and maintenance and renovation history.

Calculating Depreciation Using Straight-Line Method

The simplest method to calculate annual depreciation is the straight-line method. Annual depreciation equals building value divided by expected lifespan. Note that land value is not depreciated because land does not wear out.

Example: A property with total value of 2,000,000 SAR, of which 500,000 is land value and 1,500,000 is building value. If the expected lifespan is 40 years, annual depreciation equals 37,500 SAR, which is 2.5% of building value annually.

Impact of Property Age on Risks

Older properties carry additional risks including higher probability of major repairs such as plumbing, electrical, and roof, non-compliance with modern building codes, designs that may not suit contemporary needs, difficulty obtaining financing with good terms, and higher insurance costs. However, old properties in excellent locations may carry heritage value or location advantages that compensate for their age.

Part Five: Assessing Location and Neighborhood Risks

The golden rule in real estate says: location, location, location. But how do we evaluate location scientifically and not just impressionistically?

Components of Location Risk

Natural disaster risks include whether the area is prone to floods, earthquakes, or fires. In Saudi Arabia, some areas are prone to flash floods during rainy season. Infrastructure quality includes road conditions, lighting, sewage, and electricity and water networks. Proximity to services includes distance from schools, hospitals, markets, and mosques. Crime rates are sometimes available from official sources or can be estimated from neighborhood character. Future development includes whether there are upcoming projects that will raise or lower the area's value.

Weighted Assessment Model for Location

The same weighted assessment methodology can be used for location. Suggested factors and weights are: proximity to essential services at 25%, infrastructure quality at 20%, crime rates and safety at 20%, accessibility and transportation at 15%, nearby school quality at 10%, and natural disaster risks at 10%.

Risk Heat Maps

Modern tools allow creating heat maps showing risk levels in different areas. These maps combine multiple data such as historical property prices, vacancy rates, crime, and natural disasters to give a quick visual picture of each area's risks.

Part Six: Advanced Methodologies - Monte Carlo Simulation and Value at Risk

For professional investors and institutions, there are more sophisticated tools for measuring risks. Monte Carlo simulation and Value at Risk (VaR) are among the most important of these tools.

What is Monte Carlo Simulation?

Named after the famous Monte Carlo casino because it relies on randomness like gambling games. The idea is to simulate thousands of possible future scenarios based on probability distributions of different variables, then analyze the results to understand the range of possible returns and the probability of each.

In real estate, simulation can be used to study the impact of rent changes between negative 10% and positive 15%, interest rate changes, possible occupancy rates, and unexpected maintenance costs. By running thousands of scenarios, we get a distribution of possible results instead of a single number.

Value at Risk (VaR)

Value at Risk answers a specific question: What is the worst expected loss at a certain confidence level over a specified time period? Example: If the VaR for a real estate portfolio at 95% confidence level over one year is one million riyals, this means there is only a 5% probability that the portfolio will lose more than one million riyals during the year.

Calculating VaR for real estate requires historical data on price and return fluctuations, which is increasingly available in the Saudi market through the Real Estate General Authority indicators.

Risk-Adjusted Return

The Sharpe Ratio measures the excess return per unit of risk. The formula is that the Sharpe Ratio equals investment return minus risk-free rate of return, divided by the standard deviation of returns. The higher the Sharpe Ratio, the better the investment in terms of return versus risk.

Example: Property A has a return of 12% and standard deviation of 8%. Property B has a return of 15% and standard deviation of 15%. If the risk-free return is 3%, the Sharpe Ratio for Property A equals 1.125 while for Property B it equals 0.8. Although Property B has a higher return, Property A is better when considering risks.

Part Seven: Application in the Saudi Market

Now we move from theory to practical application in the Saudi market. The Saudi market has its own characteristics that must be considered when measuring risks.

Saudi Regulatory Framework

The Saudi Authority for Accredited Valuers (Taqeem) is the regulatory body for the property valuation profession. The accredited valuer adheres to International Valuation Standards (IVS) with modifications suitable for the local market. There are three approved valuation approaches: the market approach for comparing the property to similar properties recently sold, the income approach for estimating value based on expected future income, and the cost approach for calculating the cost of rebuilding the property with depreciation deducted.

Real Estate General Authority Indicators

The Real Estate General Authority provides valuable indicators for measuring risks including the Real Estate Price Index in 18 cities, real estate transaction data from the Ministry of Justice, rental indicators by cities and neighborhoods, and quarterly real estate sector performance reports.

In Q4 2025, the Real Estate Price Index recorded a decline of 0.7% compared to the same period in 2024, indicating market stability with a slight correction tendency.

Risk Characteristics in the Saudi Market

Regulatory change risks include white land fees and their impact on land prices, the Ejar system and its effect on the rental market, and construction and development requirements. Major project risks such as NEOM, Qiddiya, and the Red Sea create opportunities but may draw liquidity from other areas. Liquidity risks in some areas mean selling property may take a long time, especially for large properties.

Cap Rates in the Saudi Market

Cap rates vary by property type and location. Residential properties in major cities range between 5% and 7%. Commercial properties range between 7% and 10%. Industrial and logistics properties range between 8% and 12%. Major shopping centers in excellent locations may reach 4% to 6%.

Part Eight: Practical Guide - How to Assess Property Risks Before Buying

After all these theories and formulas, here is a practical step-by-step guide to assess the risks of any property you are considering buying.

Step One: Gather Basic Data

Collect the following information: requested property price, current or expected rent, annual operating expenses, property age and condition, maintenance and renovation history, neighborhood and location information, and available financing terms.

Step Two: Calculate Basic Indicators

Calculate Net Operating Income by subtracting expenses from rent. Calculate Cap Rate by dividing NOI by price. Calculate Rent Multiplier by dividing price by annual rent. If you will finance, calculate LTV ratio, DSCR ratio, and Cash-on-Cash Return.

Step Three: Evaluate Risk Factors

Rate each factor from 1 to 10: location and neighborhood quality, property age and condition, current or expected tenant quality, ease of resale, regulatory compliance, and future expectations for the area.

Step Four: Calculate Overall Risk Score

Use the weighted assessment model to calculate an overall score. Compare this score with other properties you are studying.

Step Five: Scenario Analysis

Ask yourself: What if rent drops 20%? What if the property stays vacant for 6 months? What if you need major repairs? What if interest rates rise? Calculate the impact of each scenario on your returns and ability to continue.

Step Six: Make the Decision

Based on all the above, decide: Do the expected returns justify the risks? Can you handle the worst scenarios? Is this property better than available alternatives?

Frequently Asked Questions

What is a good Cap Rate in Saudi Arabia?

It varies by property type and location, but generally: 5-7% for residential in major cities is considered good, 7-10% for commercial, and more than 10% for industrial. A very high rate may indicate hidden risks.

Is an old property always riskier than a new one?

Not necessarily. An old property in an excellent location with good maintenance may be less risky than a new property in a bad location. What matters is the effective age, not chronological, along with location and maintenance condition.

How do I get market data to calculate indicators?

Data sources include the Real Estate General Authority website for real estate indicators, Ministry of Justice reports for transactions, real estate marketing websites for asking prices, and accredited valuers for professional valuations.

What is the difference between income approach and market approach in valuation?

The market approach compares the property to similar properties recently sold, and is most suitable for residential properties and land. The income approach calculates value based on expected future income, and is most suitable for income-producing investment properties.

Can I rely on my own calculations or do I need an accredited valuer?

For your personal decisions, your calculations are sufficient as a preliminary stage. But for bank financing, legal cases, or large transactions, you need a report from a valuer accredited by the Saudi Authority for Accredited Valuers.

How do I calculate the effective age of a property?

Effective age is estimated based on the property's current condition compared to a new property. A 20-year-old property that has undergone comprehensive renovation may have an effective age of 5 years. The professional appraiser determines this based on inspection and maintenance history.

Conclusion

Measuring real estate risks is not an intellectual luxury but a practical necessity for every investor who wants to protect their capital and maximize returns. In this guide, we learned the basic formulas such as NOI, Cap Rate, LTV, and DSCR, weighted assessment methodologies, advanced tools like Monte Carlo simulation, and how to apply all of this in the Saudi market.

Remember that numbers and formulas are tools that help you make better decisions, but they do not replace sound judgment and experience. Use these tools as part of a comprehensive analysis that also includes field inspection, market understanding, and consulting experts. Successful real estate investment combines science and art, numbers and intuition based on knowledge.

We wish you successful and well-studied investments, and remind you that continuous learning is the best investment you make in yourself.