Complete Guide to Off-Plan Sales in Saudi Arabia 2025: Everything Developers and Buyers Need to Know About the WAFI System

A comprehensive detailed guide to the off-plan sales system (WAFI) in Saudi Arabia. Learn about licensing requirements, developer points system, escrow account mechanism, buyer rights, warranties, penalties, and fees. Everything you need from A to Z.

Introduction: Why Off-Plan Sales?

Imagine buying your dream home at 30% below market price, paying in comfortable installments, with strong government guarantees protecting every riyal you pay. This is exactly what the off-plan sales system offers in Saudi Arabia.

On the other hand, if you're a real estate developer, you have a golden opportunity to obtain self-financing for your project without bank interest, with early marketing that ensures your project's success before completion. However, entering this market requires a precise understanding of procedures and requirements.

In this comprehensive guide, we'll take you on a detailed journey through all aspects of the off-plan sales system in Saudi Arabia, from qualification and licensing to escrow accounts and penalties, whether you're a developer looking to expand or a buyer seeking an investment or residential opportunity.

First: What is Off-Plan Sales?

Off-plan sales is a system that enables real estate developers to sell or lease real estate units before their construction is complete, based on approved plans and designs. This system is known in Saudi Arabia as the "WAFI" program, launched in 2016 and currently supervised by the Real Estate General Authority.

The concept is simple: the buyer gets a lower price in exchange for waiting until construction is complete, and the developer gets direct financing from buyer payments without needing expensive bank loans. However, to ensure both parties' rights, the government has established a strict regulatory system including a bank escrow account and independent engineering and financial supervision.

Types of Projects Covered

The WAFI system includes all types of real estate projects: residential including villas, apartments, and complexes; commercial including offices and shopping centers; industrial, service, and tourism projects; as well as developed raw land.

Market Statistics

The off-plan sales market has witnessed exceptional growth in recent years. In October 2025 alone, 55 projects were licensed comprising over 20,000 real estate units with an estimated value exceeding 32 billion riyals. Total licensed units exceeded 200,000 housing units, while financial operations in escrow accounts exceeded 8 billion riyals.

Second: Legal and Regulatory Framework

The system for selling and leasing off-plan real estate projects was issued by Cabinet Resolution No. 536 dated 4/12/1437H, and was updated with the new system issued on 10/3/1445H corresponding to 25/9/2023. The system includes detailed executive regulations issued by the Real Estate General Authority.

Supervising Authorities

The Real Estate General Authority has full supervision over the system, including: issuing licenses, monitoring and inspection, following up on implementation, and reviewing violations. It also coordinates with the Ministry of Municipal, Rural Affairs and Housing, and the Developer Services Center "Etmam".

Third: Developer Qualification Requirements - Points System

Before you can obtain a license for an off-plan sales project, you must be registered in the "Developer Registry" with the Real Estate General Authority. Qualification is based on a points system that evaluates your financial, technical, and human capabilities.

For Legal Entities (Companies)

A minimum of 35 points out of 100 points is required. Points are distributed across several criteria including: capital and financial capacity, organizational and administrative structure, qualified human resources, previous experience in real estate development, completed projects, and strategic partnerships and alliances.

For Natural Persons (Individuals)

A minimum of 35 points out of 55 points is required. Additional restrictions apply including: building area not exceeding 5,000 square meters, project implementation period not exceeding 3 years, and number of projects executed annually not exceeding 3 projects.

Rating Upgrade and Suspension

The developer may request to raise their rating points if their capabilities change after registration. Conversely, the developer's registration is suspended if they lose the minimum rating criteria, and they are given a 3-month correction period, and their registration is deleted if they don't correct their status within this period.

Fourth: Project Licensing Requirements

After obtaining the qualification certificate and registration in the developer registry, you can apply for your project license. Here are the detailed requirements:

Basic Documents

Required documents include: copy of valid commercial registration permitting real estate development, Chamber of Commerce membership certificate, copy of credit record from a licensed company, valid building permit, and valid ownership deed for the property to be developed.

Technical Documents

Include: complete architectural designs and engineering plans, implementation timeline, financial feasibility study, and approved unit division certificate (if the project contains subdivided units).

Mandatory Agreements

Must submit: agreement with an accredited engineering consultancy office, agreement with an accredited legal accountant, and agreement to open an escrow account with a licensed bank.

Application Review Period

The Authority decides on the project license application within 10 working days from the date of application completion. In case of rejection, the decision must be justified.

Fifth: Pre-Marketing License

An important feature of the system is that the developer may request a "Project Marketing License" before obtaining the final sales license. This allows you to test the market and know the level of demand before full commitment to the project.

Marketing License Conditions

Requirements include: property ownership registration number, architectural designs and engineering plans, marketing contract with real estate broker (if any), and copy of development contract between developer and landowner (if any).

License Duration and Receiving Reservations

Marketing license duration does not exceed 180 days, renewable. If the developer wishes to receive reservation amounts during this period, they must not receive more than 5% of the unit value, and all reservation amounts must be deposited in the escrow account. If the license period ends without completing the sales license, deposited amounts are returned to their owners.

Sixth: Fees and Costs

Here is a breakdown of the required official fees:

License Fees

Internal display license is 15,000 riyals paid through SADAD system. External display license for projects within Gulf countries is 20,000 riyals, while external display license for projects outside Gulf countries is 30,000 riyals.

Additional Costs

In addition to official fees, calculate: engineering consultancy office fees, legal accountant fees, bank escrow account opening fees, and document and design preparation costs.

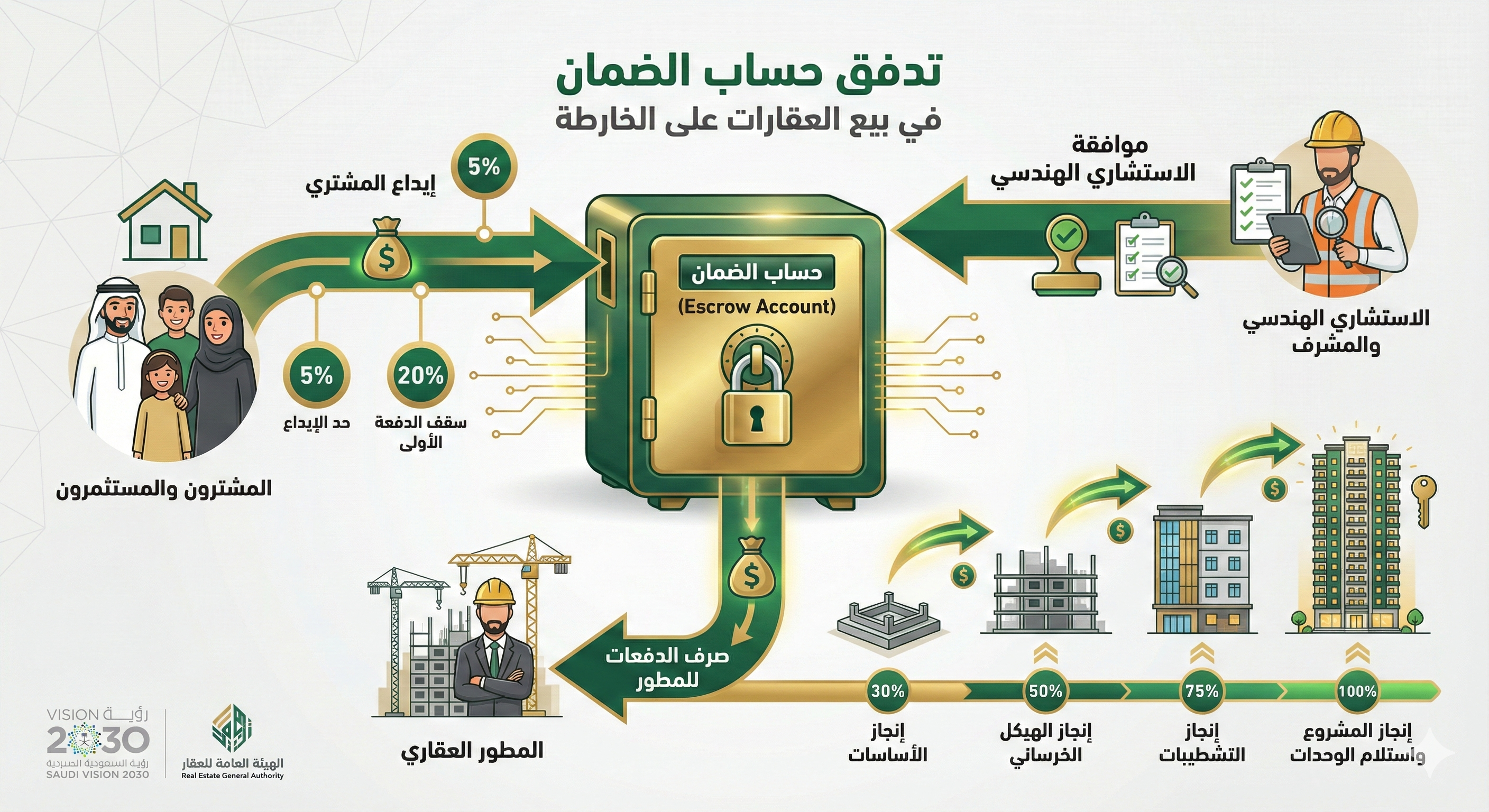

Seventh: Escrow Account - The Heart of the System

The escrow account is the backbone of the off-plan sales system, and is the mechanism that protects buyers' money and ensures it is used only for the project.

What is an Escrow Account?

A special bank account for the real estate project, where all amounts paid by buyers or financiers are deposited. The developer may not receive any money directly from buyers; it must be deposited in this account exclusively.

Account Management Parties

The escrow account is managed with participation of four parties: the bank as account trustee, the legal accountant to approve disbursement operations, the engineering consultancy office to assess completion percentages, and the Real Estate General Authority for general oversight.

Disbursement Mechanism from Escrow Account

Disbursement is only made by virtue of a disbursement document signed by the developer, engineering consultant, and legal accountant. Disbursement depends on actual completion percentages assessed by the supervising engineering office. Quarterly reports must be submitted to the Authority showing the project's financial status and completion percentages.

Disbursement Restrictions

The system placed strict restrictions on disbursement from the escrow account. Non-construction expenses do not exceed 20% of the value of sold units, and the total disbursed for non-construction expenses does not exceed 20% of the total value of sold units.

Land Value Payment Mechanism

If the developer needs to pay the project land value from the escrow account, this is done in two installments: the first when collection percentage reaches 30%, and the second when collection percentage reaches 75%.

Retention Percentage

The legal accountant must retain 5% of the total construction cost value in the escrow account after the developer obtains the completion certificate. This amount is not disbursed until one full year has passed from the project completion date.

Eighth: Payment System for Buyers

The system has set clear controls to protect buyers and organize the payment process:

Deposit

Does not exceed 5% of the real estate unit value, and this percentage includes fees and administrative service costs. Deposited in the escrow account and not handed directly to the developer.

First Payment

Does not exceed 20% of the total unit value. Made by bank check or bank transfer in the name of the escrow account.

Installment Payments

Paid according to the completion stages schedule agreed upon in the contract. Each payment is due upon achieving a certain completion percentage confirmed by the supervising engineering office. The buyer receives a "Payment Due Notice" before the due date.

Final Payment

Paid upon project completion and unit delivery. The buyer has no right to demand unit transfer until all payments are made.

Late Payment

If the buyer is late in paying any due installment, the developer sends them a notice giving them at least 21 days. If they don't comply after this period, the developer has the right to terminate the contract after Authority approval, with returning what the buyer paid after deducting no more than 5% of the contract amount.

Ninth: Buyer Rights and Warranties

The WAFI system provides strong protection for buyers through a set of guarantees:

Construction Warranties

Foundation, concrete work, and insulation warranty is not less than 10 years from unit delivery date. Electrical and mechanical work warranty is not less than one year from delivery date.

Delivery Guarantees

If the developer is late in delivering the unit without cause beyond their control, the buyer is entitled to compensation. For developed land, compensation is not less than 2% of the sale value annually. For real estate units, compensation is the equivalent rent from an accredited appraiser.

Right to Withdraw

The buyer has the right to terminate the contract and recover all payments if delivery is delayed more than 180 days from the agreed date, with entitlement to the penalty clause stipulated in the contract.

Right to Review

Every buyer has the right to review the accounting record for their real estate unit, and the developer must provide them with a copy within 10 working days from the request date.

Public Services

The developer commits to providing all public services including electricity and water connections upon unit delivery.

Tenth: Developer Obligations

The developer bears significant responsibilities under the system:

Implementation Obligations

Include: completing the project on the specified date, adhering to agreed specifications, submitting periodic reports to the Authority, delivering units with required quality, and transferring ownership deed within 30 days of construction completion certificate.

Financial Obligations

Include: depositing all amounts in the escrow account, not using funds except for the designated project, submitting financial statements prepared by the legal accountant, and paying compensation upon delay.

Administrative Obligations

Include: contracting with a qualified entity for common area maintenance, establishing an owners' association according to the system, and representing the association until unit delivery.

Eleventh: Role of Supporting Parties

Engineering Consultancy Office

Plays a pivotal role including: technical supervision of project implementation, preparing periodic completion percentage reports, verifying specification compliance with agreed terms, approving disbursement documents from escrow account, and submitting quarterly reports to the Authority.

Legal Accountant

Responsibilities include: reviewing financial documents for disbursement operations, following up on sold unit deposits in escrow account, approving fund disbursement according to escrow account regulations, certifying payment documents, and submitting quarterly financial reports to the Authority.

Account Trustee (Bank)

Handles: managing the escrow account, executing approved disbursement orders, maintaining financial records, and preparing account movement reports.

Twelfth: Penalties and Violations

The system has set deterrent penalties to ensure compliance:

Serious Penalties

Punished by imprisonment for up to 5 years or a fine up to 10 million riyals or both: anyone who practices the activity or collects amounts without a license, submits false documents to obtain a license, advertises fictitious projects knowing so, embezzles or wastes project funds, or receives amounts without depositing them in the escrow account.

Administrative Violations

The Authority classified 26 violations with graduated penalties up to 500,000 riyals, including: delay in starting project implementation with a fine of 2% of project value, developer default or bankruptcy declaration, entering contracts contrary to the standard contract, providing misleading information, receiving amounts without prior approval, and obstructing parties from performing their duties.

Additional Penalties

Include: deleting developer registration from the developer registry, canceling violator's approvals, prohibiting from practicing the activity for a specified period, and correction period ranging from 10 to 180 days.

Thirteenth: Benefits of Off-Plan Sales

For Real Estate Developers

The system provides significant benefits for developers including: obtaining self-financing from buyer payments without bank interest, early marketing and demand measurement before full commitment, reducing financial risks through pre-selling, improving project cash flow, raising competitiveness in the market, and transitioning from individual to institutional work.

For Buyers

Buyers benefit from: prices up to 30% lower compared to ready units, convenient installment payments suitable for budgets, strong government guarantees protecting funds, high transparency in project monitoring, long building warranties up to 10 years, and ability to resell before completion and achieve profits.

Fourteenth: Tips for Buyers Before Purchasing

Before signing a contract to purchase an off-plan unit, make sure to verify these matters:

License Verification

Ensure the project is licensed in the WAFI program through the Real Estate General Authority website. Request the license number and verify it electronically. Confirm the license validity and that it hasn't been suspended or cancelled.

Document Review

Request to review: approved plans and designs, implementation timeline, current completion percentage, approved escrow account number, and standard sales contract.

Specification Confirmation

Carefully review: unit area and facilities, technical specifications and finishes, shared services, and owners' association system.

Understanding Obligations

Understand well: payment schedule and dates, termination and compensation conditions, your rights in case of delay, and building warranty periods.

Fifteenth: Practical Steps for New Developers

Phase One: Qualification

Start by registering on the WAFI electronic platform and creating an account. Submit developer qualification application with required documents. Work on meeting the required points system (minimum 35 points). Wait for application review and qualification certificate issuance.

Phase Two: Project Preparation

Prepare all technical and engineering documents. Contract with an accredited engineering consultancy office. Contract with an accredited legal accountant. Open an escrow account with a licensed bank. Prepare feasibility study and timeline.

Phase Three: Licensing

Submit project license application through WAFI platform. Upload all required documents. Pay fees through SADAD system. Wait for application review (10 days). Receive off-plan sales license.

Phase Four: Implementation

Start marketing and selling according to license. Ensure all payments are deposited in escrow account. Submit periodic reports to the Authority. Adhere to timeline and specifications. Maintain communication with buyers.

Frequently Asked Questions

Can an individual (non-company) obtain an off-plan sales license?

Yes, a natural person may obtain a license with specific conditions: obtaining 35 out of 55 points, building area not exceeding 5,000 square meters, implementation period not exceeding 3 years, and number of projects not exceeding 3 projects annually.

What is the difference between deposit and first payment?

The deposit is the initial reservation amount not exceeding 5% of the unit value paid upon contract signing. The first payment is the next amount not exceeding 20% of the total value. Both are deposited in the escrow account.

What happens if the developer defaults and doesn't complete the project?

In case of developer default, the Real Estate General Authority intervenes and can: appoint a substitute developer to complete the project, use escrow account funds to finish the project, or return amounts to buyers from the escrow account. This is the main purpose of the escrow account system.

Can I sell the unit before construction is complete?

Yes, the buyer has the right to resell their off-plan unit before construction is complete and achieve profits from the property value increase as the project progresses.

What is the building warranty period?

The developer commits to a warranty of not less than 10 years on foundations, concrete work, and insulation, and a warranty of not less than one year on electrical and mechanical work, starting from the unit delivery date.

How do I verify the project license?

You can verify licensed projects through the Real Estate General Authority website (rega.gov.sa) or WAFI electronic platform. Any project advertisement must also include the license number and escrow account number.

What is the penalty for off-plan sales without a license?

Imprisonment up to 5 years or fine up to 10 million riyals or both. The Authority recently announced applying legal procedures against 25 developers for practicing the activity without a license.

Conclusion

The off-plan sales system in Saudi Arabia represents a qualitative leap in real estate market organization, providing exceptional opportunities for both developers and buyers. However, success in this market requires precise understanding of regulations and procedures, and full commitment to requirements.

For developers: The system opens the door to self-financing and early marketing, but places great responsibility on you toward buyers and regulatory authorities. Commit to transparency, quality, and deadlines, and you'll find the system supports you and protects your reputation.

For buyers: Enjoy the opportunity to buy a home at a special price with strong government guarantees, but do your due diligence in verifying licenses and documents. Choose only licensed projects, and keep all deposit receipts in the escrow account.

At Raghdan, we believe knowledge is the key to making the right decisions in the real estate market. We hope this guide has illuminated the path to a deeper understanding of the off-plan sales system. Share your experience or questions with us, and we're here to help you.